By Emily Molstad and Caleb Ralphs, VALIS Insights Inc.,

and Aaron Birt, Sean Kelly, and Diran Apelian, Solvus Global.

The aluminum industry requires a drastic shift in business as usual to meet rapidly growing demand while significantly reducing emissions associated with production. The automotive industry highlights this shift, as utilization of aluminum for lightweighting and electrification initiatives has increased. With new enabling technologies, the automotive scrap metal recycling industry has the opportunity to maximize post-consumer recycling and reduce aluminum production emissions by 30%. The key to unlocking the full potential of recovery and reuse of post-consumer material is the implementation of enhanced sensing, integration, and automation capabilities, as encompassed by Industry 4.0.

The Potential and Pitfalls of Aluminum

Aluminum is an essential metal in advancing and meeting societal needs, whether it be in transportation, housing and infrastructure, or packaging. Its high recyclability, low density, and desirable mechanical properties have made it an obvious choice for a myriad of applications. Aluminum’s material attributes are especially relevant for the automotive industry’s lightweighting and electrification initiatives. A single passenger vehicle emits approximately 4.6 tonnes of CO2 each year, with all passenger vehicles accounting for 14% of total U.S. greenhouse gas (GHG) emissions.1-2 Electrification and lightweighting, both of which depend on aluminum, are critical to producing low or zero emission cars and trucks. Aluminum content in vehicles is expected to grow 12% by 2026, enabling a 17% reduction in emissions per aluminum-intensive vehicle.3

Rising global consumption and growing adoption across major sectors are expected to increase the demand for aluminum by 80% by 2050. The current ecological footprint of aluminum falls significantly short of what is required to mitigate climate change. Today, aluminum production accounts for 2% of human generated emissions at 1.11 million tonnes per year. This is expected to reach 1.6 million tonnes of CO2e by 2050 under the “Business as Usual” scenario, in which current aluminum production practices are maintained. The International Energy Association has set a budget of 250 million tonnes of CO2e for the aluminum sector under the Beyond 2°C Scenario for the year 2050. This requires a staggering 77% reduction in emissions in the midst of rapidly growing demand.4

The majority (90%) of the aluminum industry’s emissions are associated with primary production, where primary production meets 70% of global demand.4 Pathways towards emission reduction, laid out by the International Aluminum Institute (IAI), have prioritized recycling—specifically, the sorting and utilization of post-consumer scrap recovered from end-of-life (EOL) products—as a key area for development. Enhanced recycling capabilities not only benefit environmental goals, but are also a national security interest. In 2018, North American aluminum imports totaled 9.19 billion lbs, while 3.9 billion lbs of scrap were exported. Maximized domestic processing and recovery of scrap feedstock has the potential to reduce imports by 40% and meet over 10% of total demand. 5 In the face of global events impacting supply chains and the need to combat climate change, it is imperative that recycling capabilities are maximized.

Challenges with Post-Consumer Aluminum

Understanding the difference in impact between pre-consumer and post-consumer scrap is critical when evaluating opportunities and gaps within aluminum production. Pre-consumer (or new) scrap is generated during the manufacturing process. This material is typically clean and of known composition, making it easy to reuse. While recycling of new scrap is important to reclaim valuable material, it does not bear a significant impact on overall emission reduction due to already high collection and low loss rates. This is the reason behind the IAI’s emphasis on post-consumer scrap (or old), which is generated when a product has reached the end of its useful life (Figure 1). Recycling of post-consumer scrap avoids nearly 30% of emissions. Therefore, maximizing recovery of EOL aluminum has the potential to eliminate an additional 20% of industry emissions.4

The transportation industry is one of the largest consumers of aluminum with the automotive sector making up 23% of global demand.6 Today, cast and sheet products are comprised of roughly 95% and 25% recycled content, respectively. However, sheet aluminum recycled content is primarily derived from new scrap.7 Furthermore, EOL scrap is predominantly recycled into A380 and A319, which are low value alloys for powertrain components. Electrification and lightweighting initiatives are driving demand for high value complex alloys, such as 5000 and 6000 series wrought alloys and low copper containing alloys. The misalignment between current scrap packages and consumption pathways is problematic, as historic scrap processing has resulted in the downgrading of high value material into low value packages, leading to maintained dependence on primary aluminum for sheet production. The overall recycling rate for automotive aluminum is an impressive 91%, but challenges must be addressed to ensure material is not only being recovered, but also properly utilized.8 Most auto-shred aluminum scrap (~50-80%) is presently downcycled into a component of lesser value or into a dissimilar application than the previous useful life (i.e., auto-sheet aluminum mixed in a shredded automotive scrap charged to form a cast alloy).9

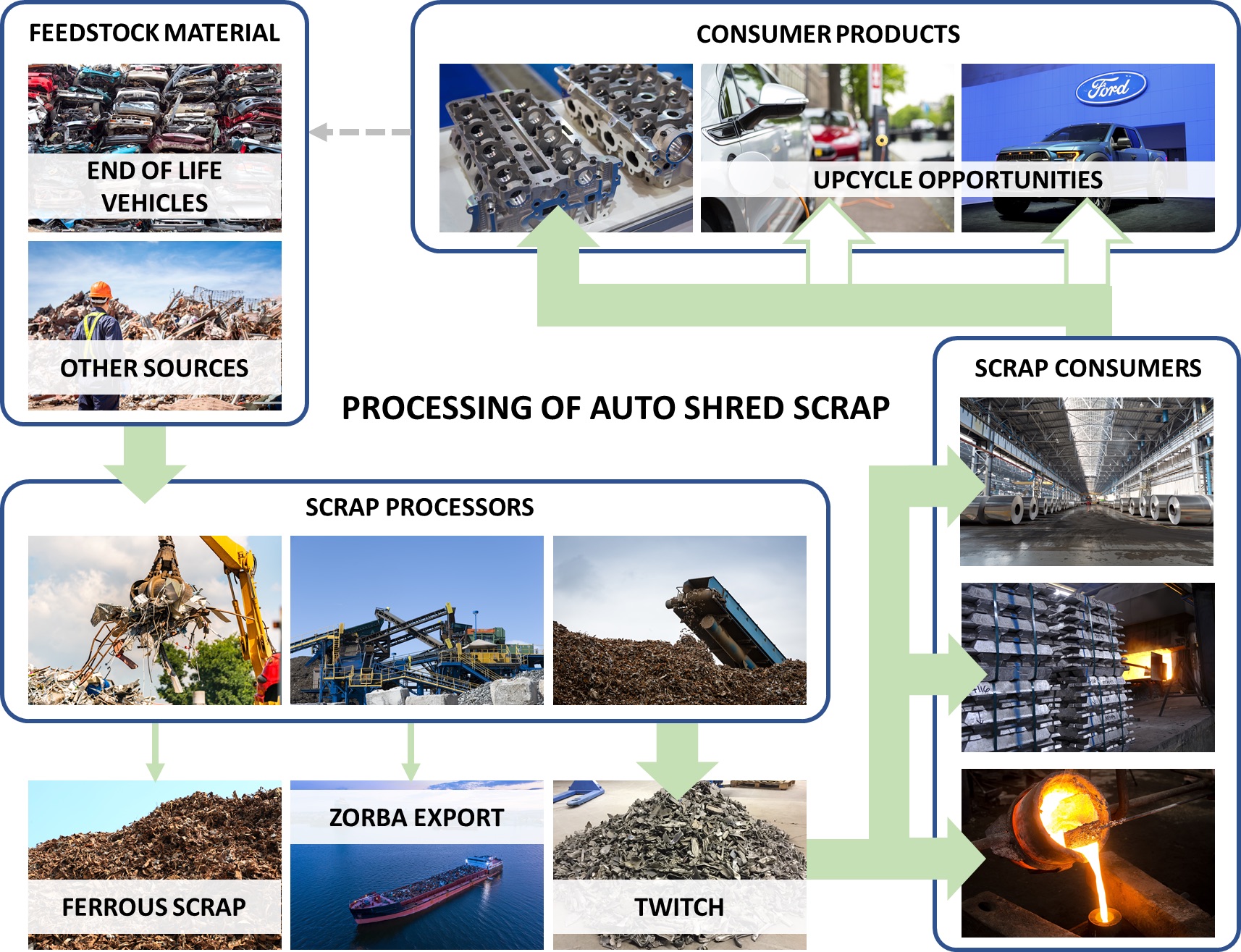

The efficient utilization of post-consumer auto-shred aluminum, referred to as Twitch (Figure 2), is limited by two key challenges: the effective separation of alloys and the inconsistent nature, both in terms of composition and contamination, of old EOL scrap. The former requires enhanced development and adoption of sorting technology to enable the upcycling of material into high value components. The latter challenge has created hesitancy and ultimately reluctance to use auto-shred aluminum in safety relevant applications, while also preventing the consideration of its use in other common applications for aluminum alloys (e.g., structural and aerospace applications).

Vehicles, on average, reach their end of life 12-15 years after original manufacturing; aluminum content in vehicles has increased 38% since 2010, with significant changes to the specific alloys that have been utilized since then.7 Manufacturers must be prepared to reincorporate material that was produced over a decade ago into the alloys that are used during manufacturing today. Additionally, they need confidence that the higher level of contaminants (Figure 3) will not drastically reduce resulting material properties and process yield, which has economic and environmental implications.

To tackle these key challenges, there must be available physical capabilities along with digital systems that capture valuable data needed for enhanced processing, alloy design for recyclability, and overall, a circular economy for automotive aluminum.

Leveraging Industry 4.0 Methodologies

The amount of high-quality, decision-driving data that currently goes untapped at scrap recycling facilities is staggering, especially when considering such data can be used to alleviate the two key aforementioned challenges. However, the fourth industrial revolution is starting to transform manufacturing and provides a great opportunity for the scrap recycling industry. Industry 4.0 (Figure 4) and the Industrial Internet of Things (IIoT) is generally defined around interconnecting people and machines through integrated physical and digital ecosystems. This is a fancy way of saying today’s technological advances in how people use and interact with equipment, sensors, and data collection systems create efficient ways to make meaningful sense and create knowledge from the information and data available in manufacturing and production settings.

In relation to scrap recycling, such data streams can include information about materials, feedstock, pre-processed and post-processed inventory, operational information and efficiencies, historical business decisions, and equipment performance, to name a few. Many of these data streams are presently available in our manufacturing infrastructure, but, unfortunately, they lie in silos. The advent of sensor-based sorting (SBS) systems and in-process monitoring capabilities, along with a platform for fusing these data streams, provides optimal decision-making abilities and product quality assurances.

SBS systems separate the bulk constituents of heterogeneous scrap mixtures based on detectable differences in material property. The development and optimization of SBS systems that can sort by base-metal or alloyed composition at the industrial scale have gained significant traction in recent years, as the need to achieve sustainable material consumption becomes increasingly evident. Upcycling auto-shred will not be possible without widespread implementation of these systems.

There are many SBS types that are commercially available to sort nonferrous and aluminum scrap metal mixtures using image processing and emission detection techniques. SBS techniques based on the fundamentals of x-ray transmission (XRT), x-ray fluorescence (XRF), and laser-induced breakdown spectroscopy (LIBS) are the most advanced for sorting nonferrous scrap mixtures. XRT is based on material density, whereas XRF and LIBS are based on chemical composition. These systems are usually supported by other sensing techniques, such as object detection and color-based sensors, that contribute to spatial and image resolution enhancement in addition to size-detection.

The various sensors provide data streams that can be learned from to make informed decisions both proactively and in reaction to a change in processing and commodity conditions. Additionally, operation metrics, such as conveyor belt speed, scrap ejection efficiency, output product monitoring, and quality characterization, among others, supplement existing data for optimal decision-making. This data amalgamation creates the opportunity for the scrap industry to realize all that this next industrial age has to offer.

Cross Industry Research for Aluminum Upcycling

Developing the technology needed to enable a circular economy requires collaboration across various sectors of the industry: processors, consumers, manufacturers, equipment suppliers, and data/software providers. The heart of Industry 4.0 lies in the connectivity of not only systems and data, but also of stakeholders and decision makers.

Solvus Global and VALIS Insights Inc. have partnered with Novelis, Energy Research Company (ERCo), Eck Industries, Mercury Marine, and Schnitzer Steel Industries to build out IIoT capabilities to support a broad increase in post-consumer scrap utilization across the industry. This project, titled Enhanced Processing of Aluminum Scrap at End-of-Life via Artificial Intelligence and Smart Sensing, has received support from the REMADE Institute.

The cross-industry collaboration aims to deliver value-based intelligent melt control (VALI-Melt), a process control software tool with advanced sensing and processing capabilities. VALI-Melt incorporates a scrap quality assessment tool (SQA), control software, and an in-melt LIBS analyzer to enable closed-loop control for the utilization of post-consumer scrap. Upon completion, this project will deliver a commercially viable software and sensing control tool that will enable optimal processing of scrap and real time adjustments based on feedstock composition and quality. This tool has the potential to enable a 24-40% increase in post-consumer scrap content for automotive, potential reduction in total emissions by 30%, and a 5-8% reduction in cost associated with primary aluminum consumption based on projections for 2030 aluminum demand.

References

- “Fast Facts U.S. Transportation Sector Greenhouse Gas Emissions 1990-2020,” U.S. Environmental Protection Agency, 2022.

- “Greenhouse Gas Emissions from a Typical Passenger Vehicle,” U.S. Environmental Protection Agency, 2018.

- “Automotive Accelerating Greater Efficiency,” The Aluminum Association (accessed October 7, 2022).

- “Aluminium Sector Greenhouse Gas Pathways to 2050,” International Aluminium Institute, September 2021.

- “Industry Statistics: Facts at a Glance – 2018,” The Aluminum Association, January 2020.

- “Global end use of aluminum products in 2020, by sector,” Statista Research Department, June 24, 2022.

- “Roadmap for Automotive Aluminum,” Drive Aluminum, 2021.

- Kelly, S. and D. Apelian, “Grave-to-gate: Automotive aluminum recycling at end-of-life,” Light Metal Age, Vol. 75, No. 1, 2017, pp. 40–43.

- Kelly, S.M., “Recycling of Passenger Vehicles: A framework for upcycling and required enabling technologies” (dissertation), Worcester Polytechnic Institute, May 2018.

Editor’s Note: This article first appeared in the August 2021 issue of Light Metal Age. To receive the current issue, please subscribe.