By Dean M. Peters, Contributing Writer.

For decades automotive companies have been seeking ways to reduce the weight of various classes of vehicles in order to improve vehicle efficiency and fuel economy and reduce carbon emissions. Recently, the forging industry has taken a closer look at its technologies and processes to see how it can best help this effort. Both globally and in North America, forging companies are engaging in lightweighting through part redesigns and the substitution of lighter weight materials, such as aluminum. This has resulted in significant investments in new facilities, equipment, and technologies, such as at the new Bharat Forge Aluminum USA facility in Sanford, NC.

The Trend Toward Lightweighting

Everything that falls under the category of automotive fuel economy is based on one simple principle of physics: given a roughly equivalent aerodynamic design and regardless of the energy source of the vehicle, it takes less energy to accelerate a lighter vehicle than it does a heavy one. This is obvious to any high school student of Newtonian mechanics, but in recent years the automotive industry, in partnership with its supply chain partners, has taken a closer, more detailed look at how to eliminate every ounce or gram of excess weight in the interest of vehicle efficiency, fuel economy, and lean manufacturing.

According to the U.S. Department of Energy, “Lightweight materials offer great potential for increasing vehicle efficiency. A 10% reduction in vehicle weight can result in a 6-8% fuel economy improvement.” And, incidentally, even if you are cruising along at a constant speed and hit neither the brake nor accelerator, your vehicle is continually accelerating against the roughness of the street, internal friction in the car, and aerodynamic drag, in which more energy is dissipated the heavier the car is.

Advancements in alloy metallurgy have permitted the replacement of ferrous castings and forgings and traditional steel components with lightweight materials, such as advanced aluminum and magnesium alloys, high-strength steel, carbon fiber, and composite materials. These advanced materials have found application in traditionally weighty powertrain and suspension components in internal combustion engine (ICE) vehicles and in newer vehicle designs, such as hybrid electric, plug-in electric, and fully electric vehicles (EVs).

The use of lightweight automotive structural members and components on traditional ICE cars and light trucks enables the integration of safety devices, emission control systems, and more electronics without increasing vehicle weight. And with the increasing ubiquity of various hybrid and pure electric vehicle designs, the use of lightweight materials can offset the weight of batteries and electric motors and improve the all-electric range of these vehicles.

“There is a lot of room for lightweight design with forged components in automotive applications,” says Dr. Hans-Willi Raedt, CEO of prosimalys GmbH, a German engineering consultancy for forging, materials, lightweighting and CO2 reduction. Raedt was deeply involved in Germany’s Lightweight Forging Initiative, which was started in 2013 and focused on looking for areas and techniques in which forged products could be redesigned for lighter weight. Using this methodical and hands-on approach, the team of engineers studied forgeable powertrain components accounting for slightly less than half of the vehicle’s weight. In summary of Phase II of the project, it was found that, using alternative materials and new design concepts, forged products could save up to 99 kg in weight. Two-thirds of this reduction could be achieved using new design concepts in steel, while an additional 34 kg in weight savings could be achieved using nonferrous metals.

“Compared to cast or sintered materials, forgings are stronger with a higher ductility, so they lend themselves best for lightweight design, which leads to higher stresses in the components,” explained Raedt. “But even where forgings are already applied, even more weight savings can be achieved with the full utilization of modern forging [alloys] and advanced forging technology. This, however, calls for an intensive collaboration between material producers, forging companies, and auto producers. Reducing component mass will save propulsion energy, which is beneficial for conventional and new automotive powertrains. Subsequent reduction of input material yields energy and thus CO2-emission savings in production, which also are increasingly in demand. Many components currently in use clearly demonstrate a further 10-15% potential for reduced mass, CO2 emissions, and production cost with minimal development efforts.”

The Global Response to Lightweighting

There is nothing new about lightweighting in automotive applications, except that automotive executives and designers now work more closely with their industry’s relevant supply chain partners. The goal is an in-depth and detailed understanding of the processes, designs, and component materials from which modern vehicles are assembled. Narrowing the field to the lightweighting of traditionally forged parts (dominated by powertrain, suspension components, and fasteners), these ideas can take the form of a full re-imagining of a part or assembly, revised geometries that reduce the material content of existing traditional components, and the use of advanced materials and material substitutions (such as aluminum, high-strength steel, and magnesium). In particular, most of the headlines are grabbed by the trend toward more aluminum.

In 2019 Norwegian aluminum producer Hydro announced an upgrade to casting operations at its Husnes facility with new technology to produce more advanced products for the growing automotive aluminum forging market. The Hydro-developed technology enables a shift from traditional extruded forge stock to cast forge stock, eliminating costly steps in the production process while improving quality. According to Hydro Husnes, the new technology will strengthen the plant’s ability to deliver more advanced aluminum products. The key is the flexibility to be able to cast both extrusion ingots and forging materials according to customer demand in a flexible and efficient way. More recently, Hydro announced its intention to deliver its first commercial volumes of near-zero carbon aluminum in 2022. The company is also continuing its technology efforts toward an industrial scale pilot producing carbon-free aluminum by 2030.

Large investments by forgers in lightweighting are being made in the form of new or additional aluminum forging lines. A case in point is the August 2021 announcement by Otto Fuchs KG of the crank forging press they ordered from Schuler for its Shenyang, China, location. The automotive supplier will use the 3,150 ton press to produce more aluminum chassis components for customers in China. In crank forging presses, several torque motors operate on a main shaft via a step-down gear unit. They are suitable both for wear-free single-stroke operation and for forging in continuous operation.

In September 2021, Hirschvogel Automotive Components (Pinghu) Co. Ltd., a manufacturer of automotive parts and components in China, contracted with SMS group to supply a fully automated closed-die forging press to forge aluminum chassis components at the company’s Pinghu location near Shanghai. The new line will be the third such unit from SMS at this site and is scheduled to be commissioned in Q2 of this year.

Announcements of this nature have become relatively commonplace and represent only a few selected examples in a broader context of lightweighting by the forging industry.

Lightweighting via Simulation

North American forgers are facing the same lightweighting challenges as other industrialized regions of the world. “The automotive industry, especially cars and light trucks, is the driver of lightweighting initiatives in the U.S. at the present time,” says Nicolas Poulain, director of Sales & Technology for Transvalor Americas, a supplier of virtual engineering software platforms that model industrial processes for the forming of metals and other materials. “This is the case, at least within the forging industry, and there is a need in the U.S. for additional lightweighting activities.”

The gradual shift away from traditional ICE cars and light trucks toward hybrid and pure EVs is not a thing of the future. This trend and its consequent reduction in demand for powertrain components has already started. It is today’s metaphorical equivalent of the challenge presented to metal forgers when additive manufacturing (AM) processes started coming into their own about 25 years ago.

From Poulain’s perspective, those who simulate processes and model efficient parts can get a leading indication of what is trending within the industries they serve (Figure 1). He notes, “We are getting more requests for simulating manufacturing processes for aluminum than any other lightweight metal, and the backlogs of the aluminum forgers we work with are growing rapidly.”

North American Investment

On November 23, 2003, Bharat Forge Ltd., Pune, India, a leading maker and exporter of crankshafts and axles, officially acquired the assets of Carl Dan Peddinghaus GmbH, one of Germany’s biggest forging firms. As part of this transaction Bharat Forge (a Kalyani Group company) acquired Peddinghaus’ aluminum division, CDP Aluminiumtechnik, located in Brand-Erbisdorf, Germany. This facility was transformed from a steel forge to an aluminum one in 1996 and became a supplier of aluminum components to the automotive industry. Under the Bharat Forge banner, this company became known as BF-AT. During subsequent years, investments in BF-AT improved the plant’s capacity and efficiency through automation and other investments. In 2019, BF-AT completed the installation and commissioning of a major melting facility to produce HCM (Horizontal Cast Material) feedstock to the plant. In 2019, BF-AT started the commissioning of the new forging line in Brand-Erbisdorf.

The success of the BF-AT operation in Brand-Erbisdorf, coupled with increased global demand for aluminum automotive components, got Bharat Forge thinking of starting up its first aluminum line in the U.S. In September 2019, Bharat Forge America Inc. announced its acquisition of a 92-acre greenfield site in Sanford, NC, to do just that and provide room for significant long-term expansion. The initial $127.3 million investment was to help it create a strong global manufacturing footprint as part of its aluminum strategy. According to Vick Kheny, director of sales for Bharat Forge Aluminum USA, “This was Bharat Forge’s first greenfield investment outside Indian borders, as well as its first aluminum investment outside of Germany.” Groundbreaking in North Carolina took place in February 2020.

And then COVID hit.

Valuable time was lost in the U.S. and overseas as the pandemic reached global proportions. Lasco Umformtechnik GmbH, Germany, was to be the lead supplier and integrator for the new aluminum operation. According to Mike Gill, president of Lasco Engineering Services, LLC, Monroe, Michigan, “Because of COVID restrictions, our parent company in Germany could not fulfill its role on-site in North Carolina, so we were asked to step in and oversee the installation and integration of the aluminum line. In the summer of 2020, we started shipping goods into Sanford, and we began equipment installation in September. In early 2021 the line installation was completed, and in March 2021, Bharat Forge Aluminum USA forged the first trial parts.”

Kheny says, “Bharat’s intention was to mirror its BF-AT German operation here in North Carolina. There is a lot of German DNA in this installation and technology. We are a synergistic blend of three cultures, part Indian parent company, German technology, and U.S. enthusiasm. This is a turnkey, highly automated, state-of-the-art facility.”

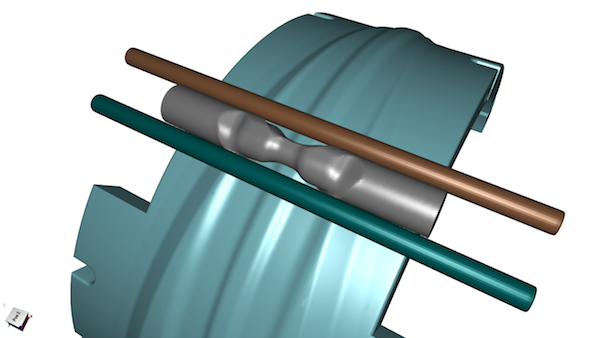

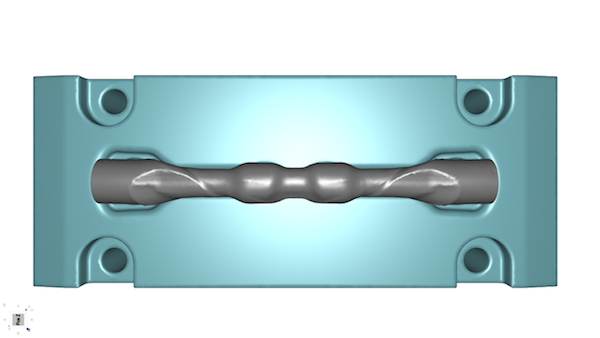

The production line utilizes the same HCM feedstock and forging process as BF-AT. It starts with bins of pre-cut aluminum billets that are melted and cast on-site. These are robotically placed in a conveyor furnace for preheating, from which the heated billets are cross-wedge-rolled into preforms that are bent and/or flattened as needed. Two 4,000 ton Lasco screw presses do the actual forging (Figure 2), from which the raw parts are sent to a trimming press. They are able to produce a new automotive component approximately every 10 seconds. After a T6 annealing treatment, the trimmed parts are water-quenched, then artificially aged via thermal processing. After fluorescent inspection and shot blasting, the parts are moved to other parts of the plant for finishing operations as needed.

Bharat Forge Aluminum USA has started up a showcase operation in Sanford. It verifies the forging community’s willingness to invest in accommodating the changing needs of its automotive customers in highly automated and sustainable ways.

Conclusion

Automotive lightweighting can take many forms such as conceptual design changes, functional or geometrical redesigns, and material substitutions, all the while trying to reduce or control manufacturing costs. Both domestically and abroad, forgers have made investments to accommodate shifting demand patterns from their automotive customers.

Many of the lightweighting projects are being done by large companies and involve significant investments. It is too early to tell whether smaller forge shops who may need to diversify or change their focus will have the financial and technical resources to survive trending market shifts

Dean M. Peters has covered metal working markets, including the foundry, welding and industrial gas, heat treatment, and forging industries for more than 30 years. His journalistic credentials are enhanced by his BS in metallurgical engineering, MBA in finance, and a decade of experience in market research. Contact him at: forgeoped@gmail.com.

Editor’s Note: This article originally appeared in FIA Magazine (February 2022) and was reprinted in the June 2021 issue of Light Metal Age in a slightly different format. It was reprinted with permission from the copyright holder, the Forging Industry Association (www.forging.org). All rights reserved.