By Goran Djukanovic, Aluminum Market Analyst & Consultant.

Alro S.A., located in Slatina, Romania, is largest aluminum smelter in South Eastern Europe and among the largest integrated aluminum producers in Europe. Alro is able to maintain this leading position in the industry with its vertically integrated production capacity, access to competitively priced raw materials, and continuous investments in the 15 years since its privatization. These investments have improved its production performance and capacity across all of its operations, and the company aims to continue this strategy of investment in the coming years.

Company Profile

Originally established in 1965, Alro was privatized in 2002 when it was acquired by Vimetco N.V. in the Netherlands, which owns an 84% share. After privatization, the Alro Group grew to become a vertically integrated company, consisting of the following units: Alro, producing primary aluminum production and downstream aluminum alloy products; Alum Tulcea, producing alumina since 2005; Sierra Mineral Holdings, Ltd., bauxite mining since 2011; Vimetco Extrusion, producing extruded products; Conef, Global Aluminum Ltd., providing services and information technology; and Bauxite Marketing Ltd. Alro Group has around 2,450 employees.

The aluminum smelter has a nameplate capacity of 265,000 tonnes, but produced 207,000 tonnes of aluminum in 2016 (this is due to the fact that one potline, No. 6, was not in operation). Baked anode capacity is 117,000 tpy.

The casthouse is equipped with a dozen melting furnaces of 40 and 60 tonnes capacity and utilizes Wagstaff Air-slip casting machines for billets and slabs, homogenization furnaces, sawing equipment, and two Properzi rolling mills, one of which produces alloyed wire rod. It has a nameplate capacity of 340,000 tpy, and produced 272,500 tonnes in 2016. Recycling capacity is 32,000 tpy. Downstream operations include hot rolling (55,000 tpy), cold rolling capacity (40,000 tpy), and extrusion operations (25,000 tpy).

The company also operates an alumina refinery in Tulcea, Romania, with a total capacity of 600,000 tpy and controls a bauxite mine in Sierra Leone (Africa) with a total capacity of 1.7 million tpa.

Alro’s products are sold throughout the European Union. Romania remains the main market for primary products, representing over 40% of deliveries, followed by Czech Republic, Bulgaria, Italy, Spain, and Germany. The company’s processed products (rolled and extrusion) are mainly for export (95% value of sales of processed aluminum) to Germany, Italy, Poland, the U.S., and other EU and Asia countries.

Continued Investment

Over the course of 15 years, Alro invested US$570 million in modernizing and improving its operations, equating to an average of US$38 million/year). Of this, over US$100 million was invested in environmental protection equipment. This investment strategy was focused on the following:

- Fully comply with EU rules regarding environmental and green house gases emissions

- Increase energy efficiency by reducing specific energy, natural gas, and other utilities consumption

- Increase production of value-added products

- Become fully integrated, from bauxite to high value-added products for the automotive and aerospace industry

“Over the past 15 years, we have continually invested in modern equipment that has increased not only production, but also operational efficiency,” said Gheorghe Dobra, general manager of Alro.

In the primary aluminum sector, Alro replaced the DC rectifiers, resulting in a savings of 30,000 MWh/year or US$1.5 million annually. It also implemented computer-assisted central supply technology, as well as gas capture and purification in gas treatment centers, which led to a reduction in direct consumption of electricity of about 1,000 kWh/t of aluminum, saving 200,000 MWh/year, or about US$10 million annually. The consumption of natural gas in the production of anodes was also reduced by three times through the use of modernizing the baking furnaces, and decreased by 20% for the melting and casting furnaces. These reductions resulted in considerable energy savings, an important factor as Alro pays US$50/MWh for electricity (this cost does not include taxes for renewable energy the company has been paying in past years but which have been significantly reduced recently). Water consumption was also decreased about fivefold, thanks to the construction of recirculation and water treatment stations.

Some key achievements in energy usage since 2002 include:

- Natural gas specific consumption dropped from 242 m3/t Al to 95 m3/t Al (around 2.5 times lower)

- Specific power consumption for electrolysis dropped from 14.6 MWh/t to 13.55 MWh/t

- Electricity intensity was increased from 85 kA to 120 kA

- Electricity efficiency was increased from 90% to 95.5%

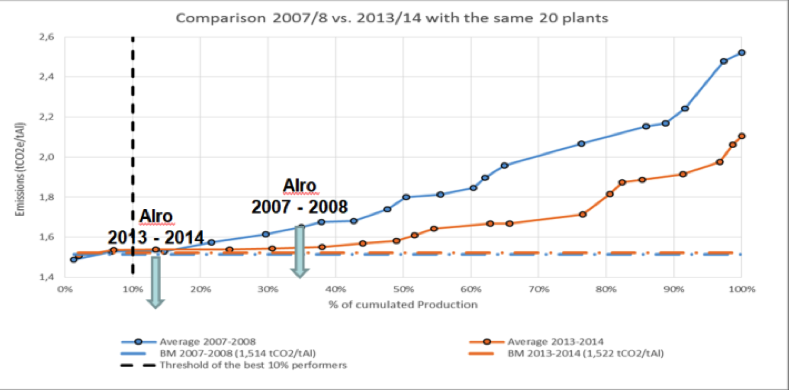

Alro also implemented dry scrubbing throughout entire smelter in order to treat gas emissions. As a result, environmental protection has been improved significantly — for example, the 2016 PFC emissions were 85 times lower than in 2002. Due to this reduction in emissions, Alro obtained the Integrated Environment Permit (IPPC) system in 2006, the first such permit in the Oltenia, Romania, region.

In the processed aluminum division (called ALPROM), Alro upgraded its extrusion and rolling processing lines, introducing new technologies and equipment with high energy efficiency. In addition, it has implemented a predictive maintenance system. All these improvements have resulted in an increase of processed aluminum production by four times, a reduction in specific electricity consumption by five times, and a reduction in natural gas consumption of ten times. State-of-the-art technology has enabled the company to introduce new types of products in its portfolio, for the automotive and aerospace industries.

Notable improvements in the processed aluminum division since 2002 include:

- Extrusion production (Vimetco Extrusion) increased from 4,560 tpy to 25,000 tpy

- Flat rolled production increased from 19,000 tpy to 80,000 tpy

- Wire rod production increased from 40,000 tpy to 75,000 tpy, including alloyed wire

- Natural gas specific consumption dropped from 1200 m3/t to 102 m3/t

- Power specific consumption dropped from 2.6 MWh/ t to 0.6 MWh/t

Aside from the substantial investments mentioned, Alro is securing its competitiveness on the international market through continuous implementation of modern operational programs and management techniques in each field of the production process. This includes systems, such as: Total Productive Maintenance (TPM), Overall Equipment Effectiveness (OEE), 5S Japanese Efficient and Effective Workplace Organization, Lean Six Sigma, digitalixation, and application of international quality standards in all of its fields of activity.

Through these improvements, Alro has been able to increase deliveries of aluminum and aluminum alloy products in both the primary and processed aluminum segments. Although the company decreased the production of standard aluminum ingots from 85,000 tons in 2002 to 8,000 tonnes in 2016 (a decrease of approximately 11 times), the company significantly increased the production of value-added products.

The production of aluminum wire increased by more than two times, from 34,000 tonnes in 2002 to 74,000 tonnes in 2016. The production of rolling slabs increased from 29,000 tonnes/year to 130,000 tonnes in 2016, and the production of aluminum alloy bars increased by approximately 1.5 times, from 47,000 tonnes in 2002 to 69,000 tonnes in 2016.

Between 2002 and 2016, extruded aluminum production increased 5.5 times, from 4,560 tonnes in 2002 to 25,000 tonnes in 2016 and flat rolled products increased by more than four times from 19,000 tonnes in 2002 to 80,000 tonnes. Of this production, 32,300 tonnes was from processed aluminum and aluminum alloys with a very high added value.

Production and Financial Results for 2017

During the first nine months of 2017, Alro’s production from its primary aluminum casthouse increased by 2.7% y-o-y, amounting to 210,873 tonnes. The production mix was changed in favor of slabs and wire rod. Production from electrolysis decreased by 1% to 163,638 tonnees. Production of primary aluminum for the whole of 2017 is expected at around 210,000 tonnes, compared to around 207,000 tonnes in 2016. Casthouse production is expected at 285,000 tonnes, compared to 272,500 tonnes in 2016.

In the same period, production of flat rolled products in the processing division increased by 9.2% y-o-y, to 63,000 tonnes, with the highest increase being registered in plates (13.8% y-o-y). Production of flat products for the whole of 2017 is expected at around 88,000 tonnes, out of which around 60% will be plates.

Alro’s net profit for the first nine months of 2017 increased to RON 223.4 million (US$56.6 million), from RON 63.8 million (US$ 15.76 million) in the same period a year before. The main contributors to the significantly better results in 2017 have been a much higher LME price in Q3 2017 and higher sales from value-added products. Furthermore, Ecotaxes decreased by 10% y-o-y and amounted to RON 44.5 million (US$ 10.88 million) in the first nine months of 2017. Sales also increased during this period and were 18% higher compared to the previous year. Alro expects sales for the whole of 2017 to be around RON 2.45-2.5 billion (US$635-648 million).

Recent and Future Investments

In both the primary and processing divisions, Alro has invested US$24.5 million during the first nine months 201. The company has also invested US$6.7 million for an EU co-financed research project. In 2017, Alro has acquired state-of-the-art technology equipment from leading manufacturers in the metallurgical industry, such as Danieli & C. Officine Meccaniche S.P.A., Danieli Centro Combustion, Otto Junker, Wagstaff, and ALTEK. The company plans to develop new capacities for aluminum alloy slab, produce smaller slab than 20 mm, upgrading the slopes, and upgrading its cold strip mill no. 2 for US$5.5 million to increase production capacity for high-tech aluminum plate to expand its customer portfolio.

Danieli will deliver a new aluminum plate stretcher and major cold rolling mill modernization. The new 18 MN plate stretcher will process very thin aluminum plates with high surface quality for 1xxx to 7xxx series alloys used for aerospace, marine, defense, and commercial transportation applications. The modernization Alro’s cold mill No. 2 will allow the company to improve sheet gauge and flatness tolerances, increase productivity, improve strip dryness, and mill reliability. New filtering and fume treatment systems will also improve environmental protection levels. In this way, Alro will increase production capacity for high-tech aluminum plates used in the automotive and aerospace industries. Both projects include the implementation of a complete package of mechanical, fluid, automation, and electrical systems as well as the complete supervision of the installation and commissioning. Plant startup is scheduled for the second quarter of 2018.

In addition, Alro is in the process of developing European-funded R&D projects in order to obtain new high value-added products. New capacities for aluminum alloy sheets, slabs with a thickness of less than 20 mm, and homogenization of the shavings will be developed as part of these projects.

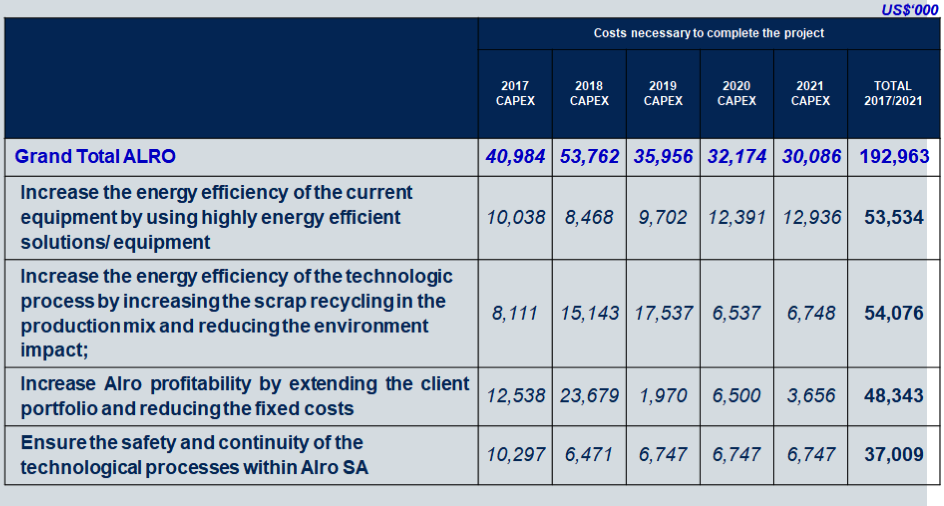

Alro aims to continue to invest in its operations, with a business plan for the period of 2017-2021 that predicts total investments of over US$190 million, of which over US$100 million will be for energy efficiency projects. These projects include utilizing a “Green Factory” concept that would implement state-of-the-art green technologies in order to contribute to meeting Alro’s close to zero-waste and zero emissions targets, as well as enabling the company to produce a higher amount of value-added aluminum products.

Conclusion

Alro faced significant challenges that generated losses in past years, caused by high electricity costs and taxes for removable energy and environment protection — aside from unstable market conditions and weak prices. However, the company’s continuous and substantial investments over a longer period of time have carried the company through difficult times and affirmed Alro’s position as a market leader in Europe, securing its bright future.

Alro shows that continuous investments are of key importance for securing an aluminum producer’s business. For example, the company’s investments over the past 15 years and recently has positioned it as a reliable supplier to automotive and aerospace industry. As a result, the company signed a long term contract with Airbus to supply 7xxx aluminum alloy sheet and plate (deliveries started in 2017). This had a significant impact on the company’s sales and profit figures in 2017, which were approximately US$650 million and US$80 million, respectively — illustrating the giant Alro has become.

Goran Djukanovic is an aluminum market analyst and industry consultant based in Podgorica, Montenegro. He has published papers in a number of publications and presents at industry events around the world.

Goran Djukanovic is an aluminum market analyst and industry consultant based in Podgorica, Montenegro. He has published papers in a number of publications and presents at industry events around the world.