Automotive is a key pillar of Constellium’s overall strategy, accounting for 24% of the company’s sales in 2018 with further growth expected in the near future. This growth is reflected in the company’s recent investments in its global Automotive Structures business unit, with two new plants in Mexico and Slovakia. These new facilities enable the company to better serve the local markets in which they are situated as well as addressing growing trends in the automotive industry.

Key Trends

The demand for aluminum is driven by the need for lighter weight vehicles to meet government regulations for fuel economy and emissions, as well as to cater to consumer preferences. “Not only are consumers choosing SUVs and trucks, they also want more safety, comfort, and infotainment features in their vehicles, all of which add weight,” explained Lionel Chapis, managing director of Constellium Automotive Structures. “So, choosing aluminum makes perfect sense to reduce weight, improve safety, and in many cases, reduce complexity in vehicle assembly. Since aluminum is highly formable, we can replace an assembly of several components with just a single piece.”

One of the major trends that Constellium is focused on is the automotive industry’s transition to electric vehicles (EVs). “As automakers introduce additional EVs, we are working with them to take full advantage of the benefits of aluminum,” said Chapis. “The batteries that power EVs are extremely heavy, so lightweighting is essential throughout the vehicle and aluminum is a preferred choice for that. It is also an excellent material for thermal management, which Constellium is incorporating into EV battery enclosures with innovative systems for future applications.”

In serving the EV market, the company has been working to develop new high strength alloys (HSA6™) and high crush alloys (HCA6™), which are particularly useful in crash management systems. Improved crash management is important for EVs due to how the electric drive train changes the structural aspects of a vehicle compared to an internal combustion engine. “Without an engine in front, the crash management system has to be much more robust to absorb energy in a collision and protect occupants,” said Chapis. “Therefore, we are designing systems that are larger, stronger, and can absorb significantly more energy.”

According to Chapis, Constellium is uniquely positioned as a supplier of aluminum solutions for the auto industry, due to its ability to develop new alloys and manufacture both extrusions and sheet products. “We can design and produce products made of extrusions, sheet, and even castings, such as battery enclosures for EVs,” noted Chapis. “We see this as a winning strategy to help automakers adopt lightweight aluminum that also provides key advantages such as strength, crash, intrusion resistance, and thermal management.“

Automotive Structures

The Automotive Structures business is a supplier of advanced solutions for the automotive industry around the world. The business produces aluminum crash management systems, body structure components, and battery enclosures for EVs. Constellium works closely with the automakers, from alloy development to product design, simulation and testing, rapid prototyping, and mass production for global programs.

Automotive Structures primarily works with aluminum extrusions, which are stretched, bent, machined, laser cut, welded, bonded, and more to create custom components and assemblies. However, the business also provides aluminum sheet, castings, or other materials in order to offer the right solution for automakers. “In fact, one of our newest projects is a series of assemblies that make up a significant portion of the frame for a sports car,” explained Chapis. “These assemblies can have up to 20 sub-components each, including aluminum extrusions, castings, sheet, and also some hight-strength steel sheet.”

The business unit operates seven production facilities for Automotive Structures across the globe—two of which came on-stream in 2018. “Constellium’s growth is completely driven by customer demand,” said Chapis. “We open new facilities near our OEM customers to supply custom products for specific vehicle models.”

In addition to its manufacturing capabilities, Constellium operates a University Technology Center (UTC) at Brunel University London in the U.K. At the UTC, the company has dedicated, full production-scale casting and extrusion equipment for developing new alloys. “This means we don’t have to wait for an opportunity at one of our extrusion plants to run a trial, which has allowed us to speed up the development process for new automotive alloys by more than 50%,” said Chapis. “Last year, we expanded the UTC, so now we can produce and test prototype components.”

San Luis Potosí Facility

The automotive industry in Mexico is growing rapidly. It is expected that more than five million vehicles will be assembled annually in Mexico by 2020. “Mexico is one of the largest markets for automotive production and is growing in domestic sales as well,” explained Chapis. “Automakers from all over the world have a home in Mexico as a base to serve the Americas and that makes it an attractive opportunity for Constellium.”

In order to serve customers in the region, the company constructed its new Automotive Structures facility in San Luis Potosí (Figure 1), a major center of the automotive industry located in Central Mexico. “The city is not only well positioned for serving our current customers, but also for targeting future business opportunities in Mexico and there is an established supply base,” noted Chapis. The plant was designed with room to expand should future business opportunities in the region require it.

Starting operation in March 2018, the 5,000 sq m facility produces crash management systems (a combination of bumper beams and crashboxes) and other structural components. Therefore, the plant specializes in processes, such as bending, machining, welding, and heat treatment. Local producers supply aluminum extrusions to the facility, which are then converted into automotive components through a series of operations. For example, a crash management system will involve stretch bending of the bumper beams, machining of specific features into the beam, fabrication of the crashboxes, and welding of the crashboxes to the beam. This is followed by heat treatment to provide the part with its final required strength. “All of these operations have to be synchronized to make the part to our customer’s specifications,” said Chapis. “In some cases, we are measuring quality to within a fraction of a millimeter so the precision of each operation is critical.”

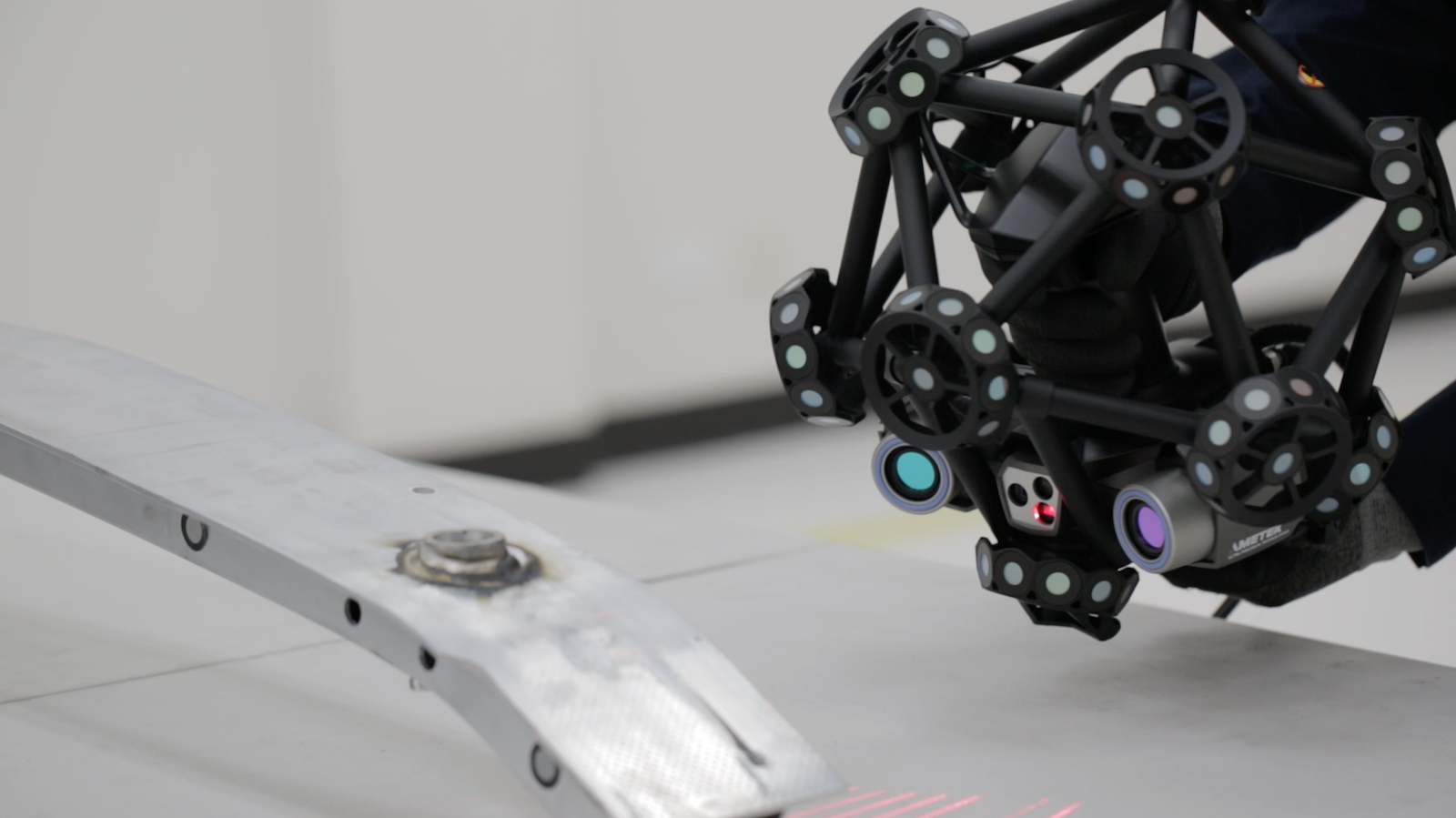

In order to ensure that the automotive components produced meet the strict requirements of the industry, the facility also features a quality lab to continually evaluate products. The lab features a coordinate measuring machine (CMM) and a FARO robotic arm for measuring the features of the parts with extreme precision. The site also includes a laser scanner (Figure 2), which enables engineers to construct a 3D image of the part within minutes, allowing for a comparison between the final part and the original drawing in order to make certain it meets the customer’s exact specifications. In addition, the lab has the ability to perform tensile tests to confirm the material properties of the aluminum, weld tests to ensure components are properly joined, and crush tests to be sure safety components perform as intended in the event of a collision.

Shortly after starting operation, the San Luis Potosí facility, along with Constellium’s Rastatt, Germany, plant, began supplying structural components for Mercedes-Benz and Daimler vehicles. “As a global program, our team coordinated the development of the project from our locations in Gottmadingen, Germany and Van Buren, Michigan. And this international team worked together to specify and install the equipment at the San Luis Potosí plant,” explained Chapis. “We consider the result an internal benchmark for lean manufacturing.”

Zilina Facility

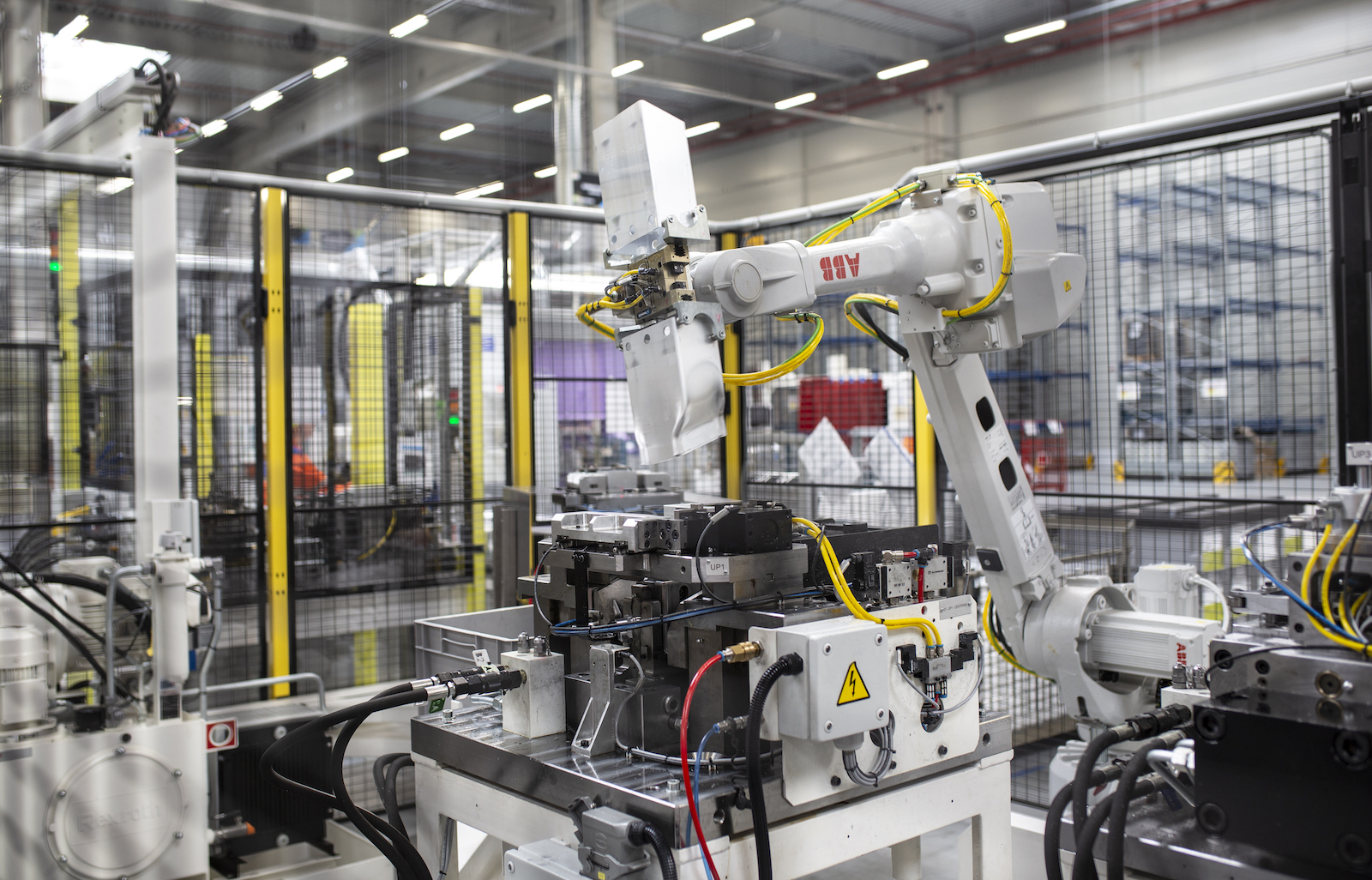

The Zilina facility in Slovakia officially started production in Spring 2019, aiming to serve the European automotive market. Slovakia has an extensive automotive industry serving Europe, which makes the plant well situated to serve a number of Constellium’s customer programs. The plant produces crash management and other safety systems (Figure 3), with manufacturing processes for cutting, punching, and washing aluminum extrusions for crash management systems. In addition, it features advanced technologies and processes for precision forming, machining (Figure 4), welding, riveting and gluing, and heat-treating aluminum automotive components, along with a quality lab—all of which are similar to the capabilities of the Mexico facility.

In May 2019, the plant was expanded from its initial 5,200 sq m to 15,000 sq m in order to accommodate new programs for automaker assembly plants in Europe. “The Zilina plant was expanded to accommodate new business that will launch in 2019 and 2020,” said Chapis. “The additional space houses equipment for forming and joining crash management systems and other body structure components.”

Future Expansion

As aluminum continues to be a key material in the automotive industry, Constellium is adapting to the needs of the market. In addition to the new plants in Mexico and Slovakia, the company is launching another two Automotive Structures facilities in 2019, which are to be located in Vigo, Spain, and Nanjing, China. Investing in its capabilities enables Constellium to partner with automakers, beginning early in the design process in order to achieve the optimal weight, performance, and cost of the final component. “Not only do we work with traditional OEMs, but several new EV manufacturers have sought our expertise as well,” said Chapis. “By continuing to provide the complete range of services, as well as quality products on time, we believe we can make our customer relationships even stronger to be the supplier of choice for aluminum structural components.”

Editor’s Note: This article first appeared in the August 2019 issue of Light Metal Age. To receive the current issue, please subscribe.