By Geoff Scamans, BCAST at Brunel University London and Innoval Technology.

Vehicles must become inherently more efficient and lightweight if automotive OEMs are to meet global emissions targets. The implementation of aluminum has helped move OEMs toward this goal, and as a result, there has been significant growth in aluminum intensive vehicles (AIVs) over the past 20 years across vehicle segments — from niche to premium to volume vehicles. Although steel still dominates in body-in-white (BIW) applications, aluminum growth is also expected to continue to grow and exceed well over 3 million AIVs by 2030. In fact, many of the most recent class leading battery electric vehicles (BEVs) are aluminum intensive.

Automotive lightweighting presents many benefits for OEMS. However, as Mark White, technical director of Alumobility, recently stated, lightweight materials must be affordable to achieve adoption in the rapidly growing mass electric vehicle market. In addition, they need to provide a major reduction in embedded carbon compared to the steel and aluminum currently employed as the main materials for vehicle body construction. Therefore, the key to aluminum growth in electric vehicle applications is moving away from the use of prime aluminum and shifting toward end-of-life secondary aluminum for the development of new alloys for automotive. This article provides an overview of recent development projects that have been focused on achieving this goal.

Average Vehicle Weight

It is impossible to analyze current trends in vehicle lightweighting without discussing the present trend of increasing vehicle weight derived both from consumer preference for SUVs and the need for electric vehicles to provide an acceptable driving range. According to the U.S. Environmental Protection Agency (EPA), cars in the U.S. have gained weight since the COVID pandemic,1 increasing by an average of nearly 100 kg. Cars around the world are also getting heavier. In Europe, the average weight of a car increased by 272 kg to 1,600 kg from 2001 to 2022.2 Meanwhile, in the U.S., the increase was slightly lower over a similar time span at 195 kg, with the average car weight being around 1,908 kg, which is approaching an alarming 2 tonnes.

The transition to electric vehicles has not helped this trend, due to the increasing weight of batteries to provide an acceptable driving range for these leviathans. A particular example from VW is the ID.3 BEV, which weighs 1,830 kg — 442 kg (24%) heavier than the 1,388 kg Golf with an internal combustion engine (ICE).

In the U.S., the weight gap between electric and ICE vehicles is smaller, with BEVs tending to be only 10% heavier, because vehicles are larger on average. Although, notably, the Ford F-150 Lightning is 28% heavier than its ICE equivalent. Although cars are getting both progressively larger and progressively safer, the switch to more and more SUVs, which are significantly heavier than the hatchbacks and city cars they have replaced, has not helped.

Over many years it has repeatedly been shown that aluminum vehicle bodies are generally 40–45% lighter than equivalent steel bodied vehicles, which has been emphasized in a recently published Alumobility white paper.3 In the paper, AIVs are shown to be more efficient and improve the range of both BEVs and ICE vehicles. They are also inherently corrosion resistant without the need for coatings and provide opportunities for secondary weight saving and for the use of smaller batteries. Lighter vehicles are also safer, as aluminum absorbs more energy than steel. They do less damage to other road users and pedestrians, while reducing tire wear and related particle emissions. Lighter vehicles are also less damaging to roads and other transport infrastructure and are particularly suited to last-mile delivery vehicles, where reduced weight can be translated into increased payload, according to a recent study by Gordon Murray Design.

The Carbon Impact of Aluminum

The primary aluminum industry is a major global emitter of CO2 and other potent greenhouse gases. The embedded carbon in primary production has stuck at a world average of about 17 t CO2e/t Al and is not following the designated glide path for average global emissions reduction needed to contribute to keeping the global temperature rise at less than 1.5°C by 2050, according to the International Aluminium Institute (IAI).

Significantly, producing a tonne of secondary aluminum generates only about 3-5% of the emissions associated with a tonne of primary aluminum and even this level can be reduced by switching to electric melting or plasma-based melting. When using aluminum to lightweight vehicles, the quickest path to decarbonization is to switch from using primary to secondary aluminum derived from end-of-life vehicles and other suitable secondary sources as part of a closed-loop circular economy. This direct route to decarbonization is way beyond the dreams of primary aluminum producers.

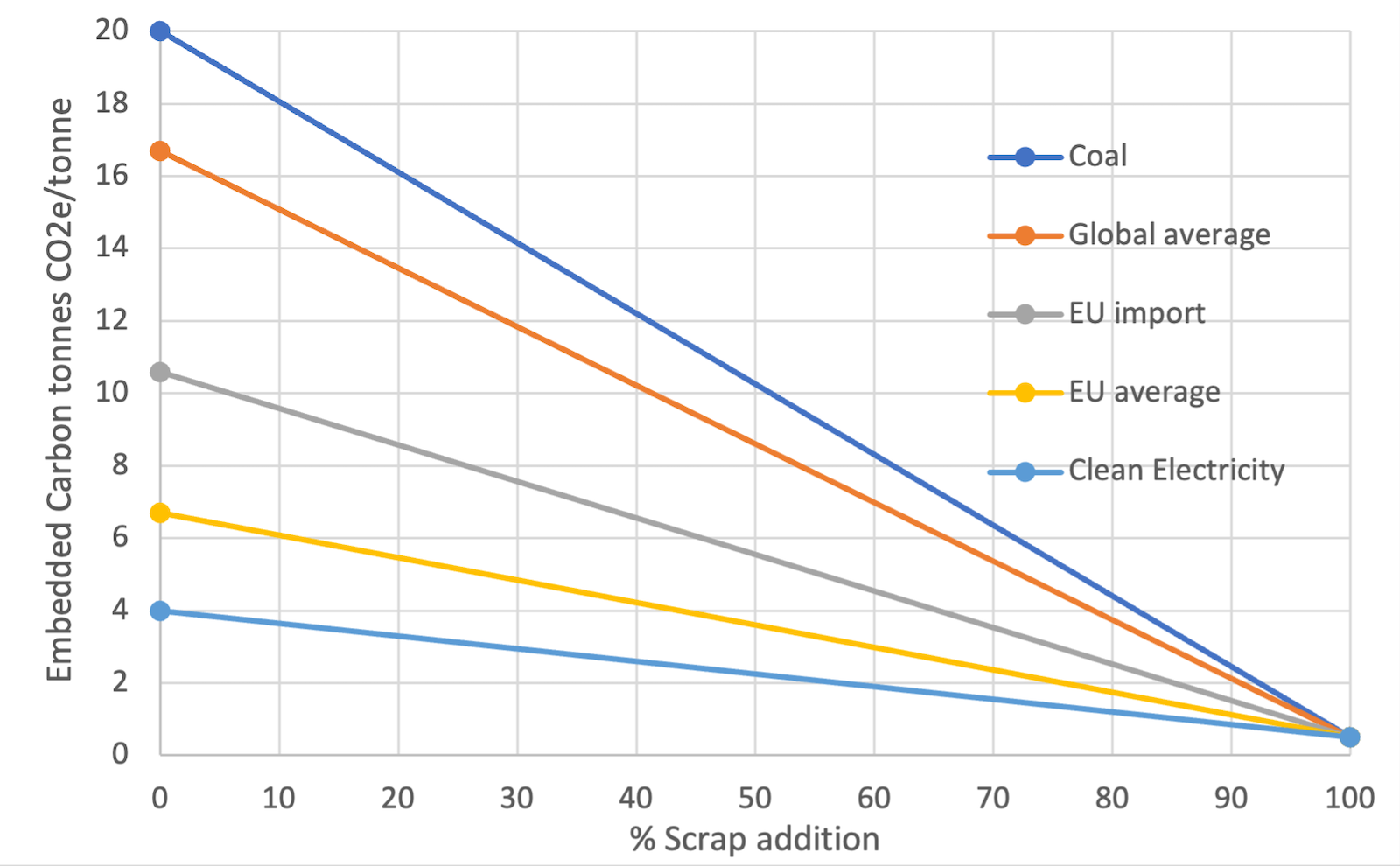

Primary or virgin aluminum has a carbon burden ranging from 20 t CO2e/t Al down to 4 t CO2e/t Al, depending on the energy source used for the smelting process. When formulating aluminum alloys with recycled content, the use of more and more end-of-life scrap progressively reduces the carbon burden down to 0.5 t CO2e/t Al or less with 100% utilization. Figure 1 shows this progression of mixing in post-consumer scrap into primary aluminum (based on different sources for electricity generation) imported into Europe. At the 100% post-consumer scrap level, the carbon footprint is brought close to zero, if clean electricity or green hydrogen is used for all heating and melting operations. The present target sweet spot for OEM supply at 2 t CO2e/t Al is achieved at a 55% post-consumer scrap addition, when combined with the lowest carbon-embedded prime aluminum. However, for the most carbon intensive prime, the addition of more than 90% scrap is required to reach this level.

Both shredded construction scrap (old rolled or taint tabor) and non-ferrous Twitch derived from shredded vehicles can be purchased at relatively low cost (50–60% of LME) and can then be upgraded to higher value using relatively simple dry purification technologies (magnet plus eddy current sorting), followed by automated x-ray transmission (XRT) density-based sensing and sorting. Laser induced breakdown spectroscopy (LIBS) composition-based sorting can also be implemented, though this treatment may only be required as an additional treatment to provide further purification of the scrap stream for blending to reduce iron impurity levels and copper, silicon, and manganese levels where the alloy specifications only allow limited amounts of these elements.

Significant progress has been made in the development of aluminum automotive body sheet, extruded sections, and structural castings formulated from secondary aluminum. These developments provide low carbon products without any significant loss of mechanical or corrosion properties.

Recycled Automotive Body Sheet

The REALCAR and REALITY projects led by Jaguar Land Rover demonstrated the value of recovering press shop scrap for the formulation of automotive sheet alloys like AA5754 and AA6111.4-5 These alloys were then popularized by Novelis as RC5754 and RC6111. However, aluminum alloys made from recycled process scrap are not necessarily low carbon, as they carry the burden of the alloy mix from which they were originally cast.

Aluminum automotive body sheet (ABS) made from wrought aluminum produced from end-of-life vehicles and other secondary sources is of limited commercial availability. It may be confined to producers like Profilglass and Gränges through their acquisition of Aluminium Konin in Poland.

Profilglass supplied ABS from post-consumer recycled scrap to Stellantis, which was used in trials. This recycled ABS alloy development is part of an EU-funded project coordinated by European Aluminium, entitled SALEMA.6 The project, which includes sixteen partners from six European countries, aims to produce secondary aluminum alloys with a minimum silicon and magnesium content to reduce industry dependence on these critical metals. The project is focused on providing a path toward a green automotive industry that starts with lightweight cars made of aluminum.

Aluminium Konin supplied low carbon AA6082 sheet to Impression Technologies Limited (ITL) for hot forming and quench (HFQ) trials for battery enclosure applications. ITL and FEV Group developed an exoskeleton battery housing concept for electric vehicles using HFQ to enable the use of secondary aluminum-based sheet products and to increase the space for more cells within the enclosure to increase vehicle range.7 Earlier work for this development was part of the RACEForm project,8 which demonstrated that AA6111 aluminum ABS sheet could be made from 100% recycled scrap at a laboratory scale. In this case, aluminum recovered from incinerator bottom ash (IBA) from a domestic waste based energy recovery facility (ERF) was fed into the melting furnace. In cross-die hot forming trials and cold forming trials, the 100% scrap-based AA6111 alloy had equivalent performance to commercially supplied AA6111 sheet. ITL has had difficulty sourcing high recycled content aluminum ABS from the major commercial suppliers, as the company’s tonnage requirements are low, which directly led to the AA6082 recycled sheet development work with Gränges.

Recycled Extrusions

The ALIVE project led by Constellium in collaboration with OEMs and suppliers was set up to tackle the present inability to produce structural aluminum battery enclosures to the required quality and price targets for the rapidly growing BEV fleets.9 The solution to be evaluated was based on the use of the Constellium HAS6® high strength AlMgSiCu aluminum extrusion alloy portfolio combined with radical new design and manufacturing concepts to provide the most cost-effective aluminum battery enclosures produced to date. The solutions evaluated in the project combined a safety cell for the battery modules with crash protection systems for vehicle and occupant safety, with or without integrated cooling as requested by the OEM partners. The key innovation was the use of simplified assembly techniques that required minimal capital costs; design freedom to produce lightweight, multi-variant enclosures with exceptional dimensional accuracy and sealing system; and the ability to produce multiple enclosure variants on a single production line. The project results have the potential to unlock the supply chain—both for the low volume manufacture of different platform variants and technology demonstrators. This has the power to enable a cost-effective transition from ICE to Hybrid to full BEV models, while also providing scalability for high volume production. The results from the project include a set of four different enclosure variants, which were displayed for the first time last month at the 2023 CENEX LCV show in Millbrook, U.K. (Figure 2).10

The next phase of aluminum extrusion alloy application development is now underway in the CirConAl project,11 also led by Constellium with a similar set of partners, along with additional partners from further upstream in the supply chain. The project aims to provide secondary aluminum from end-of-life scrap streams using advanced sorting technologies, such as XRT and LIBS. The various scrap streams being studied range from shredded end-of-life vehicles to end-of-life buildings. Both the Constellium HSA6® high-strength and Constellium HCA6® high crush alloys have been cast and extruded successfully in complex sections at scale 1:1 at Brunel University London from melts comprised of blended scrap streams sourced and provided as remelt secondary ingot (RSI). The project will demonstrate lightweight aluminum battery enclosures and crash management systems made using high recycled content alloys for specific BEV vehicles specified by the OEM partners in the project.

Recycled Casting Alloys

Aluminum casting alloys for power train applications have been made using secondary aluminum for many years, and their compositions have been set to accommodate mixed scrap. However, the situation is very different for casting alloys used in structural automotive applications, where their formulation is almost always based on prime aluminum.

This issue was partially addressed in the EU funded RecycAL project,12 which addressed the problem of intermetallic formation of Fe, Sn, and Mn impurities in recycled aluminum scrap through development and demonstration of a high shear processing (HSP) and sedimentation technique. The process allowed iron containing intermetallic particles to be separated from the molten aluminum via sedimentation, thus reducing iron contamination in the scrap material. This showed that high iron “low quality” secondary scrap could be upcycled to a higher quality scrap with a much lower iron content. It probably represented the first industrially viable means of achieving this iron reduction. The process was successfully demonstrated through the production of automotive exhaust brackets cast by F.O.M.T. in Italy using secondary aluminum derived from a Suldouro mechanical biological treatment (MBT) plant in Portugal. The castings were found to have comparable properties to components cast from primary metal in terms of tensile strength, fatigue, and corrosion performance (Figure 3).

Raffmetal in Italy, one of the partners in the SALEMA project, is the leading EU producer of aluminum foundry alloys made from secondary aluminum with a production capacity of 350,000 tpy. The company has shown that it is possible to produce high-performance structural aluminum casting alloys from selected end-of-life scrap streams. Their SILVAL range of foundry alloys have a recycled content of between 80% and 100% with a cradle-to-gate carbon footprint as low as 0.48 kg CO2eq/kg Al. Raffmetal invested in both XRT and LIBS sorting technology to obtain suitable secondary aluminum compositions to produce their alloys, with properties that match those of prime aluminum melts.

Electrolytic refining of post-consumer recycled aluminum could also be of value for aluminum casting alloys. A potential feedstock could be the mountain of scrap from the reduced demand for ICE and other conventional transmission systems, as sales of new vehicles with this type of power train are progressively legislated away. The tonnages of aluminum tied up in these secondary alloy-based casting products is relatively large, and refinement of these alloys at the end of their life could provide metal for structural casting and wrought product applications. Furthermore, there could be an opportunity to recover alloying additions like magnesium and silicon from this stream to satisfy alloying requirements.

A development moving this forward is the Alcoa ASTRAEA technology for purification of post-consumer secondary aluminum, which is said to reach a purity level of P0101 (0.01 wt% Si and 0.01 wt% Fe). This is better than the purity of P1020 (0.10 wt% Si and 0.20 wt% Fe) aluminum produced in a typical smelter. The intended feedstock for this process is the cast aluminum scrap derived from Twitch, which is an aluminum fraction pulled from the Zorba mixed-metal scrap fraction obtained from shredded end-of-life vehicles and white goods (large electrical products, such as refrigerators and washing machines).

The Aluminum Lightweighting Advantage

Secondary aluminum-based sheet, extrusion, and casting alloys offer multiple advantages for structural automotive applications. These advantages include weight savings combined with the high performance attributes similar or equal to those obtained from prime alloys, but with a much lower level of embedded carbon that has the potential to be reduced to near zero. These advantages are available today and depend on manufacturing technologies that are already well established, thus eliminating the need for eye-wateringly expensive development programs or scientific or engineering breakthroughs. The available product forms each have a major role to play in the future generations of the lightweight electric vehicles that are required to decarbonize road transport.

References

- “The EPA Automotive Trends Report,” U.S. EPA, 2022.

- Munoz, J.F., “Obesity of cars, the new challenge of the industry,” Motor1, November 17, 2022.

- “When It Comes to Aluminum Vehicles, Less Is More,” Alumobility, 2023.

- “Cars Reborn in New Aluminium Recycling Scheme,” JLR, September 5, 2017.

- “Jaguar Land Rover Upcycles Aluminium to Cut Carbon Emissions by a Quarter,” JLR, August 21, 2020.

- SALEMA Project.

- “FEV and ITL Develop Innovative Battery Housing Demonstrator for E-Vehicles,” FEV, May 4, 2023.

- “APC7 – RACEFORM (Rapid Aluminium Cost-Effective Forming),” Brunel University London.

- “Constellium to lead £15 million ALIVE project for the development of new aluminium battery enclosures for electric vehicles,” Constellium, June 25, 2020.

- CENEX LCV Show.

- “Constellium – Circular and Constant Aluminium (CirConAl),” Advanced Propulsion Center UK.

- RecycAl project.

- F.O.M.T.

Editor’s Note: This article first appeared in the October 2023 issue of Light Metal Age. To receive the current issue, please subscribe.