The Aluminum Association in cooperation with Ducker Carlisle published its 2023 North American Light Vehicle Aluminum Content and Outlook study in April 2023. This new survey of automakers and Tier 1 suppliers confirms that aluminum use will continue to grow in the automotive market throughout the end of the decade, largely fueled by demand for more sustainable transportation, such as electric vehicles (EVs). Light Metal Age (LMA) sat down with Abey Abraham (Figure 1), principal of Automotive and Materials at Ducker Carlisle, and Mike Keown (Figure 2), chair of the Aluminum Association’s Aluminum Transportation Group (ATG) and chief executive officer of Commonwealth Rolled Products, to better understand the evolution of the automotive aluminum market, OEM trends, and other recent developments.

LMA: For over a decade, reports from Ducker have indicated that aluminum content is and will continue to grow in the automotive sector. With trends continuing to evolve, how has the focus on aluminum in automotive shifted? What are the major trends of today?

Mike Keown: As we see it, aluminum is the definition of efficiency, effectiveness, and flexibility. It delivers a lot of agility to the automotive market, which continues to evolve. For example, the U.S. government and its administration have outlined that 50% of the vehicles for sale will need to be EVs by 2030. Lightweighting is still a requirement for both traditional internal combustion engine (ICE) vehicles and battery electric vehicles (BEVs), but it also provides a number of other benefits. BEVs weigh considerably more — over 1,000 lbs heavier — than ICE vehicles, due to their battery infrastructure. Aluminum is the ideal metal to address those weight balance needs, enabling BEVs to meet the range requirements that customers demand. Aluminum also allows for automakers to design the large-size vehicles that a lot of customers are looking for, and it supports them in achieving their CO2 reduction goals, which the aluminum industry has been working on for decades. Basically, we don’t see the impact or benefit of aluminum necessarily changing, it’s a matter of where and how aluminum is applied in the sector.

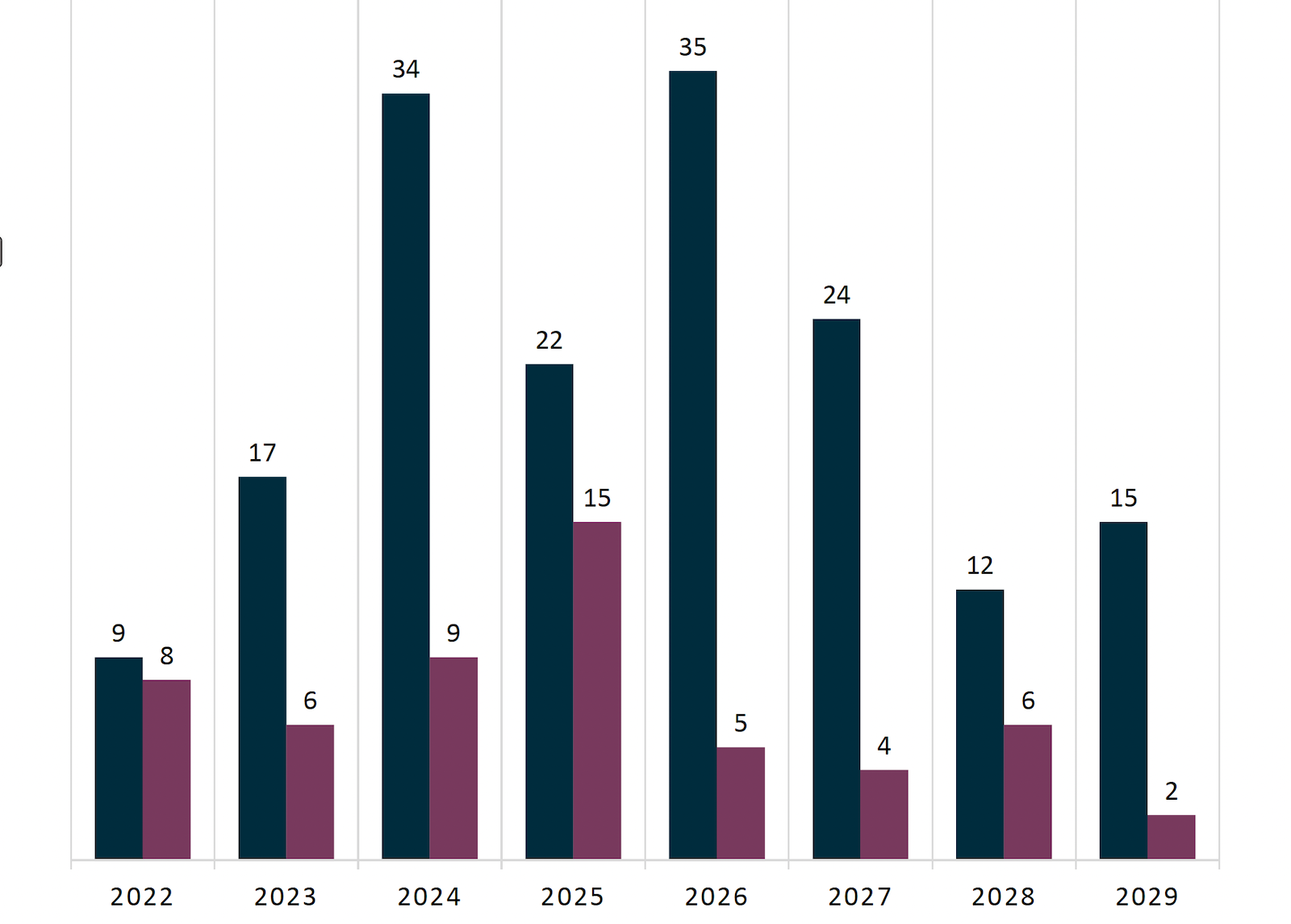

Abey Abraham: Building off what Mike said, I want to note that the target of 50% EV sales by 2030 is a voluntary goal. If you look at the vehicle production forecast from Global Data, a third-party company that provides industry research, it is likely that the automotive production mix will be about 40% EVs by 2030. Another thing to consider is that there will be over 300 new nameplates (vehicle models) launching between 2022 and 2030, and the majority of those (over 55%, I believe) are expected to be BEVs (Figure 3). Clearly, this will be a major trend going forward. However, what these numbers also tell you is that the other 45–60% of vehicles through 2030 are going to be ICE-based models, which will still have to contend with addressing CO2 regulations. Just as BEVs need to reduce weight to improve range, ICE vehicles need to improve fuel economy. So, lightweighting is still a key issue that will be looked into over the next decade.

Keown: From an industry perspective, we have really continued to answer the call for more aluminum in automotive. There have been roughly $9 billion in investments that the industry has announced over the last decade to support automotive growth — whether it’s ICE vehicles or BEVs. This is a key and core market for the aluminum industry, whether it’s a rolling mill, extruder, forger, or casting facility. The industry continues to work collaboratively with the OEMs, and we have proven that by putting greenfield money in the ground.

LMA: How are the automotive aluminum growth trends different in North America compared to Europe? What are the main similarities and differences?

Abraham: One of the first differences is in the different regulations between the U.S. and Europe. The U.S. is still focused on a CO2 cadence, which allows for OEMs to figure out what their mix of ICE vehicles and BEVs should be, based on their consumer base. On the other hand, the European Union (EU) is setting mandates to eliminate ICE vehicles by a certain point, with each country having their own specific targets.

Vehicles in the U.S. also tend to be larger than the European vehicles. Larger vehicles need larger engines and wheels, which means more aluminum castings. It also means an increased need for lightweighting in order to meet CO2 requirements. As a result, the U.S. has historically led in terms of aluminum content on a per vehicle basis and therefore on overall demand. But given the EV push that we’re seeing in the EU, eventually Europe will outpace the North American market in terms of aluminum content per vehicle.

In North America, there was 501 pounds per vehicle (PPV) in 2022, while in Europe, the number was 452 PPV. By 2026, we expect the market to grow to 523 PPV in North America and also to 523 lbs in Europe — showing some equalization in the markets. And by 2030, we expect North America to reach 556 PPV, with Europe outpacing that with 564 PPV. A lot of this growth will be driven by BEVs, both in North America and Europe, due to the fact that the average BEV has more aluminum than its non-BEV counterpart.

Another consideration is that the European market is starting to adopt a lot more mega- and giga-castings, which add more aluminum content. In addition, although the U.S. has traditionally been known for its larger vehicles, Europe is starting to trend toward using more SUVs and other large vehicles.

LMA: As you both have mentioned, lightweighting is a major driver of aluminum use in vehicles. What are some of the other reasons major OEMs choose aluminum?

Keown: There are a few things. There’s no denying that federal regulations and incentives kickstarted the demand for aluminum roughly a decade or so ago and that continues to help. In my opinion, the main thing that this has done is pushed innovation, engineering, design, and performance. Coupled with the EV revolution, this has really pushed all of that forward.

But we don’t really view that as the leading cause of growth for aluminum in this space. Automakers respond to consumer demands and consumers want vehicles to be safer, bigger, and more efficient. Consumers want all of the technological and infotainment features that they’ve grown accustomed to. With all of that, it really continues to point to lightweighting, because trying to fit in more features in the same or similar-sized vehicle requires a weight trade-off. That’s why aluminum has continued to grow over the last five decades. The advantages of aluminum are clear, from recyclability to corrosion resistance and crash energy absorption. In those regards, aluminum’s attributes are undisputable.

Abraham: Adding on to what Mike was saying, there are all these drivers for increased mass, including comfort and convenience systems and advanced driver assistance systems (ADAS). Massaging seats, which are more common now, add another 10–20 lbs of weight per seat. For OEMs to be competitive, they need to offer those features. OEMs work closely with their suppliers and they are very clear in understanding that mass savings translates to secondary mass savings throughout the vehicle. They have very complex formulas that they apply to deciding on a material for their vehicles, based on the vehicle size segment, competition, the range expectations, where the vehicle is going to be used, and so on. They have to figure out exactly what material to adopt in terms of different strategies, and lightweighting is just part of that complex process.

LMA: What is the current usage of aluminum within vehicles and how is it expected to continue to grow in the future? What are some of the major systems/components where aluminum penetration is growing?

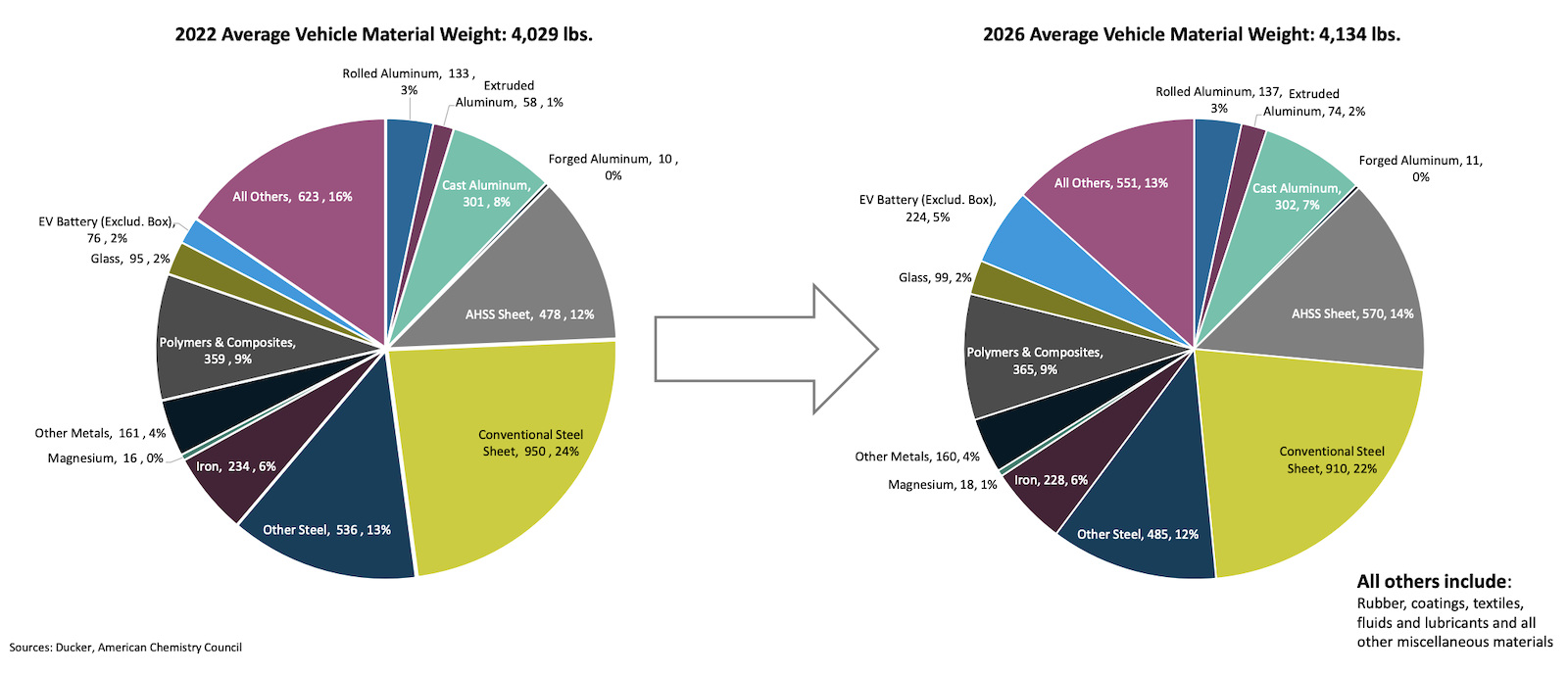

Abraham: If you look at the data from our North American report (Figure 4), castings are the largest segment of aluminum content per vehicle. If you look at the vehicle mix today, there are still a lot of ICE vehicles, which means a lot of engine blocks, transmission cases, and driveline components. This also includes wheels, which are big users of aluminum castings.

The next major category is rolled products, including sheet applications for body-in-white and closures. Aluminum sheet is also used in powertrain applications. So, that area still continues to grow at a pretty fast clip.

Extrusions are the next major category, and they play a big role in the transition to electrification. They are seen almost as a backbone material for a lot of battery housings.

For forgings, we see more propensity for their use in heavier EV segments. Forgings are primarily used for the performance they provide in regards to stiffness and strength, combined with low weight.

In terms of key applications, as I mentioned, battery housings are going to be a major growth area for aluminum in a lot of product forms. They’re using sheet for the top and bottom covers, extrusions for the frame or cross members, and there is also opportunity for replacing multi-part frames with giga-castings. While EVs do not need traditional powertrain components (such as engine blocks and heads), these are being offset by aluminum usage elsewhere, including the use of castings within the vehicle for the e-Motor and e-Drive housings and the gearbox that they’re connected to. A lot of the electronics for the inverter and converters in EVs need to be watertight, as well, which provides more areas for aluminum content.

Another area where we’re seeing some accelerated growth are sills and rockers, which form a lot of the structure for protecting passengers against side impact. Aluminum does a really good job at absorbing the energy of an impact and can help shift that energy to other crash zones in the vehicle. For these components, we see extrusions, roll-formed aluminum sheet, hot-stamped sheet, and some castings.

LMA: We’ve discussed EVs a bit already, but can you dive deeper into this sector? How have they shifted demand for aluminum? What are the trends?

Abraham: If you look historically at the vehicles that have launched and what we now see coming out in the market, the data shows that EVs (particularly BEVs) have outpaced non-BEV models in terms of aluminum content. Whether it’s sheet, extrusions, castings, or forgings, BEVs just contain more of all of these product forms. But keep in mind, that EVs are also seeing a lot of other advanced materials as part of their lightweighting solutions.

As we’ve touched on, this is driven by efficiency in order to meet the certain range requirements that consumers are expecting. To achieve this, there are three things that could happen. One, you could make the battery bigger, but that adds mass. When you add mass, you also have to increase the size of your brakes, suspension, chassis, and all the supporting structures. Two, you could increase the efficiency of the motor and the electronics, and a lot of OEMs are doing that to either consume less power or to get more power out of it. Three, you can address range with lightweighting, which allows the automaker to maintain a smaller battery size, which secondarily reduces the size of the brakes and other components. Every OEM has their own approach to this issue.

Keown: From an aluminum industry perspective, our job is to support the OEMs by bringing solutions — and we know car makers are focusing on a multi-material strategy. When thinking about weight reduction and range, they are thinking about how to lower the cost for batteries and other components, while also making them smaller and more efficient.

The other piece regarding increased battery weight is from a safety perspective. Having a massive amount of vehicles on the road that may weigh a thousand pounds more than other vehicles creates important concerns for impact situations between vehicles. Beyond cost and other considerations, safety is important and meaningful to OEMs. Improved safety is another benefit of lightweighting.

LMA: One of the major trends that we are seeing is a growing interest in aluminum giga-castings (or mega-castings). Is this a significant area of growth in automotive?

Abraham: Giga-castings have advantages, particularly parts consolidation, which reduces weight and limits the amount of assembly required. We consider giga-castings to be large, structural components that are produced using machines with a clamping force of 6,500 tons and above. We’ve even seen some machines on the market with a 12,000 ton clamping force, and there’s going to be larger machines coming into the Asian market, as well. In line with giga-castings, there has been an increased interest in rheocasting, which is a process that can work well with giga-casting machinery. Another aspect is the shift from primary foundry alloys toward the increased utilization of recycled materials now and in the future.

Europe is implementing giga-castings at a fast rate. We are also seeing the Asian OEMs utilizing these components, particularly for EVs. In North America, Tesla really kicked off this trend, but we haven’t seen much use beyond that company. However, it’s just a matter of time before we start seeing giga-castings proliferate in the U.S. and North American market as well.

LMA: Another interesting technology is aluminum additive manufacturing (AM). What sort of role is AM expected to play in the future of automotive manufacturing?

Keown: It’s definitely on the radar. Aluminum companies have invested in AM technology for several years now. We’ll see what the future holds, but I think this is a technology that will definitely find its place. We’ll see very high performance components developed for a wide range of transportation applications using AM.

I think the technology will continue to evolve. Some of the applications will be at scale, while some will be niche components that are expensive to run at scale, but provide a specific solution. This fits nicely into the whole agility aspect of our industry. It enables OEMs to find the right material form for the right application, along with the right cost structure.

Abraham: The agility point is so key in terms of new designs and materials. Powdered metals, in both aluminum and steel, aren’t new to the industry, and with the new 3D-printing solutions being developed, it’s possible that they could address the scale requirements that the automotive industry wants. AM is excellent at being able to put the metal exactly where you need it from a geometric perspective, without having any scrap. That’s why the aerospace and medical industries are also heavily investing in this. There’s a lot of growth potential for AM, and it’s something that we’re all very interested in tracking.

LMA: Can you talk about the growing interest in recycling and sustainability? What are you seeing in the market?

Abraham: Although they’ve been a part of the industry for years, we’re seeing a much greater focus on sustainability, CO2 reduction, and environmental, social, and corporate governance (ESG) as part of the goals that OEMs are setting. European OEMs are kind of setting the roadmap, but we’re seeing this in the North American market, too. OEMs are constantly working hand in hand with their suppliers to push the boundaries in terms of sustainability.

A couple of things come into play with this. First, is energy sources. If the supplier can utilize sustainable sources of energy for their manufacturing, OEMs are going to value that. They are also looking at recycling, with closed-loop recycling — where the scrap from the stamping or fabrication areas is segregated by alloy and returned to the supplier for recycling — having been and continuing to be heavily implemented. Now, they’re working with suppliers to adjust the alloy chemistries to increase the use of post-consumer recycled content. So, there’s a lot of interest and activity there.

Keown: There have been massive investments in this space on recycling, whether it’s R&D to improve recyclability, sorting, or other facets. The other piece of this is not just investment, but also education of consumers. Five to ten years ago, sustainability was just something that was nice to talk about. Now, on both the automakers’ and suppliers’ sides, this is not just an interest for them, this is a mandate; this is a requirement of doing business. Sustainability, CO2 reduction, and recycling are all being driven by action and firm commitments at every level of the supply chain.

LMA: How will competing materials, such as steel, plastics, composites, and magnesium, fair compared to aluminum in the coming years? Which material presents the biggest challenge to aluminum?

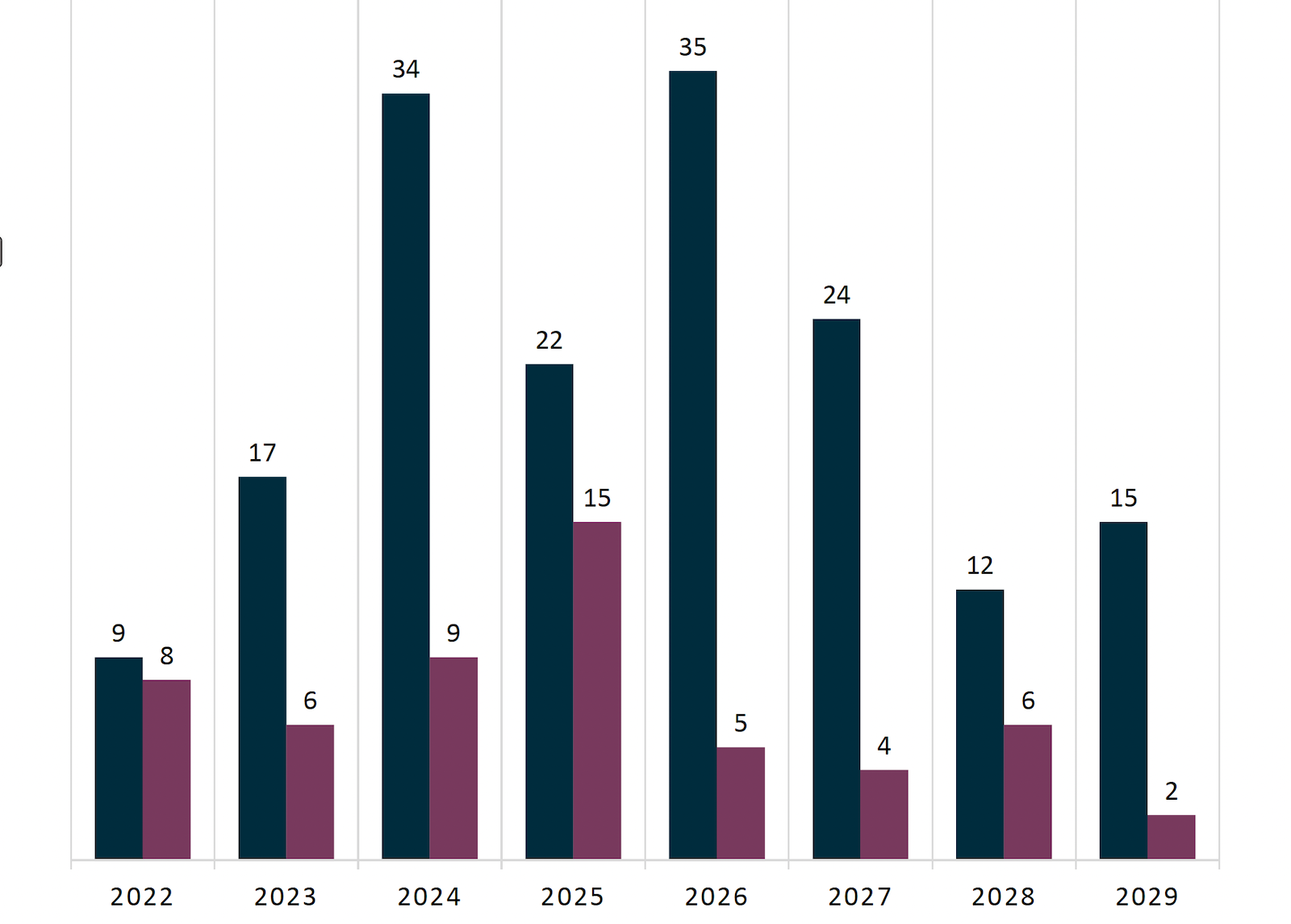

Abraham: Looking at the North American report again (Figure 5), one of the key things that we’re learning is that “silver bullet” strategies are no longer going to be a focus in the automotive industry. We’re seeing less and less monolithic use of materials. Instead, the mixed material approach is really proliferating. Automakers are focused on choosing the right material for the right part and applying forming and joining technologies to get the best performance and efficiency out of their components.

The material industries — not just aluminum, but also steel, composites, and magnesium — are really pushing the accelerator pedal for innovation. All of the material suppliers are working closely with OEMs to come up with customized solutions that put the right level of strength where they need it or that meet the formability or recycling requirements. There are no accidental material choices. It’s a very dynamic time to be in the industry. At the end of the day, the OEM has a lot of choices, and that’s what we want. We want to give the OEM engineer the ability to select the best materials for each of those types of applications.

LMA: Are there any final thoughts that you would like to add?

Keown: First, I’d just like to thank Abey and the Ducker Carlisle team for what they did in partnership and collaboration with the Aluminum Association and the ATG. In the aluminum industry, we’re continuing to stay out in front of new and existing customers and the new opportunities on the market. To that end, we’re hosting an in-person event on November 2 in Detroit, MI, to provide education and training on the sustainable design and engineering of vehicles using aluminum. It will be a day to meet OEM market players and engineers. It’s been many years since we’ve hosted this kind of event, and we’re restarting that now, because we’ve got to do a better job of telling our story in the aluminum industry.

Abraham: For me, it’s a very exciting time. There’s a lot of change that’s happening in the market, from the type of vehicles to the types of batteries and charging infrastructure to the implementation of new technologies in vehicles. I think there’s a really bright future for lightweighting and for aluminum, and we’re very happy to be able to track this and are looking forward to learning more as we go along.

Editor’s Note: Both the North American and European aluminum content summary reports are free to access online. The North American report can be found here. The European report can be found here.

Note: This article first appeared in the October 2023 issue of Light Metal Age. To receive the current issue, please subscribe.