By Alton Tabereaux, Contributing Editor.

Sixty-eight million tonnes of primary aluminum were produced worldwide in smelters in 2021. According to the Aluminium Stewardship Initiative (ASI), the aluminum sector was directly responsible for 275 million tonnes of CO2 emissions in 2021, a 2% increase over the previous year. If the indirect emissions from electricity are included, the number increases to around 1.1 billion tonnes of CO2e, which would account for 70% of total direct and indirect aluminum production in 2021.1

Primary aluminum production (mining to ingot casting) is responsible for 95% of these emissions. Decarbonization of the electrical supply to the smelters offers the most significant opportunity to reduce carbon emissions to net zero by 2050. Electricity used during alumina refining and aluminum smelting accounts for more than 90% of the industry’s carbon emissions. The electrochemical reaction is responsible for over 60% of aluminum production’s direct CO2 emissions, with the rest being from anode production, aluminum casting, and recycled production.

The carbon footprint of primary aluminum can span a wide range — from less than 5 t CO2e/t Al for renewable energy (such as hydropower) to more than 25 t CO2e/t Al for coal. According to the Center for Strategic International Studies (CSIS), the estimated cost of decarbonizing the aluminum sector ranges from $500 billion to $1.5 trillion.2

Many countries and industries are working toward the Paris Agreement, a legally binding international treaty on climate change. It was adopted by 196 Parties at COP 21 in Paris, France, on December 12, 2015, and was entered into force on November 4, 2016. According to the Transition Pathway Initiative, the goals of the agreement are to limit global warming to well below 2°C (preferably to 1.5 °C), compared to pre-industrial levels.3

The carbon footprint of industrial companies is measured via the Scope 1-3 emissions introduced by the Greenhouse Gas (GHG) Protocol, which are as follows:

- Scope 1: Direct GHG emissions produced by activities or operations that are owned or controlled by the reporting company, including emissions from physical or chemical processing (aluminum electrolysis, anode baking) and emissions from on-site energy generation (e.g., electricity, steam) through fuel combustion.

- Scope 2: Indirect GHG emissions created by the purchase of energy as they occur at sources owned or controlled by a supplier. This includes indirect emissions from business energy use, like electricity, heating, and cooling provided by an energy company.

- Scope 3: Indirect GHG emissions that occur from sources owned or controlled by the supplier company, including emissions from upstream production of raw materials used by the company (e.g., alumina, calcined petroleum pitch, coal tar pitch) and emissions from external transportation of products, materials, and waste.

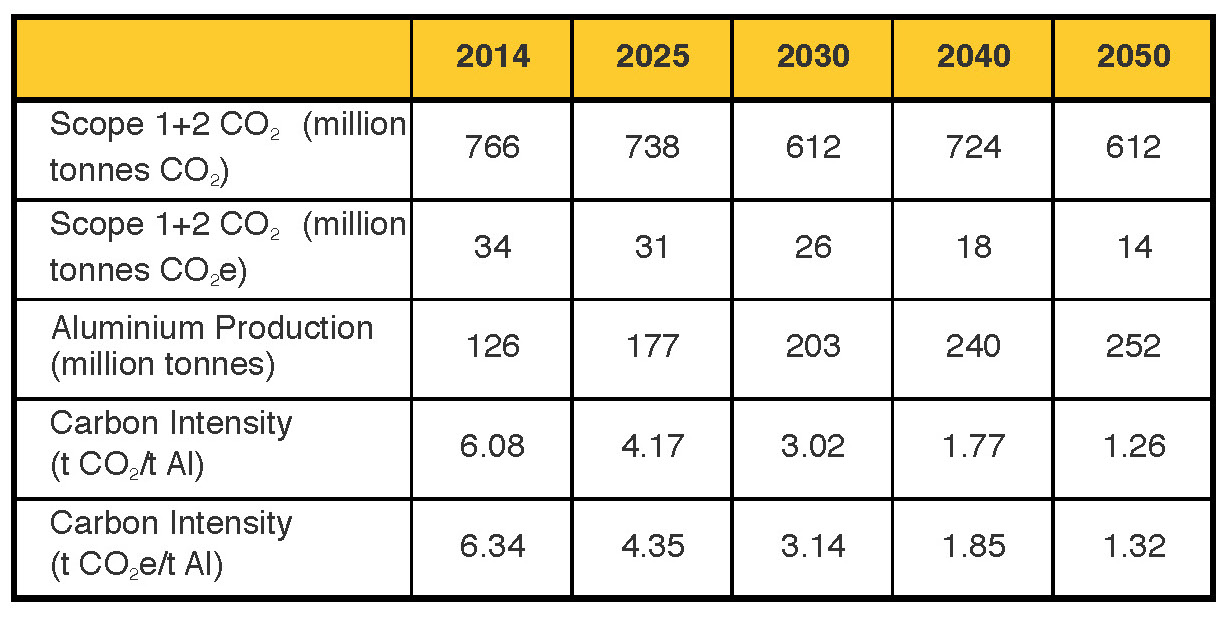

Under the Paris Agreement scenario for 2025, global Scope 1 and 2 emissions from the aluminum sector are projected to be 738 million tonnes of CO2 and total aluminum production is projected to be 177 million tonnes in 2025. Thus, the carbon emission intensity of an aluminum producer in 2025 is projected in Table I to be 738 million tonnes CO2 for Scope 1 and 2 and 177 million tonnes CO2 for aluminum production, which amounts to 4.17 t CO2e/t Al compared to the actual 6.08 t CO2e/t Al in 2014 for a 31% reduction.

Les Edwards, et al., reported that the Aluminerie Alouette smelter in Quebec, Canada operates with one of the lowest carbon footprints in the world with a 2019 estimate of 3.9 t CO2e/t Al (Scope 1–3), compared with a global average reference smelter footprint of 16.3 t CO2e/t Al. The analysis shows that most smelters with renewable power can achieve Scope 1 and 2 emissions of >4 t CO2e/t Al. However, achieving this for Scope 1–3 emissions is much more challenging.4

More than a fifth of the world’s two-thousand largest public companies have committed to a net-zero target. Globally, the aluminum sector must cut its emissions by 77% by 2050 to meet climate goals to limit global warming below 2°C, according to an IAI analysis of the decarbonization challenges.5 Decarbonizing the electrical power used to convert alumina into metal in the smelting process is the single biggest lever to reduce carbon impact, as it can cut emissions by 60%, and up to 85% could be achieved with future electric boilers and inert anodes.

China is the world’s largest aluminum producer, accounting for over 55% of global aluminum production and demand. China is also the world’s most heavily polluting aluminum industry because it relies on coal powered electricity with emissions of 12.7 t CO2e/t Al versus a global average of 10.3 t CO2e/t Al. President Xi Jinping announced that China’s emissions would peak by 2030 and that the country would achieve carbon neutrality by 2060. Steel accounts for 15% of China’s carbon emissions, the most of any manufacturing sector in China, while aluminum only accounts for nearly 4%. As a result, decarbonization of both steel and aluminum have been made key government priorities. China’s “14th Five-Year Plan for 2021–2025” provides targets for steel and aluminum carbon optimization, which has led ministries and provinces to announce that they will be putting a price on aluminum emissions.6

Sources of Electrical Power for Smelting

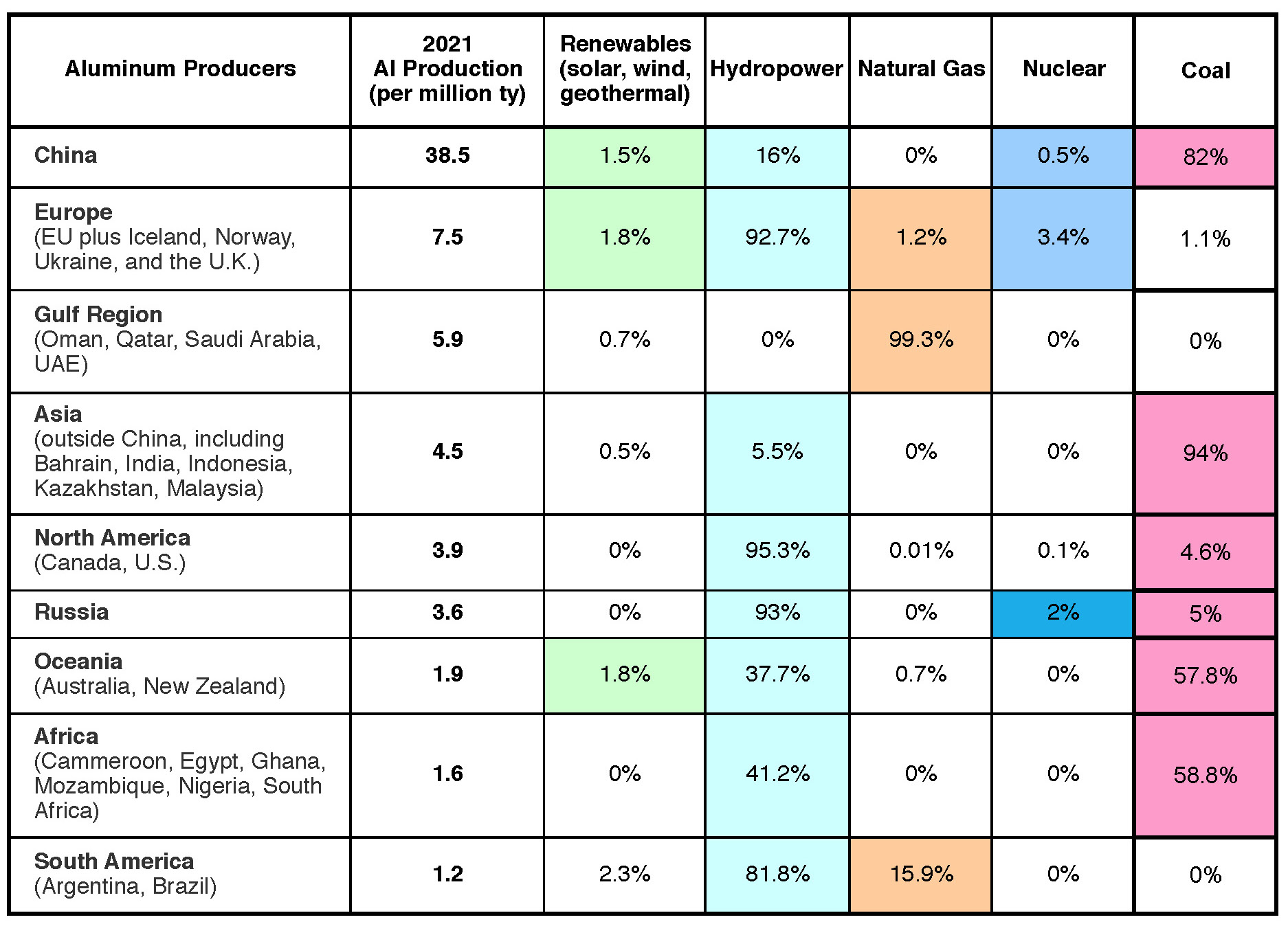

The electrical power used to produce aluminum is a significant source of carbon emissions. The annual aluminum production in 2021 and the distribution of the diverse types of energy sources utilized by global aluminum smelters in various counties is shown in Table II.7-8 A large number of aluminum producers are working to switch their power generation toward renewable energy.

Coal Power Generation

The aluminum smelters in China, India, Malaysia, and Indonesia obtain the highest percentage (93%) of their electrical power from coal-fired plants. China accounts for around 57% of global aluminum output in 2021 and currently obtains 80% of their electrical power from coal-fired plants. The country’s aluminum smelters rely on coal for 90% of their energy needs. Other regions that generate significant electrical power from coal-fired plants for smelters include Australia (67%) and Africa (49%).

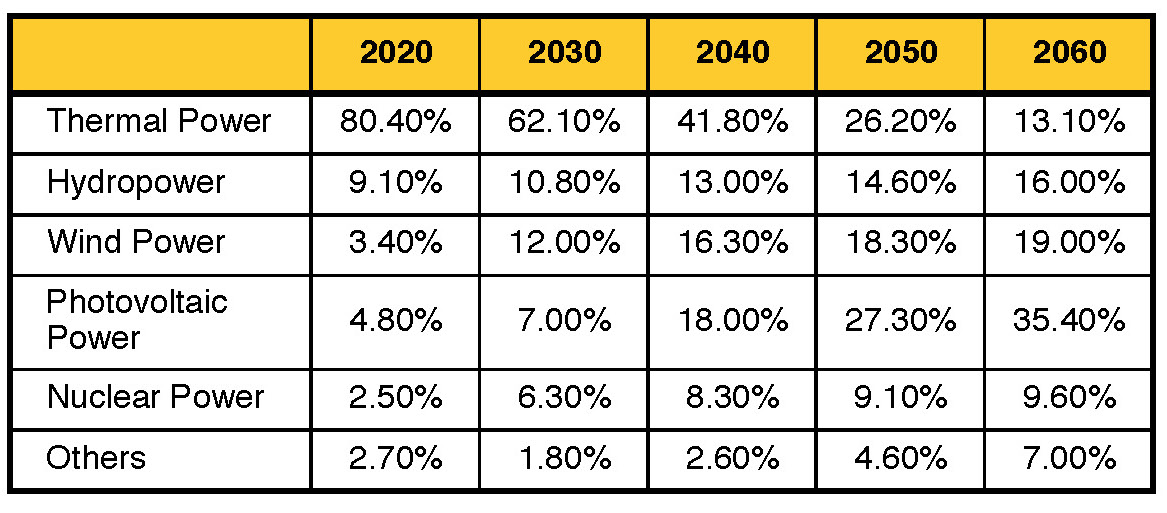

Due to the high proportion of coal-fired energy used, 12.7 tonnes of carbon are emitted per tonne of aluminum produced in China versus a global average of 10.3 tonnes. It is estimated that Chinese aluminum smelters produce an average of 12.36 t CO2e/t Al from coal-fired power generation. Decarbonizing the power supply for primary aluminum production will help China meet their 2060 carbon neutrality goals (Table III).6

Hydropower Generation

Russia is home to 9% of the world’s hydro resources, mostly in Siberia and the country’s far east. The largest dams in Russia are the Sayano-Shushenskaya Dam on the Yenisei River (6,400 MW), the Krasnoyarsk Dam on the Yenisei River (6,000 MW), the Bratsk Dam on the Angara River (4,500 MW), the Ust-Ilimsk Dam on the Angara River (4,320 MW), and the Boguchany Dam on the Angara River (1,920 MW). The Rusal aluminum smelters in Russia obtain a high percentage (93%) of their electrical power from hydroelectric dams, mostly from the major rivers in Siberia. More than 98% of the electricity required for aluminum production at Rusal comes from renewable sources.

In 2020, China commissioned 12 GW of new hydropower generation capacity, followed by Turkey with 2.5 GW. Chinese smelters have in recent years transferred millions of tonnes of aluminum capacity to the country’s southwest to tap cleaner hydropower for their operations at favorable prices, instead of using the more polluting coal-fired power. Aluminum smelters in China currently obtain 16% of their electrical power from hydroelectric plants on rivers located primarily in Southwest Yunnan and neighboring Guangxi provinces.

Norsk Hydro operates more than 20 hydropower facilities throughout Norway, providing around 10 TWh of clean and renewable energy annually for aluminum production. The aluminum smelters in Canada, Iceland, Norway, Argentina, and Brazil obtain a high percentile of renewable electrical power (~80%) from hydroelectric dams on regional rivers. Around 90% of Canadian aluminum is produced in Quebec, where the metal is generally considered the most sustainable in the world, since it is produced almost entirely with hydroelectric power.

Alcoa Corporation and partner South32 will restart their Brazil-based Alumar aluminum smelter, which has been fully curtailed since 2015. The smelter will be 100% powered by renewable hydroelectric energy, placing it in the second quartile of the global aluminum site cost curve. First production is expected in June 2022, with full capacity of 447,000 tpy from the smelter’s three potlines to be achieved in March 2023.

Iceland began switching from fossil fuels to renewable energy in the 1960s, and today, the country’s electricity grid is powered by 100% renewable energy. Hydropower provides 72% of its electricity and geothermal energy provides 25%, with wind power projects in development. The main use of geothermal energy is for space heating, with the heat being distributed to buildings through extensive district-heating systems. About 85% of all houses in Iceland are heated with geothermal energy. The move from oil-based heating to geothermal heating saved Iceland an estimated total of US$8.2 billion from 1970 to 2000 and lowered the release of carbon dioxide emissions by 37%.

The aluminum smelters in Iceland contribute only one-sixth of the average GHG emissions from aluminum production worldwide. The three aluminum smelters—Norðurál (Century Aluminum), Fjarðaál (Alcoa), and ISAL (Rio Tinto)—obtain their renewable energy from the electrical grid with mixtures of local renewable hydroelectric and geothermal energy sources. ISAL is further reducing the carbon footprint of its Hafnarfjörður smelter by partnering with Carbfix to implement carbon capture technology at the plant. This will enable the smelter to capture liquified CO2 from European industrial plants and store it underground.

Natural Gas Power Generation

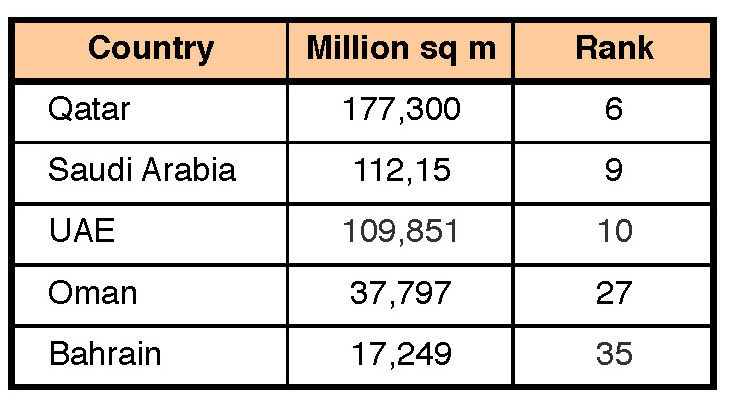

The aluminum smelters in Gulf Cooperation Council (GCC) countries—Bahrain, Dubai, Oman, Qatar, and Saudi Arabia—obtained 100% of their electrical power from natural gas produced at local oil facilities (Table IV). The aluminum plants in South America obtained 19% of their electrical power from natural gas.

In 2021, Qatar produced 177 billion cubic meters of natural gas and ranked sixth in the world. Saudi Arabia produced 112 billion cubic meters of natural gas (ranked 9th), and UAE produced 110 billion cubic meters (ranked 10th).

Russia supplied around 45% of the EU’s natural gas in 2021, and Germany relied on Russia for half of its natural gas and coal and for more than one-third of its oil. When Russia invaded Ukraine on February 24, 2022, many European countries provided aid to Ukraine in terms of military support and assistance to millions of refugees. Western leaders also imposed a series of sanctions on Russian oil and gas following the invasion of Ukraine. In retaliation, Russia cut its gas supplies to the European Union by around 88%. As a result of these supply interruptions, Europe has seen elevated energy prices, which are expected to continue into 2023 and beyond.

Thus, the European Union is currently working to reduce their consumption of Russian oil and natural gas. European leaders are turning to Africa for more natural gas, as they try to replace Russian energy. The initial field near Senegal and Mauritania’s coastlines is expected to contain about 425 billion cubic meters of gas, five times more than what gas-dependent Germany used in all of 2019. But production isn’t expected to start until the end of next year.

Nuclear Power Generation

Most nuclear power plants have operating lifetimes of between 20 to 40 years. The average age of U.S. commercial nuclear power reactors that were operational as of December 31, 2021, was about 40 years. Aging is defined as a continuing time-dependent degradation of material due to service conditions, including normal operation and transient conditions.

Nuclear energy now provides about 10% of the world’s electricity from about 440 power reactors and is the world’s second largest source of low-carbon power (28% of the total in 2019).9 In 2021, all operating nuclear plants supplied 2,653 TWh of electricity.

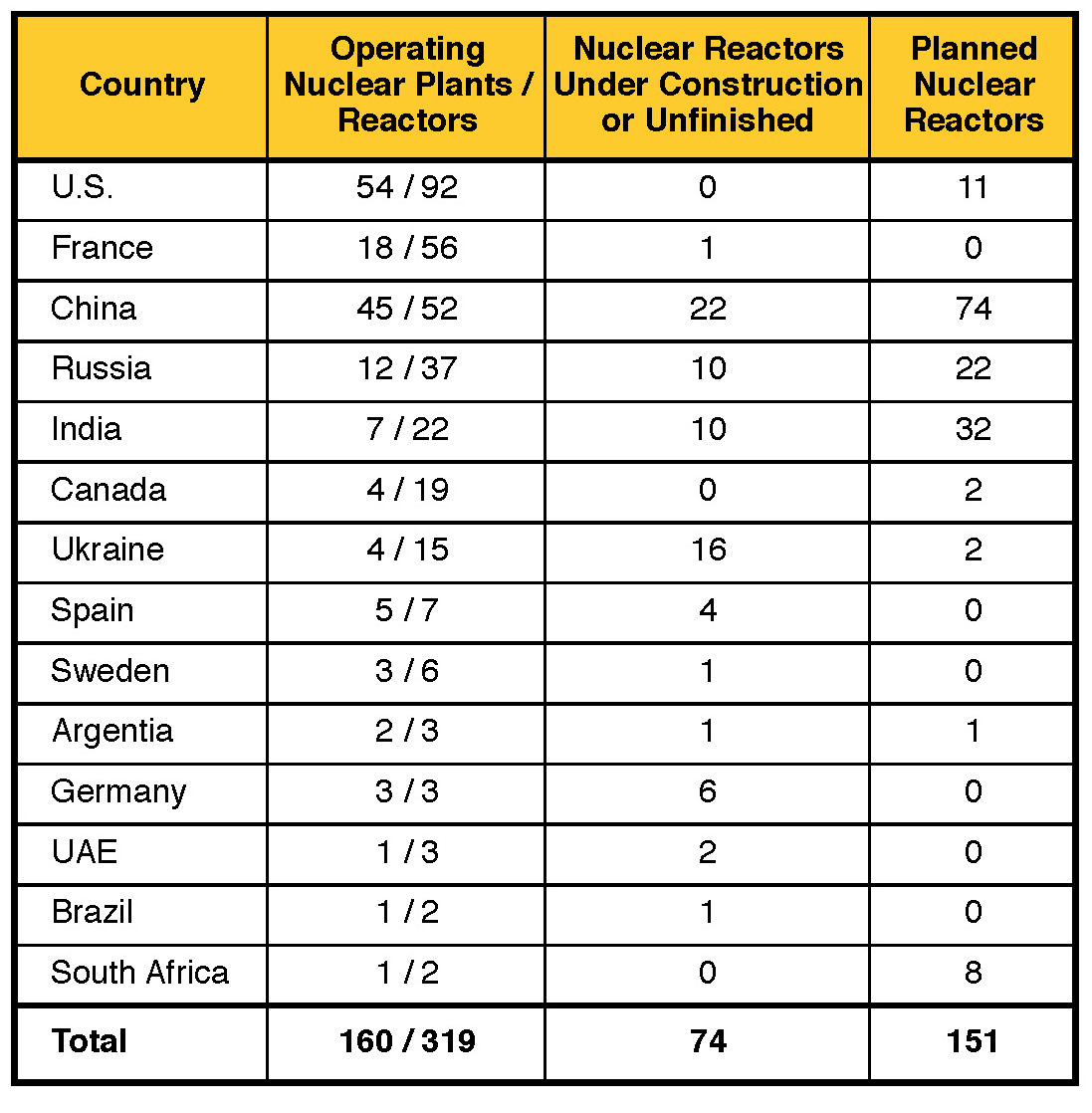

In October 2022, the 440 civilian operable power reactors had a combined electrical capacity of 393 GW. There are 57 reactors under construction and 102 reactors planned (Table V). The aluminum smelters in Europe obtain the highest percentage (6%) of their electrical power from nuclear power plants. France gets around 70% of its electricity from nuclear energy, as it has the highest number of operating nuclear plants (56) in Europe, but it only has one nuclear plant currently under construction and none are being planned. Ukraine, Slovakia, Belgium, and Hungary get about half of their electricity from nuclear plants.

Germany’s immediate challenge is to reduce reliance on natural gas in the power-generation sector, which is further complicated by the country’s exit from nuclear power. Its last three nuclear stations are scheduled to close this year. For this reason, Germany aims to fulfill 100% of its electricity needs with supplies from renewable sources by 2035 compared to its previous target to abandon fossil fuels well before 2040.

The U.S. has the highest number of operating nuclear plants (57) with a total of 92 nuclear reactors, but no new nuclear plants are under construction. This indicates that the nuclear power program is not currently being supported as a major source of electrical power generation in the U.S.

China’s aluminum smelters obtain only 1% of their energy from nuclear plants. China has 45 operating nuclear plants with 52 nuclear reactors. Two nuclear reactors are under construction and 74 additional nuclear reactors are planned, which indicates that a nuclear energy program is important to China’s future.

Russia has 12 operating nuclear plants with 37 nuclear reactors. The country has an additional ten nuclear reactors under construction and 22 additional nuclear reactors planned.

Solar Power Generation

Total solar capacity has now reached about the same level as wind capacity, largely due to expansion in Asia (78 GW) in 2020. Major capacity increases occurred in China (49 GW) and Vietnam (11 GW). The U.S. added 15 GW, Japan added over 5 GW, and India and the Republic of Korea both expanded solar capacity by more than 4 GW.

Aluminum is the single most widely used material in photovoltaic (PV) applications. In fact, the metal accounts for more than 85% of most solar PV components, from frames to panels. Solar PV panels are made to last more than 25 years. In fact, many solar panels installed as early as the 1980s are still working at expected capacity today.

The International Technology Roadmap for Photovoltaics (ITRPV) has set a target for 60 TW of PV panels to be installed by 2050.10 This would mean that the world would need to produce 4.5 TW of additional capacity each year until 2050 to reach net-zero emissions and limit global warming to under 2°C. For context, by the end of 2020, just over 700 GW were installed. The 4,500 TWh generated by PV in 2050 is expected to save 2.3 giga-tonnes of CO2 emissions on an annual basis worldwide. This corresponds to approximately 5% of the total avoided CO2 emissions (48 giga-tonnes).

Based on a representative silicon model panel size of 320 W, then 1 GW of power is equal to 3.125 million PV panels and the average cost of solar energy is 6–8 cents per kWh. Based on the average utility-scale wind turbine size of 3 MW installed in 2021, the 1 GW of power from solar panels is equivalent to 333 utility-scale wind turbines. Solar maker GCL System Integration Technology is investing US$2.5 billion in a solar-module factory in Hefei, Anhui Province, China that will have capacity to produce 60 GW of modules. This will be the single largest solar panel production site in the world, able to supply around half of current global demand for solar modules.

Hindalco is one of the many aluminum producers looking to source power from solar. The company’s Mahan Aluminium facility in Bargawan, Madhya Pradesh, India, is an integrated aluminum smelting complex, which comprises a 359,000 tpy smelter that utilizes modern AP36 cell technology. It is supported by a captive 900 MW fossil fuel thermal power plant. Hindalco has now begun generating electricity from a 25 MW solar plant (Figure 1), which will be used for internal needs and aluminum production. Mahan Aluminium’s president, Senthil Neith, said,11 “The plant new solar plant would generate 550 million units of electricity, reducing the consumption of 35,000 tonnes of coal and bringing down carbon emissions by 52,000 tonnes.”

Wind Power Generation

The expansion of wind power projects almost doubled in 2020, with 111 GW of capacity compared to 58 GW in 2019. China added 72 GW of new capacity, followed by the U.S. with 14 GW. Ten other countries increased wind capacity by more than 1 GW in 2020. Offshore wind increased to around 5% of total wind capacity in 2020.

Wind turbine prices averaged $800–950 per kW in 2021. Initial costs are $2.6–4 million per average-sized commercial wind turbine. The typical cost is $1.3 million per MW of electricity producing capacity. Most commercial wind turbines have a capacity of 2–3 MW, but offshore turbines can be as large as 12 MW. Because wind conditions constantly change, most turbines operated at 35–65% of their theoretical maximum production capacity. Wind turbines also need to be protected from lightning strikes, which can cause maintenance costs to skyrocket.

The aluminum smelters in Europe obtain the highest percentage (6%) of their electrical power from renewable sources on the electrical power grid. The total installed and operational onshore wind power in France in 2020 was 17.4 GW, compared to 16.4 GW in 2019 for a 6.1% increase. The total wind energy provided about 31.4% share of France’s renewable mix in 2020. The French government has awarded contracts for onshore wind and ground-based solar projects. The onshore wind contract was for the installation of 25 projects that would produce 750 MW at an average bid of US$67.90/MWh. The ground-mounted solar project was for 650 MW at a rate of US$67.42/MWh. As part of the same program, an additional 312 MW of solar capacity was also awarded, including 94 MW to compensate for the closure of France’s oldest nuclear power plant.

China has been gradually lowering the subsidies paid to onshore wind and solar projects, which currently support around 210 GW of wind capacity, as the country tries to reduce the US$14 billion deficit of its Renewable Energy Development Fund (REDF). The Ministry of Finance budgeted US$700 million to subsidize new renewables in 2020, which was used to support 8 GW to 10 GW of new onshore wind capacity.

Alcoa Corporation signed a contract with Greenalia, an independent renewable energy developer and producer, for the supply of renewable energy to support the planned restart of its San Ciprián aluminum smelter in northwestern Spain in 2024.12 The long-term power purchase agreement (which will commence in 2024 and will extend to the end of 2033) is expected to provide up to 183 MW of the smelter’s baseload power consumption, representing approximately 45% of the energy required to meet the smelter’s maximum capacity of 228,000 tpy. The company has signed a similar agreement with Capital Energy, which is currently developing 11 wind farms in the Galicia region (see opening image). Through this second agreement, Alcoa will secure some 573 MW of wind power for its San Ciprian smelter. Capital Energy said it had committed to supply 876 GWh per year to the San Ciprian smelter for an initial period of ten years. This agreement is also expected to commence in 2024.

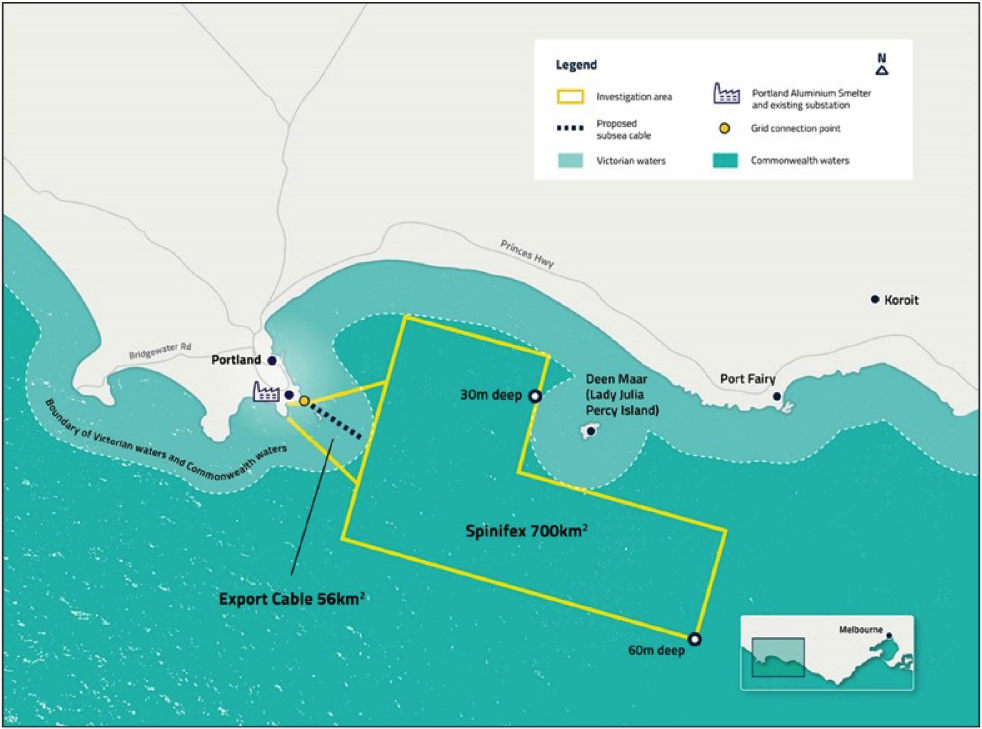

Operating since 1986, Alcoa’s Portland aluminum smelter is one of the four remaining smelters in Australia. It produces 19% of Australia’s total aluminum and is among Victoria’s top exporters. Currently more than 30% of the electricity consumed by the Portland smelter is derived from renewable sources, including electricity from a nearby onshore wind farm. Australian power company Alinta Energy plans to build a 1,000 MW offshore wind farm off the coast of Victoria to help Alcoa’s Portland aluminum smelter go green.13 Though the project is in its earliest stages, a 500 sq km patch off the coast is being considered for the project, dubbed Spinifex (Figure 2). Spinifex is expected to cost $4 billion and would connect to the grid through the Portland smelter. Through this agreement, Portland will be able to draw 100% of its power from renewable energy — making it Australia’s first aluminum smelter to do so.

In 2021, Century Aluminum’s Norðurál aluminum smelter in Grundartangi, Iceland, signed a letter of intent with Qair, an independent renewable energy power producer. Under the agreement, the smelter will receive wind power originating from two of Qair’s wind farms under development in Iceland, which will have a total installed capacity of 200 MW. In addition, the two companies agreed to join forces to capture CO2 from the Norðurál smelter, which will be used for the production of “eFuel” by Qair’s Grundartangi hydrogen plant to be built on a site next to Norðurál.

Hydro has also had a number of wind and renewable energy projects under way. In 2020, Hydro Energy took over operation of Norway’s second largest wind farm, Tonstad Vindpark (208 MW), and developed battery use cases for Hydro’s plants to establish storage capacity to avoid peak power prices and tariffs.

In 2022, Hydro Rein partnered with Macquarie Asset Management’s Green Investment Group to build and operate a 586 MW combined wind and solar power project in Brazil, called Feijão.14 The hybrid wind and solar project will be located in the states of Piauí and Pernambuco, and will have 80 wind turbines with a combined capacity of 456 MW in phase one, with the option to develop up to 130 MW of solar power production in phase two. The northeast region of Brazil is home to 90% of the country’s installed wind energy capacity due to the favorable climate conditions and strong winds. The country has a total capacity of 21 GW from 777 completed wind energy plants with a further 4.9GW of capacity currently under construction. The Feijão project will supply 100% of the electricity required for Hydro’s bauxite mine Paragominas and will further reduce carbon emissions from Hydro’s alumina refinery Alunorte, by enabling coal replacement towards 2030.15 The project will also be an important enabler to reach Hydro’s target of a 30% CO2 reduction by 2030.

Other Power Sources

Additional potential sources of renewable power include geothermal energy and bioenergy, both of which are being considered at smaller scales. Geothermal energy is produced from heat energy from the Earth’s crust, which occurs when magma heats underground water sources, such as hot springs, steam vents, geysers, etc. In 2020, Turkey increased its geothermal power capacity by 99 MW and small expansions have occurred in New Zealand, the U.S., and Italy. In the U.S., the geothermal power generated was 17,126 GWh in 2023, with a cumulative installed capacity of 3,889 MWh. California leads in regard to geothermal power generation.

Bioenergy is derived from recently living organic materials. It is known as biomass and can be made into biofuel. In China, the capacity for bioenergy has expanded by over 2 GW. Europe was the only other region with significant expansion in 2020, adding 1.2 GW of bioenergy capacity (solid biomaterials are utilized for heating and liquid biomaterials (e.g., ethanol) are for fuel). At the end of 2022, Bharat Aluminium Company Limited (BALCO), a subsidiary of Vedanta Aluminium, successfully conducted trial runs for using biodiesel in its smelter operations in Korba, Chhattisgarh, India. In the pilot test, the smelter used biodiesel for preheating ladle vehicles that carry molten aluminum. With the successful completion of this project, BALCO may begin using biodiesel in its other facilities.

Transmission Capacity

Renewable energy production, such as offshore wind farms or major solar fields, is often located far away from production facilities, meaning that electricity must travel long distances to reach the end user. In the U.S, 5% of electricity is lost in transmission. Also, unlike coal or oil, renewable electricity cannot be trucked to a location, where it is then converted into energy. One way of mitigating these problems is to build ultra-high voltage (UHV) transmission systems, which refer to power transmission lines operating at greater than 800,000 V (800 kV). By comparison, most transmission lines currently operating in the U.S. have voltages of less than 395 kV.

Only two countries currently have functional UHVs — China and Brazil. China has 30 functional UHV lines versus two in Brazil, with the lines for both countries being constructed by Chinese companies. Domestically, China is currently pursuing a $300 billion project over 30 years to modernize and update its grid, arguably putting it at the forefront of government initiatives to modernize grids.

References

- “Issue Brief: Low Carbon Aluminium,” Aluminium Stewardship Initiative (ASI), November 2022.

- Reinsch, William and Emily Bensen, “Decarbonizing Aluminum: Rolling Out a More Sustainable Sector,” Center for Strategic International Studies, February 25, 2022.

- Dietz, Simon, Valentin Jahn, and Jolien Noels, “Carbon Performance Assessment of Aluminum Producers: Note on Methodology,” Transition Pathway Initiative, December 2020.

- Edwards, Les, et al., “Quantifying the Carbon Footprint of the Alouette Primary Aluminum Smelter,” JOM, Vol. 74, September 2022, pp. 4,909–4,919.

- “Aluminium Sector Greenhouse Gas Pathways to 2050,” IAI, September 2021.

- “How China is Decarbonizing the Electricity Supply for Aluminium,” World Economic Forum, April 21, 2022.

- “Primary Aluminium Smelting Power Consumption,” IAI, August 9, 2022.

- “Aluminum Production,” U.S. Geological Survey, Mineral Commodity Summaries, January 2022.

- “Nuclear Power in the World Today,” World Nuclear Association, updated October 2022.

- “International Technology Roadmap for Photovoltaic (ITRPV): R&D findings from the 13th Edition,” European Technology & Innovation Platforms (ETIPs), April 14, 2022.

- Majumder, Rupankar, “Hindalco’s 25 MW solar plant in Singrauli district,” AlCircle, September 12, 2022.

- “Alcoa Announces Long-Term Contract for Renewable Power to Support 2024 Restart of San Ciprián Aluminum Smelter,” Alcoa, May 19, 2022.

- “Australian Government Grants A1.5 MM to Offshore Wind Farm for Portland Aluminium Smelter,” Aluminium Insider, October 14, 2022.

- Djunisic, Sladjana, “Hurd Rein, Gig set up JV for 586-MW wind, solar hybrid in Brazil,” Renewables Now, June 1, 2022.

- “Hydro Rein and Macquarie Asset Management’s Green Investment Group to develop hybrid wind and solar project in Brazil,” Hydro, June 1, 2022.

Editor’s Note: This article first appeared in the February 2023 issue of Light Metal Age. To receive the current issue, please subscribe.