By Andrew Hall, Alken.

The 21st Arab International Aluminium Conference (Arabal 2017) took place at Shangri-La’s Barr Al Bandar hotel in Muscat, Oman over the period November 6-9, 2017. The event was hosted by Sohar Aluminium and held under the patronage of H.H. Sayyid Harib bin Thuwaini bin Shihab Al Said, assistant secretary general of the Council of Ministers for Conferences, Oman. Over 550 delegates from 35 countries attended the event — with 64 speakers and around 60 exhibitors.

The primary goal was to bring together global leaders and aluminum professionals, as well as primary aluminum manufacturers from around the world in order to create an open dialogue for the discussions. The conference program included two days of presentations, followed by a site tour of the Sohar Aluminum smelter. This article provides an overview of a selection of presentations focused on the primary aluminum industry.

Opening Cermony

Mohammed Al-Naki (Figure 1), chairman of Arabal, reflected on the long tradition of excellence, debate, and knowledge transfer established by the Arabal series of conferences. He noted that 2017 theme of “Driving Strategic Growth across the Global Aluminum Industry” had guided the steering committee and Sohar Aluminum organizing team to develop an integrated program of panel discussions featuring renowned speakers and expert analysts who would share their insights on a number of global and regional developments in the aluminum industry.

Said Mohammed Al Masoudi (Figure 2), ceo of Sohar Aluminium Company, remarked that the nation had grown as a beacon of socio-economic progress since 1970, owed to a strategy of focusing on industrial development while encouraging modernization and investment in Omani youth. He then reflected on Sohar Aluminum’s history from 2004 to the present, saying “the most important milestone we have accomplished is nurturing and training a team of high profile experts.”

H.H. Sayyid Kamil Al Said said, “While Oman’s many natural resources have been harnessed with considerable success, we need vision to unlock their full potential. This is something Oman has been able to achieve within the global aluminum sector since its emergence as a player only a few years ago. Locally, the industry has boosted job opportunities and created a valuable knowledge base regionally and internationally, which has contributed significantly in raising Oman’s profile.” In referencing the country’s Vision 2040 and the need to develop an economy underpinned by a diverse set of industries, he noted that Oman benefits from a youth bulge and was convinced that manufacturing industries such as aluminum production will be able to harness this benefit, allowing the region to emerge as a producer of non-petroleum raw materials that has complemented its current role in the global energy market.

Smelter of the Future

The session, “Technology, Research and Development: Smelter of the Future and Art of Technology” (Figure 3) was moderated by Chris Bayliss, deputy secretary general, International Aluminium Institute (IAI).

Dr. Hans Erik Vatne, PhD, senior vice president, head of technology, Primary Metal Technology, Norsk Hydro ASA, began the session by discussing Hydro Aluminium’s smelter agenda. He said that the next generation electrolysis technology at their Karmøy Technology Pilot would see energy consumption levels at below 12 kWh per kilo of aluminum produced in an industrial scale smelter. “Though it is a pilot, it is still a 75,000 tpy plant with 60 cells,” said Vatne. “And it will also have a benchmark level on emissions like CO2 and fluoride.”

He mentioned Hydro’s application of digital technology to operations within the smelter, such as the automation of cover handling and automatic anode covering and highlighted the digitization of advanced control systems, improved control loops giving better stability to the operations. “It is very important, with the connectivity that we now have to visualize with dashboards, to get the right information to operators, maintenance people, managers, and engineers at the right time,” he said.

While their medium-term aspirations were to implement spin-off technology elements into their existing smelters, Vatne emphasized the importance of combining the physical models and their domain competence with these new tools, such as artificial intelligence and machine learning, to give more continuous measurements and eventually to have an autonomous cell, a cell that works without any interference, controlled by itself.

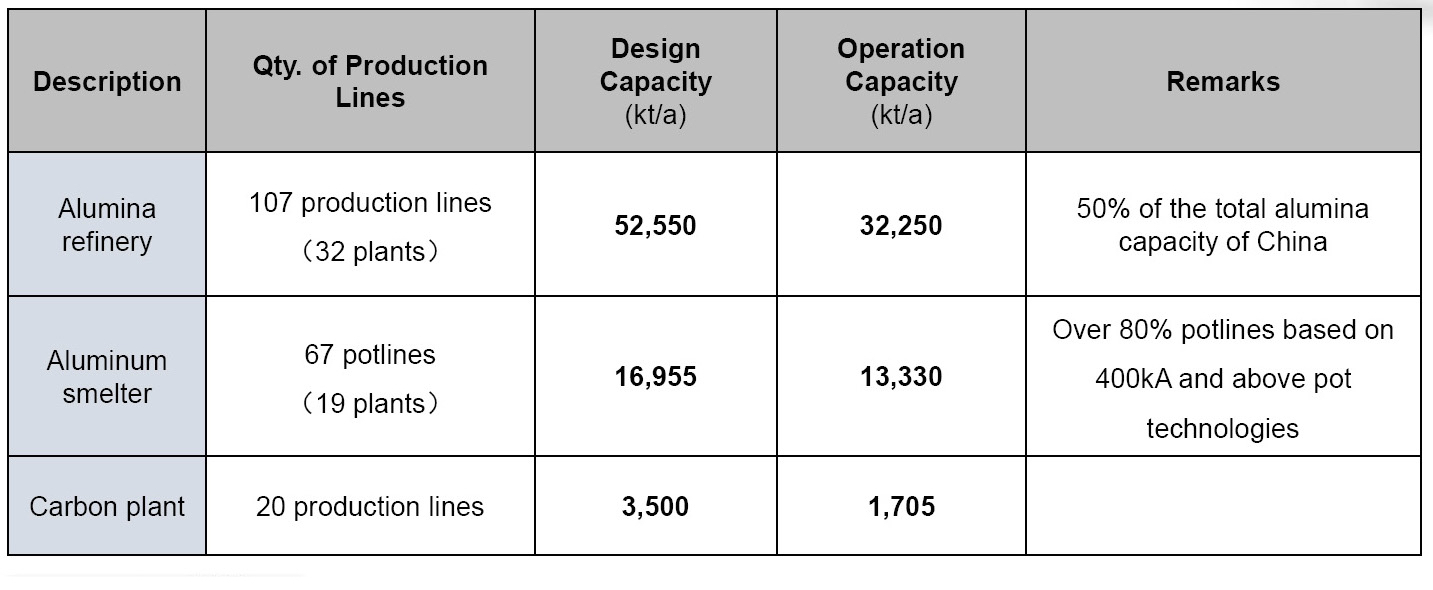

Dr. Qin Junman, vice chairman of N.E.U. Engineering and Research Institute (NEUI) and vice president of China Nonferrous Metal Industry’s Foreign Engineering and Construction Co., Ltd. (NFC) acknowledged that the additional global aluminum capacity mainly comes from China (Figure 4), providing the country many opportunities to implement their research when building new potlines. “The total capacity of aluminum smelters in China is now 46 million tpy,” he said. “The production is well below that, last year it was 32 million tonnes, this year it is expected to reach around 37 million tonnes. We have built 76 potlines in 19 smelters. The total capacity of designed smelters is about 17 million tonnes, out of which 13.3 million tonnes have been put into operation.”

Reviewing China’s technological development, Qin said the world’s first 600 kA potline (Figure 5) was put into operation in 2014, with 12 such potlines having been designed so far, of which six potlines have been put into operation. “We are able to operate at 602 kA and the PFC [generation] we are able to get down to is 12,500,” he said.

The design of an 800 kA potline has been completed in China, according to Qin. However, new environmental restrictions and considerations regarding area tolerance for their emissions, have resulted in the suspension of the project. “This kind of development does not require prototype or test cells,” he said. “Based upon our experience, we went straight into the implementation of the line, as we did this for our 300, 400, 500, and 600 kA potlines. So, I think the 800 kA potline will definitely be put into operation in China in the future. Currently, with our design for the 600 kA pots we are able to build a potline with a capacity of approximately 750,000 tonnes in a single potline.”

Vincent Christ, vice president Technology and Project Development, Aluminum, Rio Tinto, looked at recent events in the aluminum marketplace, judging that it remained volatile. This had caused Rio Tinto to essentially focus on productivity in all the major areas of the smelter. “The traditional way we have been addressing this is to have two platforms,” he said. “We have the high productivity platform, which has its merits; we basically self generate our energy, so we have attractive power costs. Productivity is the driver here. In other areas where energy prices are more challenging, we opt for a lower energy consumption design.”

He continued by citing a specific example from their productivity journey. Starting with a smelter in the ’90s at 180 kA, its amperage was increased to 400 kA, so productivity was doubled with the same asset. The limit of improvement was reached, though Rio Tinto is convinced that the journey of creeping productivity will continue with these assets, but in a different form. Christ gave a further example of productivity improvement, looking at their AP 18, AP 30, and AP 60 cell technologies, where the production was doubled.

A further innovation made was the establishment of a central control center, which all the plants linked into. The crew works in a central control room exchange with the operators, providing instructions. “The bulk of our effort is on productivity,” Christ said. “I think we have the platforms that we need should the market pick up in a way that expansions are worth it.”

Dr. Ali Hussain Ahmed Mohamed Al Zarouni, executive vice president, Midstream Technology Development and Transfer, Emirates Global Aluminum (EGA), explained that in addition to primary aluminum production, EGA was presently moving upstream — having their own bauxite mine and with an alumina refinery under development in Taweelah. He said EGA had finished a conversion of the oldest technology to get significantly higher production: almost 25% higher productivity on 10% lower energy. In regards to technology development, he noted that EGA has developed the DX and the DX+ Ultra (Figure 6), which today are operating at around 460 kA, as well as the development of a technology that goes beyond 600 kA with around 11.8 kW.

Dr. Mark Dorreen, director, Light Metals Research Centre and vice president, Energia Potior Ltd., explained that the Light Metals Research Centre, based within the University of Auckland, had a very clear role to play and that it overlapped and interfaced with technology development companies. “This is in helping find value for ourselves and helping find value for our customers,” he said. He felt that one of the areas the industry as a whole should be considering was the production of low CO2 aluminum and green aluminum, which was likely to become of real value in the marketplace.

In the subsequent panel discussion, Bayliss remarked that a lot of exciting things are going on in terms of digitization, automation, some of the soft technologies, and new cell design, with China putting a lot of energy into the latter. “Productivity improvement on the efficiency of existing assets is important as well,” he said. “What I don’t hear is where this metal is going to come from to feed the extra 20 million tonnes we are going to need by 2025 to 2030.”

Qin noted that in terms of increasing mechanized operation, intelligent running and information management would be critical, referring to NEUI/ NFC’s work to improve productivity in terms of anode current density. He emphasized that new smelters would have to be built close to cheap energy and an environment that could support larger smelters. Christ added that outside China smelters are very costly to build, while inside China there are environmental challenges, so ultimately it would be the market that would decide, with shortage driving growth in smelter construction.

Bayliss asked the panel if the smelter of the future has already been seen in smelters of the past or if it could be seen by looking at new developments. Al Zarouni said his reference for future technology was in new developments, which should also be partially fitted into the older plants. “Today the means and technology do exist, it’s just that we are reluctant to utilize and accept them,” he said. Vatne agreed that there was a desire to build new plants and implement new technologies but the reality was that some of their plants were more than 50 years old, requiring ongoing maintenance.

“The good thing is that we change the complete cathode every five to six years so that really is a good opportunity to implement new technologies and drive creep, productivity, and performance on emissions,” Vatne said.

Dorreen remarked that there is an appetite for new players in the Chinese market who are taking on the risk of building new smelters with new technology. “Perhaps that is in essence the disruption we are seeing which is changing the balance of where the [existing] aluminum and the new aluminum is coming from,” he said, noting that there were still some environmental challenges behind some of the developments, as well as cutbacks in China at the moment, some of which were related to energy sources.

Bayliss next directed the discussion towards opportunities with centralized dataflow to effect disruptive change across the whole portfolio. Christ answered in regards to Rio Tinto’s centralized operating room and the challenges it had brought along, such as who is accountable for what? “However we are seeing real results in terms of process stability, then the next phase is moving into the predictive world where we actually see anode spike detection,” said Christ. “If you catch that way ahead you can actually provide the people on the floor with guidance to pre-empt the instabilities.”

Vatne felt that the requirement for human personnel in the smelters was a backward step, putting forward the alternative of a virtual center with experts analyzing the data and giving advice. Although Dorreen agreed that virtualization was a long term trend, he emphasized the need for well-educated and experienced operatives in the smelters able to make the right call, since poor data input would make decision making even harder. He felt that digital transformation was essential to enable the automation side of the transformation.

Bayliss said the IAI also felt there was a flood of data coming through, but that there seemed to be fewer and fewer experts able to handle it. Al Zarouni agreed that this certainly applied to the Gulf region and that the level of expertise available within the industry had shrunk significantly since people were no longer staying in the business as long as they used to, with people becoming “expert” in a very short period of time. He thought the problem was not that there would not be employment for people, but there would be a lot of people who are actually unemployable. Vatne thought the future would see more people in R&D, but different people. ”We will need data scientists, we will need more expertise in automation and these new things, but still we will also need these domain experts who really understand the operation,” said Vatne.

Looking at market trends, Bayliss felt the market would define metal sourcing, with some customers requesting aluminum with a particular pedigree of sustainably sourced metal. Qin said this was a great issue for the Chinese since they had limited resources of sustainable energy. “Nowadays people are just building smelters close to coal mines with captive power plants. But I think in the future we will turn to renewable energy for supply of power to our aluminum smelters,” said Qin, adding that he believed that even some of the Chinese investors would probably go abroad and invest in aluminum smelters where renewable energy is available. Vatne noted that customers were asking more and more for delivery of sustainable aluminum, though he sounded a note of warning that the future would likely see focus come on the industry’s direct emissions of CO2. “We use a lot of CO2 in our own process. When will we really get pressure on that?” he asked.

Bayliss brought up the point that the Aluminium Stewardship Initiative certification starts in 2018, with one criteria stipulating less than 8 tonnes CO2 per tonne of aluminum from scope one and scope two emissions. He asked the those on the panel if they were preparing to certify facilities using ASI certification as one of the routes in. Vatne responded that Hydro is fortunate in having a lot of hydro-powered plants so are well positioned. Christ said Rio Tinto really believed in this, though he thought the market had a long way to go, the competitive advantage was there. “The industry has to transform itself, it is just not sustainable in the way that it works today,” he said.

Al Zarouni brought attention to the fact that within the UAE there is a major focus on solar power. “I think there is significant development in the country,” he said. “2,000 MW of solar power production in Abu Dhabi, 1000 MW in Dubai, and we have almost 5.4 GW of nuclear power coming very soon in Abu Dhabi, so there will be a lot of CO2-free power coming in.” However, he felt that the industry should take a wider focus on their operations, particularly on red mud. “I think solutions are available, it has always been a matter of cost. If we are going to become responsible then at some point we have to put our money where we are being led, so we have decided that this is a commitment and we are looking at it as a complete global issue rather than as a specific item on our agenda,” said Al Zarouni. Vatne agreed, explaining, “There is more than 1 billion tonnes of bauxite residue in deposits globally and this is not sustainable. It is not good for our industry. We need to find a solution for that, as this is not how modern sustainable industry should work.”

Renewable Energy for Aluminum

Moderator Nick Carter, director, Baring Partners and Convenor, EU-GCC Clean Energy Network, introduced the session (Figure 7), “Roadmap to 2025: What are the Next Steps Needed for Renewable Energy to Become Viable in the Aluminum Industry?” He explained that the session concerned renewable energy, including solar, photovoltaic (PV), and wind, and how it would help satisfy the terms agreed to at the Conference of Parties 21 (Cop 21), which was held in Paris, France in 2015. Carter mentioned that around 50% or more of aluminum is currently produced using coal and the remainder is mostly either oil or gas, with some nuclear and hydro energy. “The fact that we have demands on the world globally to reduce fossil fuel emissions is a driver for the massive changes we have seen in the world in the last few years, in particular in the UAE, where prices for concentrated solar power had gone below $.10 per unit, with PV at 2.5 cents per unit,” he said.

Qais Al Zakwani, executive director and member, Authority for Electricity Regulation of Oman, said that there had been a big decrease in costs and affordability of the renewable sources within Oman. This, coupled with the need for diversity in a country overly dependent upon a single source of energy, had driven the Authority for Electricity Regulation to consider ways of smoothly integrating renewables within the system. He explained that renewables were not evident in 2004 when the statutory framework was established, and it was not foreseen that they would play a major part in the energy mix in the country. He added that they were presently working on a number of interesting projects and would soon be announcing the deployment of Oman’s first large-scale solar project.

Suhaila Marafi, director, Department of Studies and Research, Ministry of Electricity and Water, Kuwait, explained work had begun ten years ago on alternative energy plans in Kuwait. They have already implemented 70 MW of PV, while concentrated solar power (CSP) would be in operation next year, with an additional plan for tendering 1,000 MW through and financed by the oil sector for PV. She said the country is aiming for 15% of renewable energy to cover its demand of about 5,000 MW by 2030.

Katharine Fog, senior vice president, Corporate Strategy and Analysis, Norsk Hydro ASA, linked this topic with previous discussions on the smelter of the future, by addressing climate change in the aluminum sector. She considered aluminum’s production footprint — from the processes of bauxite mining and alumina refining to smelting — in association with aluminum’s contribution as a metal in products to lowering the footprint of consumption. She focused first on the direct and indirect emissions inherent in the aluminum smelting process, saying the direct emissions are similar throughout the industry, averaging 2 tonnes of CO2 per tonne of aluminum. Indirect emissions, however, vary massively according to the power source, from almost zero in the case of a renewable hydro base through about 6 tonnes of CO2 per tonne of aluminum for gas-based production to about 14 tonnes of CO2 per tonne of aluminum in the case of coal-based production. While seeing this as an area that needed to be addressed, she said it should be balanced against aluminum’s contribution to lowering the carbon footprint during consumption, seen most strikingly in transportation, where its properties make it a great product for substituting from steel.

Dr. Sgouris Sgouridis, associate professor, Masdar Institute of Science and Technology, reflected on the global requirements to maintain a 2°C change by the year 2100, which would mean the phasing out of fossil fuel consumption by 2060. He explained that, considering the 50-year design lifetime for plants, new smelters coming on-stream would go over that 2060 deadline. Therefore, this would necessitate flexibly designed plants that are able to accommodate new sources of power. Sgouridis then looked at developments of renewable energy over the last three years in the GCC region, noting that costs of PV had reduced to less than half the cost of gas. This meant that plants in the region could rely upon a 1 GW of PV-based power plant for energy supply during the day, then switch to a combined cycle gas turbine for power during the night. “This is perfectly feasible,” he said. “The reality is that the actual cost of integration for these renewables today in the current system is exactly zero. Additional costs only come in when we try to integrate 30% or more renewables.”

Max Wiestner, industry manager for Aluminum, ABB Switzerland, said the biggest challenge in the use of renewable energy is the development of a storage system in order to have it permanently available. If the power supply to a smelter is interrupted for more than 3 to 5 hours, freezing of the smelter occurs, which is very costly to restart. He remarked that although the development of energy storage had been studied over the past 50 years, actual progress had been very limited compared to the energy requirements of an aluminum smelter. He considered the distribution of energy, noting that in Switzerland the first aluminum smelter was built on the Rhine Falls because hydro energy was available there in large quantities. Then smelters were built in countries where hydro power was available, now smelters are built in the Gulf region where gas is available. Thus, in the future, smelters may need to be built in areas where renewable energy is available in sufficient quantities.

Siddiqa Al Lawati, project development analyst, GlassPoint Solar, introduced her company’s view as a leader in solar manufacturing for oil and gas fields, utilizing mirrors enclosed in a glass house to produce solar thermal energy in the form of solar steam (Figure 8). She said they were currently building the world’s largest solar project of any kind, in partnership with Petroleum Development Oman, which at full scale will be producing 1 GW of thermal energy, equivalent to 6,000 tonnes of solar steam. She said when adapting renewable energy, especially for the aluminum industry, it is important to design the technology to fit with the exact application being worked on. She cited key considerations for the aluminum industry as the peak versus the average solar output, and whether power storage would be necessary, as well as the impact made upon the local environment.

In the subsequent panel discussion, Carter said, “Really, in this area, generally there are only three sources of renewable energy and power. These are photovoltaics in any form, with or without storage, concentrated solar power which presents a steam turbine to the network, which of course is very good since rotating machines have good reliability, and wind. And of the three, wind is probably the least abundant, particularly in this region.”

Marafi replied that a pilot project of 10 MW in the South West of Kuwait was performing very well at a cost competitive with gas. They were considering PV as their main renewable energy, but only to boost supply during peak demand. She said, “I think in 10 years, when the batteries and the solar will be much cheaper, we will consider it.”

Al Zakwani expanded on Oman’s plans, saying they had found a potential of 800 MW of wind energy in the southern region around Salalah. A 50 MW wind project in the south of Oman was being set up in a plot of land that could provide up to 800 MW, although the grid in that area is just 450 MW. The challenges were that wind is only available in very remote areas and figuring out integration into the power grid. However, the benefits of tapping into the renewable sources were making the projects more feasible.

Sgouridis considered a renewable energy grid of the future, saying it will basically need to be centered around “supply following,” due to the need to minimize storage. “When the supply comes, then this is where we need to be putting our demand. So, if the supply is low during the night that means that the smelter can somehow either stop, idle, or reduce its operations. Is that possible?” he asked. “There is a technology today that is being installed in a German smelter that basically involves heat exchangers around the pot and allows the operations to modulate, to increase or decrease by 30%. So if our demand is 1 GW then you can go to 1.3 or down to 700 MW. That is a very significant capability that will allow the smelter to follow the supply. It can stabilize the grid, it offers essentially a form of storage.”

Considering developments in storage, Sgouridis said that batteries were not an option for PV, but were a potential option for the electricity to ammonia process. This process allows for storage to occur during the day with the energy used overnight — or even for seasonal storage. He said CSP

had shown itself to be quite interesting and competitive, even compared to gas, with a recent bid in Dubai at around eight cents or less per kilowatt hour for stored energy, providing overnight energy for 15 hours.

Fog commented that smelters can provide some demand flexibility in the very short-term, which Hydro does in Norway, where they have a hydropower system that is renewable and flexible with water reservoirs (Figure 9). “We provide into the power system in Norway, we do provide short-term flexibility,” she said. “We sell our ability to take down production for shorter periods of time, say 15 to 30 minutes, that’s how our system runs. At 4 to 5 hours, then you really start to damage your smelter, you may even risk losing it altogether. It’s hardly worth it. If that could change in the future with a different smelter, with automation, digitization at a different level, I think everyone would try to go down that route and push the time limits. But as of today I think we are talking too long a time for the smelters.” She agreed that the use of combined cycle gas turbines (CCGTs) at night, where the CCGTs already exist, does make sense — not however, in large parts of the world where enormous amount of renewables would be needed to replace the current capacity.

Wiestner also agreed that a 4-5 hour power outage would be a significant problem, as it would damage the pots. He pointed out that if there were no wind and no solar, which can happen in Europe for up to two weeks, then storage would need to be available in order to supply that energy for two weeks solid. “The storage area and system that would be required is so huge it is just impossible,” he said.

Carter added that a lot of work is going on with what is known as Power-to-X, a technology that transforms power from renewable sources into material energy storage, energy carriers, and energy-intensive chemical products. He cited an example of PV energy generated through a process known as Power Curtailment being used to produce hydrogen, giving seasonal storage of the energy. “Some of these things are happening,” he said. “But I would also come back to the importance of CSP where it does present a steam turbine to the sector with sufficient storage. There is one being built in California that is huge, maybe 2 GW and 20 GW hours of storage capacity. Certainly at a higher price than is being achieved here, but there is huge potential for it.”

Editor’s Note: The Arabal 2018 conference and exhibition will be hosted by Kuwait Industries Co. Holding on November 11-13 in Kuwait City, Kuwait.

Edited to Add (3/20/2018): New Figures 3 and 7 included.