By Alicia Hartlieb and Martin Hartlieb, Viami International Inc.

Structural die castings for car bodies have been around for more than 30 years, and they have been growing in size and complexity. Many cars today already have parts like shock towers, cross members, and/or long side members made from structural aluminum die casting. Sometimes, even some structural magnesium castings like tailgates can be found in vehicles. Similarly, large battery enclosures for electric vehicles (EVs) or hybrids are also often made in die casting. Most of those have been produced on die casting machines (DCMs) of up to 4,500 t locking force.

Since the giga-casting industry trend was initiated by Tesla in 2020, first with DCMs of 6,000 t locking force, more and more OEMs have been adopting it and today 9,000 t, 12,000 t (even with double injection systems), and 16,000 t DCMs are operating in the market — with 20,000 t DCMs already announced. What started as a niche and was looked at with skepticism by many industry insiders and experts has now taken the center stage of many casting and car body related conferences and symposia, such that in March this year the first dedicated Giga-Casting Congress took place in Germany.

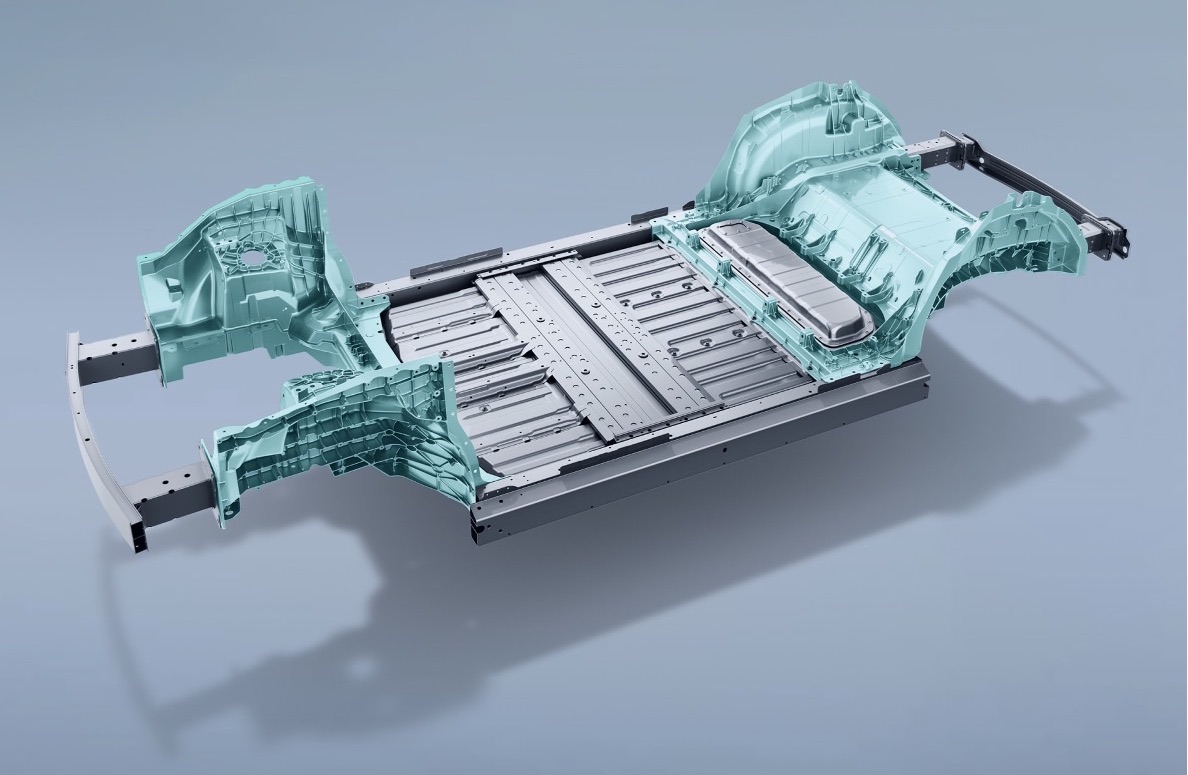

There is no generally accepted definition of “mega-casting” or “giga-casting” (and the use of either term is not related to size, but is rather company preference), but usually this refers to DCM sizes of >6,000 t locking force. The main products made on giga-presses are front and rear car underbody and battery electric vehicle (BEV) battery enclosures (and for the 20,000 t DCM a full car underbody). Larger body-in-white (BIW) and battery enclosure castings are typically made on 3,000–6,000 t DCMs, with some smaller or single cavity castings (like shock towers or pillars) being produced on DCMs with less than 3,000 t locking force.

The anticipated market growth for the giga-casting industry, as projected optimistically by Schlegel und Partner analysis and estimations, is about 33% per year between 2024 and 2030.1 However, another source, Ducker-Carlisle, expects only 13–14% annual growth between 2023 and 2030.2 Generally, this growth is fueled by BEVs and increased competition in the market. It is estimated that by 2030, approximately 70% of larger structural automotive castings (>3,000 t DCMs) will be in the form of giga-castings, with Chinese companies making up the majority portion (44%) of the market, followed by North American (35%) and European (21%) companies.1 Outside of China, giga-castings are mainly produced by OEMs and only very few Tier 1s have started to invest in it.

Giga-Castings Around the World

North America

Tesla, the company that introduced giga-castings in 2020, first made use of a giga-press with 6,000 t locking force to produce the single casting that served as the front and rear underbody of the Model Y.3 Since then, the company had worked on combining the entire Model Y car body into one casting,4 but has recently moved away from this plan and now is even reportedly discontinuing the front giga-casting for Model Y altogether.1 Despite this, Tesla remains strongly committed to the giga-casting technology, as they have been underway in purchasing further giga-presses in order to continue production. As an example, the Cybertruck giga-castings (Figure 1) are manufactured in their Texas plant and have been found to only require a 6,500 t machine, lower than the 8,000 t initially anticipated.5

Further, Honda announced they have invested in six 6,100 t giga-presses in their Anna Engine Plant in Ohio for EV components.6 Honda’s other investment in Canada has been postponed for now. For smaller volumes, where high-pressure die casting (HPDC) is not suitable, General Motors has utilized its so-called “mega precision sand casting” technology to combine various components from the car underbody in the Cadillac CELESTIQ, reducing the number of parts by about 40.5 Otherwise, Ford has invested in a giga-press and appears committed to producing these in upcoming years. Meanwhile, Nissan and Toyota have explicitly stated that they are working to produce giga-castings, which should be built into vehicles released in upcoming years.1 Linamar was the first Tier 1 in North America to invest in giga-casting, and now Georg Fischer also announced their first 6,100 t DCM for 2026.

Europe

Volvo (part of Geely Group) was the first European OEM to commit to giga-casting in 2022 at their facility in Torslanda, Sweden.7,8 They are using two 8,400 t giga-presses to produce the giga-casting that makes up the rear floor of their electric vehicles, which replaces 33 components and reduces the car weight by about 15%.5 Now, Volvo is also starting with two 9,000 t DCMs in Košice, Slovakia.9

Contrary to other markets, various European car companies are refraining from moving towards full giga-castings, instead producing larger HPDC BIW parts on DCMs of less than 6,000 t locking force. This includes companies such as Mercedes Benz or BMW, which currently question giga-castings’ feasibility and viability for their purposes. On the other hand, Volkswagen has shown clear interest in giga-casting, but has also started using a 4,400 t machine for a part that would normally require a much bigger DCM (thanks to a three-plate die design), which combines 30 individual parts of a battery frame into one in their upcoming electric vehicles.1,5

A notable addition in Europe has been the involvement of Tier 1s in giga-casting production, with Handtmann being the first of this kind to invest in giga-casting with their purchase of a 6,100 t giga-casting machine in Germany.5 GF Altenmarkt in Austria also has one 6,100 t DCM and is supposed to get another one in 2026/27. However, to date about 80% of investors in giga-casting technology remain OEMs in the European market, similar to 75% being OEMs in the North American market.10

Asia

To date, a shift in the interest in such large castings has led to a strong presence of Asian-owned companies in the giga-casting industry. In Japan, Toyota, Honda, and Nissan have already committed to giga-casting. Hyundai has also been set to introduce their so-called “hypercasting” (Figure 2), a Tesla-inspired casting production method that will serve as a vehicle frame originally starting in 2026, but it is now postponed by two years. Aisin, a Japanese auto supplier and part of the Toyota Group, is set to invest US$3.4 billion over the next three years in shifting towards the production of giga-castings.

In China, giga-castings have become a key component of electric vehicles for OEMs, and China accounted for over half of the global EV sales in 2024, making it the largest EV market worldwide.10 For instance, the Chinese-based Chuzhou Duoli Automotive Technology company recently purchased one of the largest orders of DCMs from the Bühler Group’s giga-casting business, setting them on the track to become one of the largest giga-casting parts suppliers worldwide. Similarly inspired by Tesla, XIAOMI has purchased two 9,100 t giga-presses, readying themselves for the production of an underbody giga-casting that will combine 72 components into one, as well as employ a large BIW in front. Additionally, Xpeng is utilizing a giga-casting for the front and back underbody, stating that it combines more than 300 pieces over both castings (Figure 3). Other companies include Nio, Chery, GAC, and FAW, which have all defined strategies for the production of their giga-castings and are underway with its implementation.1,5

Since then, IDRA (owned by L.K. Holdings, a Chinese-based company) has signed over 25 orders for giga-presses, many of which are being delivered to Tier 1 parts makers.5 China is the market where the most Tier 1 companies have invested in giga-casting, with about 70% of investors in giga-casting cells being Tier 1,10 while in Europe and North America this has been mainly driven by OEMs until now.

For Tier 1s, the huge investment in giga-castings is a difficult decision, as it creates a very strong dependence given that these large castings are not ideal for shipping over large distances. However, they also mean a significant revenue gain or loss, as they replace many parts that were until now made by Tier 1s and others that were not. Therefore, if a Tier 1 invests in giga-casting, they boost their revenue as they gain components, whereas if they don’t invest, they risk losing existing parts (revenue) to the OEMs with in-house (or a competitor’s) production.

Skepticism of Giga-Castings

Although the trend of adopting giga-casting production has continued and increased since its beginnings a few years ago, multiple automotive companies have raised questions and criticisms regarding this format of casting, whereas others have positioned themselves clearly against it. For instance, Magna has expressed some skepticism surrounding giga-castings and has remained cautious about moving in this direction given the complexity and difficulties that accompany the production of such a large casting.5,11 Further, Stellantis has stated that they will not be investing in giga-casting technology, rather maintaining the position that giga-castings have a low feasibility.1 Several of those skeptical about “true” giga-castings are, however, investing/invested in large casting machines (between 3,000 or 5,000 t locking force). In the meantime, some of the main early challenges of giga-casting, such as the difficulty to repair it in case of a crash, are finding solutions (e.g., bolt connections for body and frame or rear end removable structures).

The Challenges of Giga-Castings

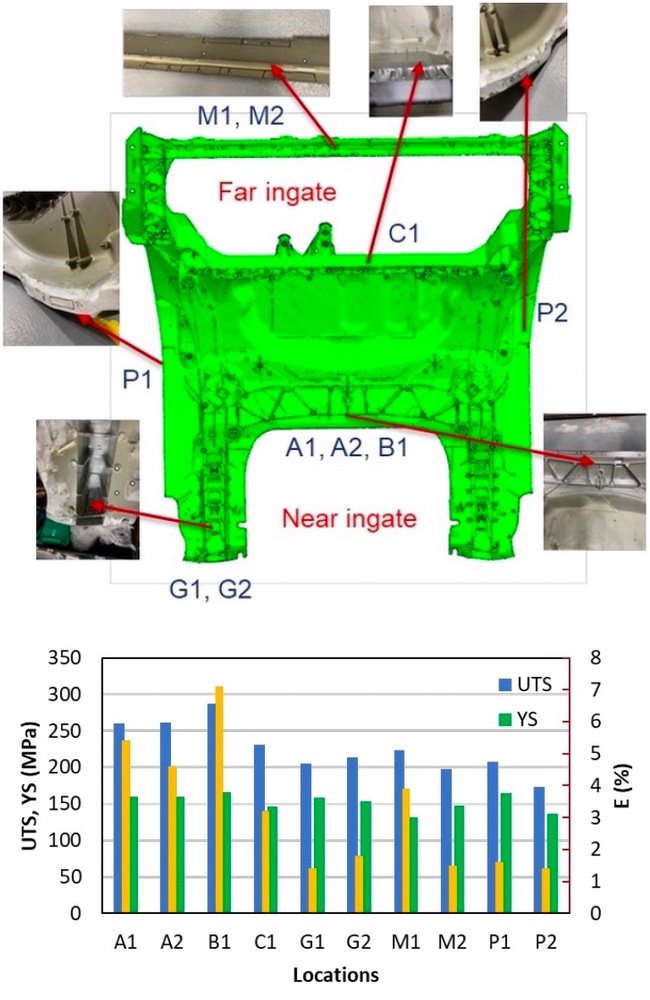

Despite giga-castings having received extensive investment from many companies, this format of casting still has various disadvantages and difficulties associated with its production, most of which have existed since the very beginning. For one, the die lifespan for this casting remains around 100,000 shots, which is much shorter than dies for stamping presses, making these giga-castings costly and less adequate for vehicles produced in very high volumes.3,5 Further, producing giga-castings has the same difficulties as any other large structural casting, except that they are much larger, have more complex designs, varying wall thicknesses, and require much longer flow lengths. This makes it more difficult to produce giga-castings that have high homogeneous mechanical properties, meet tight tolerances, and have low scrap rates. Oftentimes, casters will see that properties vary significantly on a giga-casting from location to location (Figure 4). Despite these properties being measured on the same giga-casting (in different locations), there is a notable difference between the properties.12

The size of a giga-casting further increases its susceptibility to distortion, which can even be caused by the weight of the casting itself, if not supported adequately. Giga-castings are produced in alloys that give target properties without (solution) heat treatment and quenching to minimize distortion, but the reality is that distortion is caused by many other factors as well. However, several casters hope to avoid distortion, so that they do not need to invest in adaptive straightening systems. Instead, they often opt for simple solutions like straightening the casting in the trimming press, yet usually regret this later. Adaptive straightening systems represent a high investment, but have proven to be extremely useful as they also offer 100% detection of part quality issues (process variations) and adapt to varying distortions in the casting.

Additionally, the large size of giga-castings compared to other structural castings further increases the difficulty of handling, storing, and transporting these after production.3

As giga-castings have become more widespread, it has been found that the weight and cost savings for the giga-casting of the car’s front under-body (FUB) is much lower than for the rear under-body (RUB). Additionally, the FUB giga-casting has proven itself less ideal in a crash situation, particularly for repairing damage to the vehicle. These factors have contributed to why some companies like Tesla have stopped their use of FUB giga-castings in some of their vehicles. A common problem is that giga-castings are difficult to adapt to different car models/variants, but generally the front of a car is more standardized across models than the rear, making it the easier side to adapt.

At the first Giga-Casting Congress earlier this year, all of these challenges were presented and discussed. The Casting Technology Centre (GTK) at the University of Kassel, which hosted the congress, presented and showed their rheocasting technology (Comptech process), which many in the industry consider a potential solution to a multitude of technical challenges of giga-castings (long flow-length, homogeneous high properties, thin and thick sections, die life, and potential to reduce the required DCM size). Another proposed method of solving certain problems associated with giga-castings is to redesign the car body to fit the large casting instead of simply replacing the current BIW design with a giga-casting. Some companies also suggest that giga-castings are only efficient until a certain size, which is why it is anticipated by many that the long-term trend for giga-presses will be to remain in the range of 5,000 to 8,000 t in size. Casting machines that are larger than this sometimes have dual injection systems, which run the risk of being slightly offset from one another, resulting in the production of a scrap part. Therefore, the future direction for giga-castings may actually be to move away from these ultra-large giga-presses.

Anticipation Versus Reality

Currently, there is a significant amount of giga-casting capacity installed worldwide that is under-utilized. The reason is primarily the fact that most giga-castings are used in new EVs that did not have existing assembly lines and therefore offered much greater savings potential (by avoiding investments in robots, etc.) than the conversion of existing car body assembly lines to integrate giga-castings (simply idling existing robots, etc.). EV sales growth last and this year has been lower than originally anticipated, therefore less giga-castings for those EVs are needed, or SOPs of certain models have been delayed.

Sustainability

For many automotive OEMs, sustainability continues to be a large concern—and this is also true when adopting the giga-casting production. However, most structural castings today are still made from primary aluminum, which generally has a high carbon footprint. On the contrary, sheet metal is often produced with very high recycled content, though a significant portion is pre-consumer scrap. The most effective way to increase sustainability of giga-casting remains to be by increasing the secondary aluminum content, which is now strongly being pursued by most OEMs.13 In current alloys, aluminum wheels are still the predominant source of post-consumer scrap used to make them, but several R&D projects are working on both new alloys that could accept typical current aluminum-intensive car body scrap or remove impurities from other mixed scrap streams.

Conclusion

Giga-casting is an evolving trend in the casting and car body manufacturing industries. What was initially started by Tesla is already being used by several OEMs in Asia (primarily China), North America, and Europe. While there are still many technical challenges associated with giga-castings, solutions are being developed that allow the production of ever-growing castings in larger and larger DCMs. As this technology is ideally implemented for new vehicles (with no existing assembly line), most of the first applications have been for BEVs, which are currently seeing a slow-down in market growth. Hence, this also affects the growth of giga-casting and has even created a certain over-capacity of giga-castings in the market. However, it is likely that this will not last overly long, as an increasing number of applications are being found by more and more players. The giga-casting trend is not revolutionizing the industry overnight, but rather slowly, and it certainly continues to contribute to increasing casting and aluminum content in vehicles.

References

- Lüttig, Sebastian, “HPDC in Body in White: OEM strategies and global market perspectives,” Schlegel und Partner, March 5, 2025.

- Rakoto, Bertrand and Leonard Ling, “Navigating the Evolution: Mega-Casting’s Impact on Automotive Manufacturing,” Ducker Carlisle, 2024.

- Hartlieb, Alicia, and Martin Hartlieb, “The Impact of Giga-Castings on Car Manufacturing and Aluminum Content,” Light Metal Age, June 2023.

- Greco, Luca, “Weekly Gigacasting News 29,” The Gigacasting Newsletter, May 18, 2025.

- “Market Overview Giga Casting and Giga Presses in the Automotive Industry,” Anp Management Consulting GmbH, Essen, Germany, April 3, 2024.

- “Megacasting to Start at Honda in Ohio,” North American Die Casting Association (NADCA), 2025.

- “Volvo Mega-Casting,” Volvo Car Austria, February 8, 2022.

- Werwitzke, Cora, “Elektroauto-Produktion: Volvo beschafft Giga-Pressen von Idra,” Electrive, November 10, 2023.

- Schönfeld, Markus, “Auch Honda kopiert Tesla-Trend zum Wegwerfauto,” Auto Motor Sport, October 19, 2024.

- Stokes, John, “Giga press – The Story Behind the Growth of Diecasting in Automotive BiW,” Automotive Circle Car Body Parts Symposium 2025.

- Gibbs, Nick, “Magna skeptical about Tesla-driven move to megacasting,” Automotive News Canada, September 19, 2023.

- Wang, Qigui, Andy Wang, and Jason Coryell, “Prediction of Local Tensile Properties in an Aluminum Giga Casting,” American Foundry Society, 2025.

- Rohwer, V., et al., “Sustainable Materials in Automotive Body Engineering – The Role of (Giga-) Casting Technology to Meet Net Zero Targets,” North America Die Casting Association, Die Casting Congress & Exposition 2024.

Editor’s Note: This article first appeared in the August 2025 issue of Light Metal Age. To receive the current issue, please subscribe.