By Andrew Halonen, Mayflower Consulting LLC.

In the world of product development, many materials are available to pick from, yet companies tend to play to their favorites. In metals, these materials range from exotic to common, from low density to high, and they are processed into different forms. The majority of car components — from the body panels to the protective rockers to the suspension arms — are made of aluminum, steel, or iron.

Where does magnesium fit into this conversation? Magnesium metal is the lowest density metal and is far from rare, as it is the eighth most abundant element in the Earth’s crust and the third most plentiful element in dissolved seawater.1 Magnesium has been available for centuries and can be processed into a variety of forms, including castings, extrusion, sheet, and forgings. However, despite being a low-density material that could be valuable in automotive, it is not often included in the lightweighting conversation. This article will explore the metal’s current use in automotive and its potential value in the production of forged car components.

Current Magnesium Use in Automotive

Magnesium is primarily used by aluminum and steel producers as a critical alloying element in the production of automotive components and other products. Altogether, alloying represents over 50% of the global demand for magnesium.

Outside of alloying, the next major market for magnesium is the production of near net shape castings. For example, magnesium is one of the common materials used to produce the structural steering wheel frame, primarily because it is easy to high pressure die cast (HPDC).2 The circular shape of the steering column is inherently stiff, which makes up for the low stiffness (modulus) of magnesium. Magnesium alloys also perform well for the energy absorption, which is a major requirement for providing passenger protection in a vehicle crash. In addition, magnesium has good vibration damping characteristics, which are critical for customer comfort, a major factor in how customers perceive vehicle quality.

Under the dashboard, welded steel is the most common material used to produce the cross-car beam. However, some steel-intensive vehicles (such as the 2019 Acura RDX) use one-piece magnesium die castings for the cross-car beam, because they meet both the crash and structural needs, while reducing weight. Another key benefit of magnesium die castings is their single-piece construction, which eliminates the tolerance stack-up issues common with welded structures.

A similar application is the structure for the dashboard or console, which is situated between the front seats and the center stack below the radio. These console structures are often comprised of magnesium produced with the HPDC process. In addition, magnesium has found success in seat frames, as they represent a lighter weight alternative to steel.

As can be seen by these examples, magnesium is primarily used for interior applications. There are three primary reasons for this — the structural performance of the magnesium is sufficient for these components, the components are able to provide lightweighting benefits, and interior components do not come into contact with the corrosive road salts that require additional coatings.

In the production of magnesium castings, AZ91 is most common for structural components and covers due to its high strength and moderate elongation. For those components in the crush zone that must deliver crash worthiness, AM50 and AM60 are more common because the elongation of these is 10-15%, which is a critical attribute for energy absorption. All of these alloys are readily available. They are produced as primary magnesium (mostly via the low-cost Pidgeon process) or are supplied through recycling shops here in the U.S.

The outlook for magnesium die castings is very good. According to Ducker’s presentation in August 2021, the average amount of magnesium castings used in vehicles will grow from 3.6 kg per vehicle in 2016 to 11.5 kg per vehicle in 2030. The die castings that have been noted here, along with door inners, will make up the majority of this growth.3

The current use of magnesium forgings in automotive is severely limited. The main use of magnesium forgings is the production of wheels. Magnesium seems to be a natural fit for wheel production, since having lighter wheels provides a number of benefits. The lightest weight wheel ensures the least rolling resistance, maximum efficiency for acceleration and braking, and the best fuel economy. Currently, forged magnesium wheels are available for race cars and are even mandated on Formula 1 vehicles. They are also available for high-performance motorcycles. However, magnesium wheels are not commonly used on any street vehicles, particularly not those vehicles that would need to travel the streets during the snow season when road salts are applied.

Why Magnesium Use is Limited

Automotive designers and engineers are well aware of magnesium and its potential value — but the material is still not commonly used. There are a number of reasons for this, including its low stiffness, corrosion, lack of reliable supply, and competitive quoting.

Low Stiffness

Regardless of the processing method, the modulus of elasticity (stiffness) of magnesium is 45 gigapascals (GPa). By comparison, aluminum is 69 GPa, and steel varies between 190-210 GPa. Many components are stiffness limited, and this is a significant hurdle for magnesium to overcome. Low stiffness materials require a larger cross-section to achieve the same performance. This often leads to increased cost and a larger sized component, which makes it difficult for the component to fit in the allowable space within the vehicle, referred to as package space. The component success stories are designs where the stiffness comes from the component’s inherent geometry, as in a wheel or a U-shaped interior structure underneath the center console of the car.

Corrosion

Shock towers can be made of die cast magnesium, and Ford even has a patent on this concept.4 However, there are currently no magnesium shock towers on the market. One of the major limiting factors is the risk of corrosion, and the need to develop methods to protect these castings from corrosion. According to Matt Hamblin, CEO of Keronite Group Ltd., one possible means of achieving this is Keronite PEO,5 which would offer a base coating for initial corrosion protection, enabling the use of magnesium in components like shock towers. “The coating converts the magnesium surface, where circa 50% of the coating grows into the substrate and 50% is outward growth,” explained Hamblin. “PEO by nature is a porous ceramic layer, we also then have the capability to apply primer and topcoats for a complete corrosion solution capable of surviving 2,000+ salt fog hours.”

Reliable Material Supply

Around 80-90% of the world’s magnesium is produced in China, and if they stop production, as has happened during the recent Olympic event periods, the price of magnesium skyrockets. In automotive, the suppliers are committed to multi-year contracts with yearly cost-reduction commitments. A massive increase in pricing can (and has had) a devastating effect on these suppliers, who will eliminate magnesium from their material options.

In recent news, Kaiser Aluminum Corporation had declared force majeure due to a critical shortage of magnesium (caused when US Magnesium, LLC declared its own force majeure, creating a year-long shortage). Fortunately, as of September 2022, Kaiser has since found stable supply of magnesium from alternative suppliers and were able to return to production.6 In this case, the magnesium is used as a critical strengthening element in the production of alloys for aluminum sheet.

Forging grade magnesium has additional supply chain problems. Forging stock generally requires cleaner alloys that are different from the commodity materials commonly used in casting. Because the current demand for magnesium forgings is low, forging stock is not produced very often.

Competitive Quoting

In automotive and other markets, the customer needs multiple suppliers to reduce their risk and ensure they are getting a fair price. In die casting, there are a number of well-known Tier 1 suppliers, including Meridian, Spartan Light Metal Products, Aludyne, GF Casting Solutions, and Linamar. In forging, however, there are far fewer producers and most of them target premium markets, like aerospace. This limited amount of producers presents significant risk for the automotive customer.

Magnesium Forging

Forging materials command a premium over castings, because they deliver better properties, leading to better performance. This makes forging better suited for components that face higher mechanical loads. In general, forged parts also tend to be thicker and smaller in size than castings.

Magnesium forgings are produced from forging stock, which is essentially a bar or rod that is placed into the forging press and then compressed into the desired shape. Since all of the stock will become a part of the final forged piece, every inch of the forging stock needs to have the correct chemical composition, even the surface.

There are two types of forging stock — as-cast forging stock or extruded forging stock. As-cast forging stock is less desirable, as the cast stock tends to have porosity, which leads to weak spots. Cast stock also has to be further processed in order to achieve the correct properties. “As-cast magnesium forging stock requires full machining, homogenization, and ultrasonic inspection prior to forging,” explained Rick DeLorme at Magnesium USA.7 “Care must be taken in the form of reduced strain and strain rate, along with care to maintain temperature during initial upset to render the wrought structure.”

Therefore, extruded forging stock is typically used. In this case, a cast magnesium billet is extruded into a bar to produce the stock material.8 By mechanical working the cast material, such as pushing it through an extrusion die, the forging stock will have less porosity and better overall properties, thus yielding a better forged component.

In North America, there are only three suppliers devoted to producing extruded magnesium forging stock. Magnesium USA in Euclid, OH, produces magnesium extrusions and castings for a variety of industries. One of the forging-grade alloys that the company produces is AZ80-T5, which has an ultimate tensile strength of 345 MPa and a yield strength of 262 MPa, along with a 6% elongation.9

Mag Specialties in Denver, CO, produces four forging stock alloys: AZ31B (good forgeability with medium strength), AZ61A (higher strength), AZ80A (high strength and heat treatable), and ZK60A (highest guaranteed minimum strength and higher ductility).10

ALLITE, Inc. in Dayton, OH, is another specialty producer of magnesium forging stock. The company’s ZE62 forging grade alloy has an ultimate tensile strength of 350 MPa and a yield strength of 303 MPa, along with an elongation of 21%.11

Another major consideration is the bending and flexing (or fatigue) loads that the forged magnesium components will be subject to over the design life of the vehicle, which is typically 15 years. Fatigue loads cause the part to lose strength over time. Suspension parts are subject to high fatigue loads, as are subframes. (Though it should be noted that fatigue is not much of a concern for the die castings utilized within the instrument panel or in the rear liftgate.) One limiting factor with fatigue is related to porosity or contaminants, such as oxides. These are the points where fatigue initiates and a crack begins to form. So, fatigue-driven forgings need high quality, clean metal, which cannot be easily obtained from Pidgeon-processed alloys.

Achieving the correct fatigue properties in the final component can be expensive to obtain due to the high number of cycles required in testing. In order to understand the fatigue strength of the material, engineers will bend a test piece back and forth over and over again until it breaks. Fatigue testing can last from 10,000 to 100,000 cycles, which takes a long time and makes it an expensive test, due to the machine usage cost. As a result, many material developers try to avoid it. However, this then shifts the risk to the user, who has to make a safe assumption about the fatigue life.

Case Study: Automotive Suspension Arm

In 2018, a capable team led by Talal Paracha, a Masters student at the University of Waterloo, studied forged magnesium in an automotive suspension arm in comparison with a baseline casting.8 The other team members came from CanmetMATERIALS, Automotive Partnership Canada, Multimatic Technical Centre, and Ford Motor Company. The latter two were especially important for this development project, because Ford provided the key specifications for the components, while Multimatic is a well-respected Tier 1 supplier that is accustomed to forging automotive components and had the knowledge base to address the requirements of the control arm design. Completed over five years, the project resulted in a design that ultimately received the 2021 International Magnesium Association (IMA) Award of Excellence for Wrought Products.12

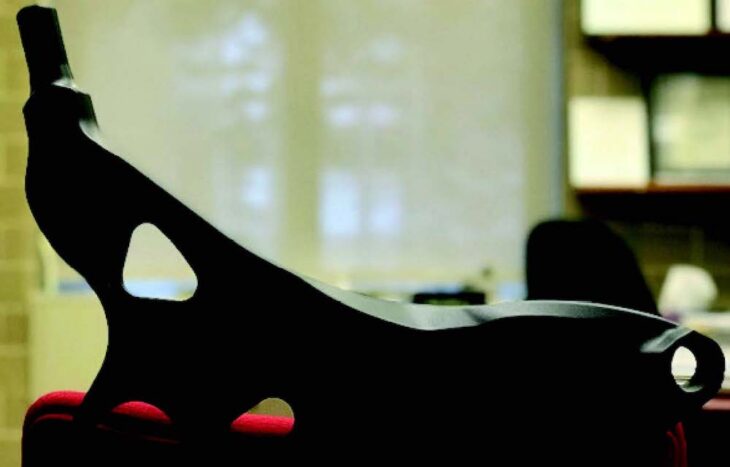

During the development of the forging process to produce the control arm (Figure 1), the effect of forging temperature, forging rate, and material flow were simulated and optimized. The forging conditions went through many iterations in order to better understand the various parameters — friction, strain rate, and other conditions — that need to be “dialed-in” to make magnesium forging a commercial success. In order to ensure that the front lower control arm would be well suited to the harsh environment that automotive components are subjected to, the research team also developed coating technologies to increase the part’s corrosion resistance.

The project resulted in the development of a high performance forged magnesium front lower control arm (Figure 2). The control arm delivered a 37% weight reduction compared to a comparable product in cast aluminum (1.53 kg for the forged magnesium version versus 2.43 kg for cast aluminum baseline), while also meeting the OEM’s performance requirements. This performance was confirmed through full-scale stiffness and durability testing.

Since the completion of the project, the research on the front lower control arm has continued with fatigue testing in a project led by Andrew Gryguc, University of Waterloo.13 As with the previous project, this fatigue testing research was supported by CanmetMATERIALS, Automotive Partnership Canada, Multimatic Technical Centre, Centerline Windsor, and Ford.

Currently, it is not clear as to whether the front lower control arm has entered commercial use. However, a study on suspension components completed in 2022 has shown that there is no known magnesium content within these components.14 Of the front lower control arms researched in the 94-vehicle study, 10% are cast aluminum, 24% are forged aluminum, and the majority are welded steel.

Beyond the forged magnesium suspension arm presented in the case study, a number of other components could also provide good opportunities for the use of forged magnesium components. Once a robust coating to protect against corrosion is developed, magnesium forgings could be used for gearboxes and covers, corner nodes for hybrid extrusion-based subframes, corner nodes for joining extrusions in EV battery boxes, frame nodes for the body-in-white, steering columns, and suspension arms and links. However, it should be noted that lightweighting generally happens from one material to another (i.e., steel to aluminum, aluminum to magnesium, etc.). Optimizing the form while using the same alloy (as in the case of using magnesium forgings to replace magnesium castings) is much less common.

The Future for Magnesium Forgings

Magnesium has the potential to play a critical role in the automotive industry. “From my perspective, magnesium is a criminally underestimated material,” said Christoph Schendera,15 managing director of the European Research Association Magnesium e.V. in Aalen, Germany. “It is not only the most important alloying element for the aluminum industry for improving strength, toughness, and corrosion resistance, magnesium is also an important material for ideal lightweight construction in combination with aluminum, high-strength steels, or fiber-reinforced plastics.”

Schendera added, “Aluminum and magnesium represent the ideal material combination in modern lightweight construction due to their physical and mechanical material properties, processability, and recyclability. But we have not managed to establish magnesium accordingly. Magnesium has also not received the support it needs from policymakers, and we have watched a magnesium monopoly being developed in China.”

Despite the various reasons as to why magnesium is not in favor today, the case study presented in this article shows that there is tremendous upside potential in lightweighting with magnesium for difficult, safety critical automotive applications. The chicken and egg scenario that currently exists is that OEMs are not requesting magnesium forgings, so the market is not innovating and developing solutions for magnesium forgings. However, because so much magnesium is used for alloying aluminum and steel, that alone ought to be a motivation to develop local supply, which will provide opportunity to develop and build further applications from there.

References

- Bray, Lee, “Magnesium Statistics and Information,” USGS, September 2021.

- “Steering Wheels,” Autoliv.

- Abraham, Abey, “Automotive Materials in an Electrified World,” Ducker Inc, IMA, August 24, 2021.

- Balzer, Jason S., and Vladimir V. Bogachuk, “Thin-walled magnesium diecast shock tower for use in a vehicle,” Ford Global Technologies LLC, March 9, 2015.

- Email with Matt Hamblin, Keronite Group Ltd., September 15, 2022.

- “Kaiser Warrick Calls Off Force Majeure Thanks to New Magnesium Supplier,” Aluminium Insider, September 22, 2022.

- Conversation with Rick DeLorme, Steven Barela, and Josh Caris, Terves/Magnesium USA.

- Paracha, Talal, “Modelling of the Forging Process for a Magnesium Alloy Automotive Control Arm,” University of Waterloo, April 30, 2018.

- “Products,” Magnesium USA.

- “Products,” Mag Specialties.

- “How does Allite Super Magnesium Compare to Other Materials?,” Allite, Inc.

- “Die Forged Magnesium Automotive Front Lower Control Arm,” IMA, 2021.

- Gryguc, Andrew, “Fatigue of Forged AZ80 Magnesium Alloy,” University of Waterloo, 2019.

- Halonen, Andrew, “Suspension & Brake Caliper Material Study,” 2022.

- “Magnesium is criminally underestimated (Part 1),” ALUMINIUM 2022, Dusseldorf, Germany, January 12, 2022.

Andrew Halonen is president of Mayflower Consulting, LLC, a lightweighting consultancy that provides strategic marketing, market research, and business development for high tech clients. Halonen works with castings, extrusions, brakes, and new material development programs. Contact him at: www.lightweighting.co.

Andrew Halonen is president of Mayflower Consulting, LLC, a lightweighting consultancy that provides strategic marketing, market research, and business development for high tech clients. Halonen works with castings, extrusions, brakes, and new material development programs. Contact him at: www.lightweighting.co.

Editor’s Note: This article first appeared in the October 2021 issue of Light Metal Age. To receive the current issue, please subscribe.