By Lynn Brown, Contributing Editor.

In order for automotive OEMs and Tier suppliers to develop aluminum applications for cars and trucks, they need to understand the capabilities of existing designs, whether sheet, extrusions, or castings, etc. Analyzing the use of aluminum in existing production vehicles to see how they compare is one way for a company to boost their knowledge in this regard. This kind of analysis might consider questions such as how many parts are being employed in a component to achieve a specific function, what materials and joining technologies are being used, what is the cost of the component, and more.

However, collecting that data can be difficult. One might crawl under or through vehicles on a dealers lot or service bay to gather information, which is inexpensive but does not provide precise data. The better method is to buy and dismantle vehicles on the market to consider them component by component, which provides much more detailed information, but is often too expensive for most automotive suppliers to consider.

Munro & Associates Benchmarking Innovation Center in Auburn Hills, MI, addresses this challenge by performing competitive benchmarking and reverse engineering services for the automotive and other industries, such as medical devices, consumer electronics, and industrial machinery. The company is able to provide detailed studies of existing vehicles by buying, dismantling, reverse engineering, and pricing out new cars down to the component level. In addition to its benchmarking and reverse engineering capabilities, Munro also provides more traditional design and development services, assisting clients with product design and renovation, manufacturing process development, and supply chain optimization.

Lean Design

Running throughout Munro’s benchmarking, engineering, and design work is a well-honed Lean Design® methodology and tool set, which dates back to a meeting between founder Sandy Munro and Dr. E. Deming in 1982. At the time, Munro was working for Ford Motor Company, where he was spearheading design for assembly (DFA) initiatives. Deming introduced new concepts to Munro regarding the importance of reducing variation to increase quality, which deeply resonated with him. While working with Deming, Munro began to consider how to eliminate variation and waste in the product development process.

After founding Munro & Associates in 1988, Munro and his team refined their processes, creating their Lean Design methodology. Subsequently, the company went on to develop a software version of Lean Design that eventually grew into a much more diverse and comprehensive suite of tools called Design Profit®. This includes Quality Report Card®, which can be used to track and predict the hidden cost of quality, DP MRL® software for auditing and tracking the manufacturing readiness level of a component, a program management tool, and other apps for material comparison and selection, determining cost, etc.

Even with this impressive set of design tools, it is the Munro & Associates benchmarking programs that set the company apart. To understand the scale of such programs, imagine a room full of front seats—all in various stages of disassembly with details on relative performance, materials, manufacturing processes, and costs for each one. Another such program might compare multiple automotive bodies-in-white, which have been similarly analyzed. That is the end result of the service that Munro has performed for its clients. To ensure the quality of its benchmarking programs, Munro only employs experienced product design and manufacturing engineers, material experts, costing engineers, and certified ergonomists with multiple industry experience in their benchmarking activities.

Benchmarking Electric Vehicle Battery Trays

An example of Munro’s reverse engineering process was presented at the Lightweighting World Expo in October 2018. The benchmarking project compared the powertrain and battery systems of the Tesla Model 3, BMW i3 (2014), and Chevy Bolt. Munro & Associates offers several reports recapping this work, including a 2,400 page report on the Tesla Model 3 with portions covering detailed aspects of the vehicle, such as Body & Chassis (500 pages) or Powertrain & Battery Pack (448 pages).

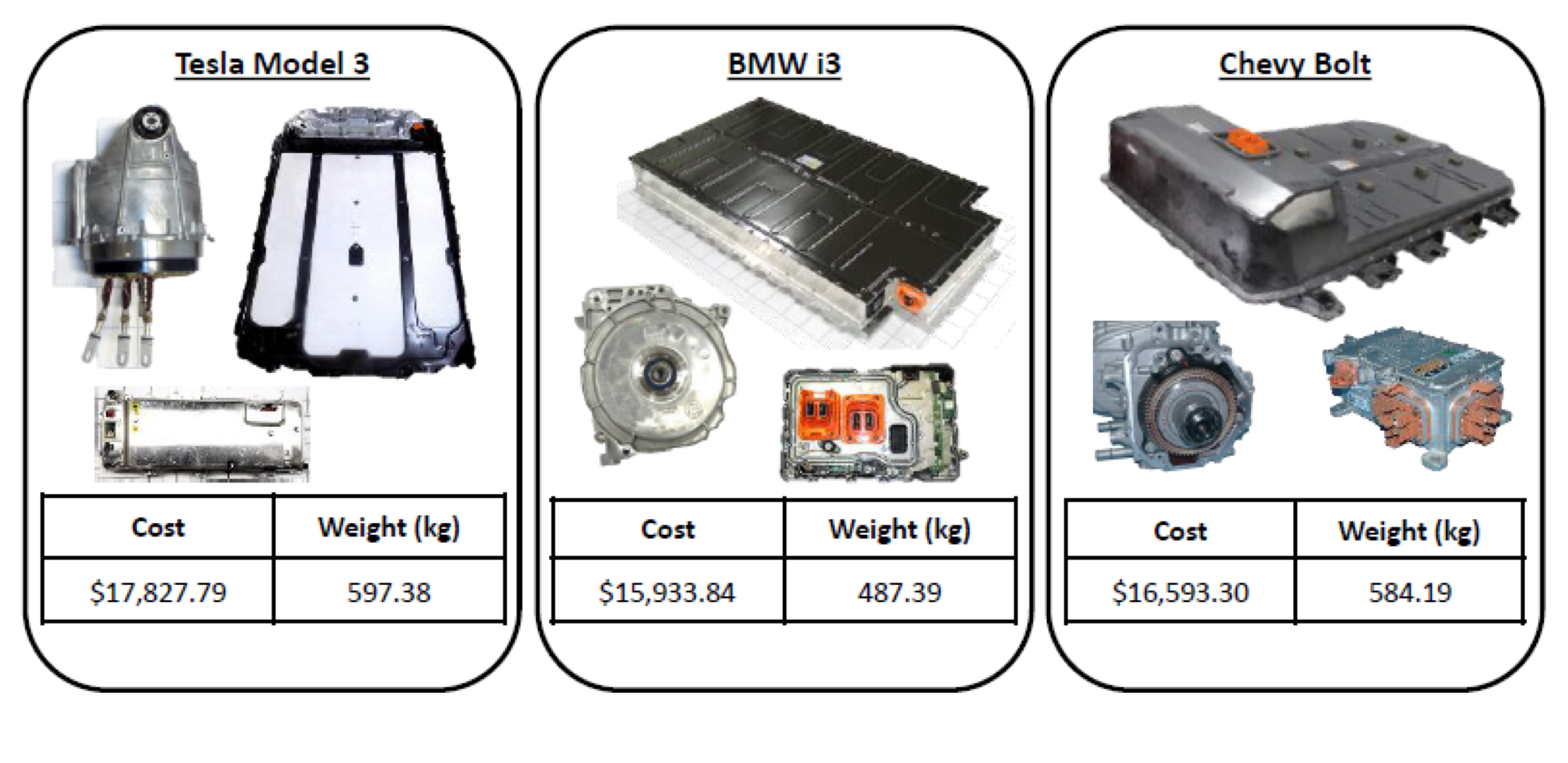

When considering the full powertrain and batterypack system of the three vehicles (Figure 1), the estimated costs of the three systems were found to be within 10% of each other and the weights within 19%—with the Tesla being the heaviest and most costly battery tray system. Certainly, some differences between the designs can be attributed to performance, as the Tesla offers 75 kW storage and a 310 mile range, while the lighter and less costly i3 system only has 22 kW of storage and a 150 mile range. The Bolt falls in the middle on cost, weight, and performance, with 60 kW of storage and a 238 mile range. Note that there are significant differences in overall vehicle weight as well. The i3, which has a carbon fiber body system, weighs in at just over 3,000 lbs, while the steel/aluminum Tesla is 25% (750 lbs) heavier.

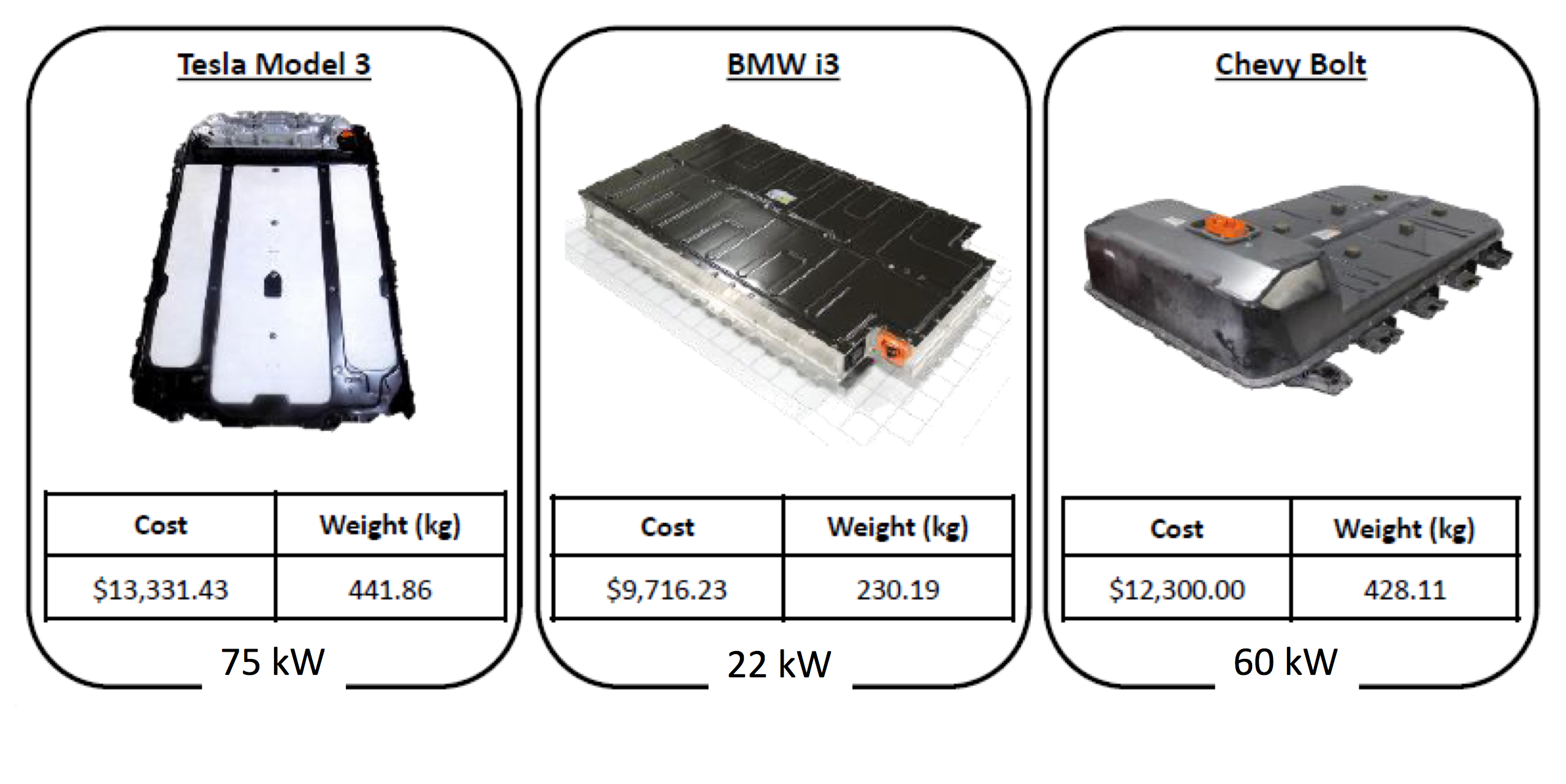

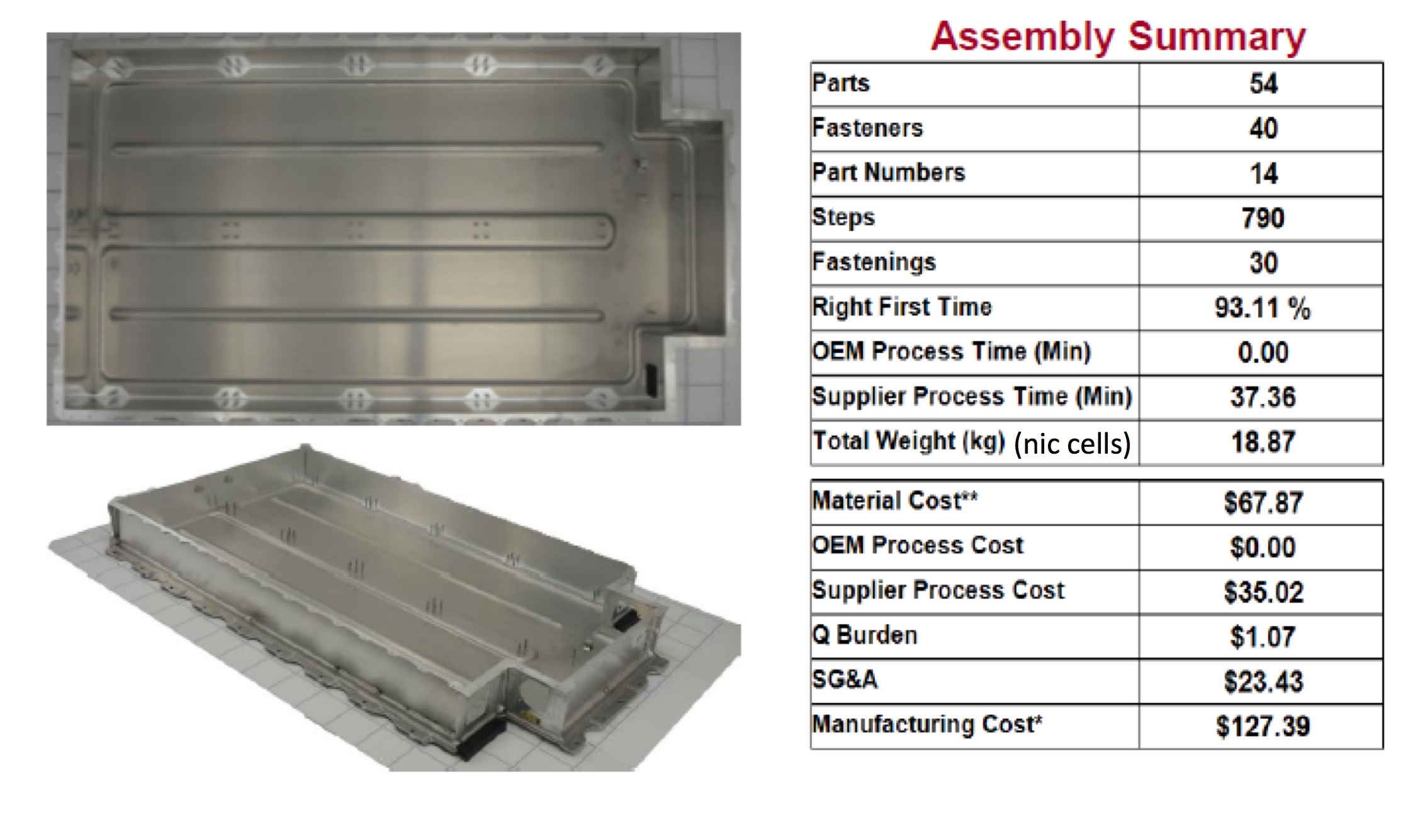

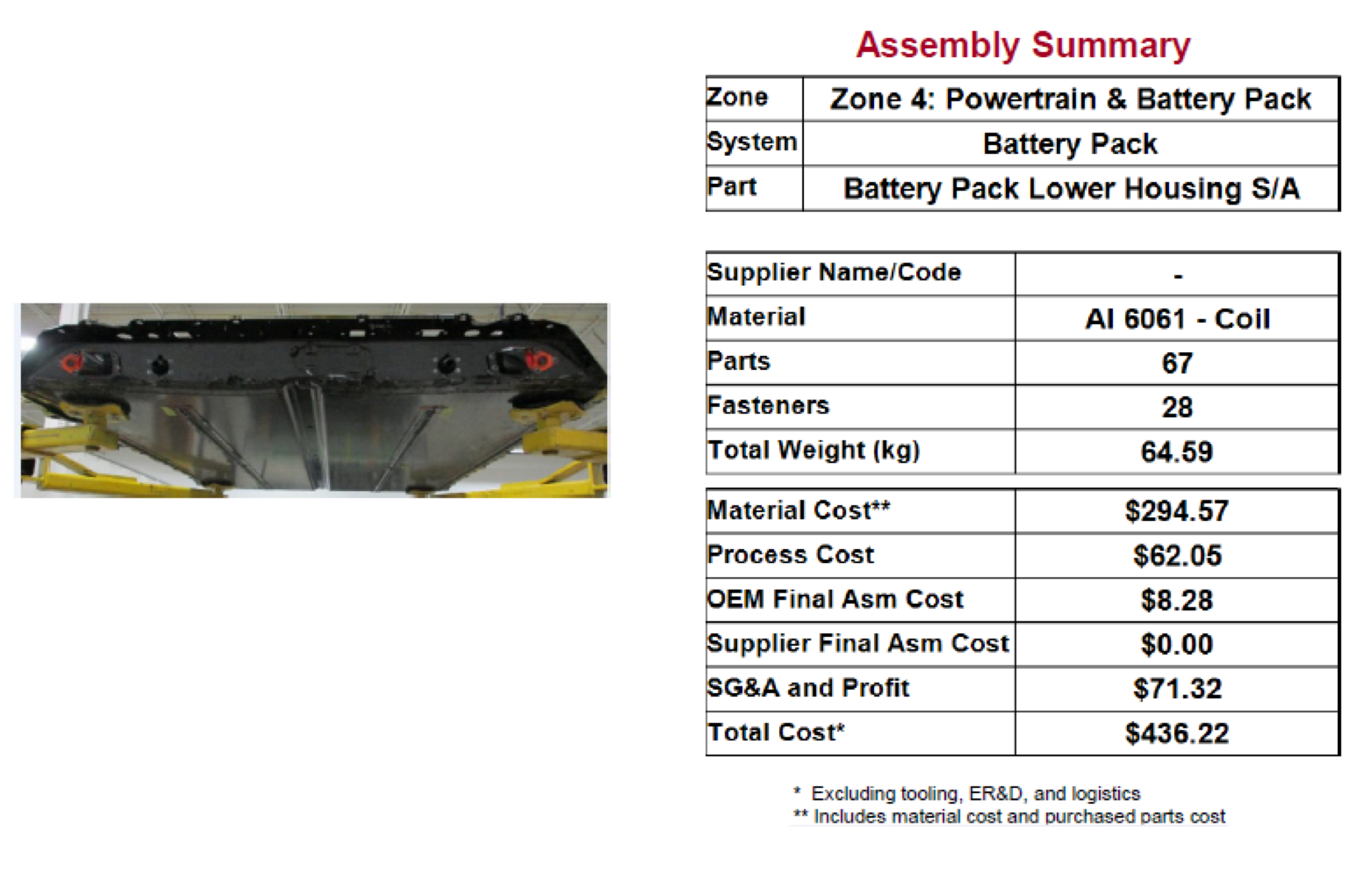

Drilling down to focus strictly on the battery pack, a similar cost/weight picture can be seen (Figure 2). A deeper look of the individual components that comprise the battery packs was presented, including the configuration and cost of the battery case bottom for the i3 (Figure 3) and a similar, though not fully comparable, assessment of the Tesla battery tray (Figure 4).

The Munro benchmarking presentation noted significant differences in the architecture and joining technologies used for each vehicle. For example, the battery enclosure in the i3 is integrated in the overall body structure for impact resistance, while the tray in the Tesla is not. Another variation in design found by Munro is that Tesla utilizes aluminum/steel friction stir welding, along with adhesives and mechanical fasteners, in the assembly of the battery box.

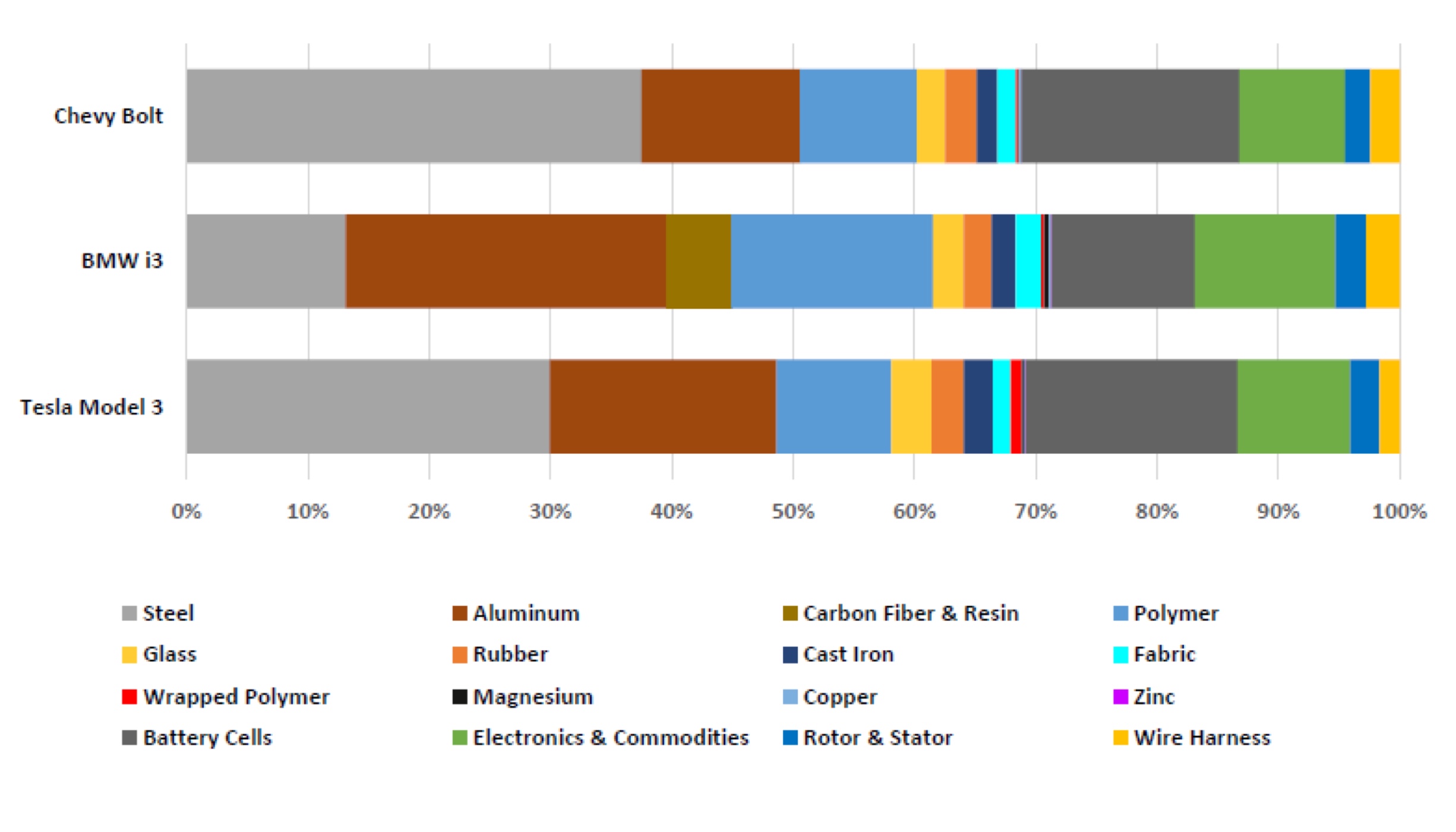

Such varying approaches are clear when considering the material usage overview (Figure 5). Aluminum clearly plays an important role, with all three vehicles showing greater than average use of aluminum. Yet steel remains a major factor in the Bolt and—to a lesser extent—the Tesla.

and the Chevy Bolt.

Based on its comparison of the Tesla, BMW, and Chevy systems, Munro is able to make some interesting predictions about the future of aluminum use in electric vehicle applications:

- As vehicle unit volumes increase from 30,000 per year to the 100,000+ per year range, the company expects battery enclosure construction to shift from the extrusion/casting model seen today to a more sheet intense design due to sheet’s cost effectiveness.

- Aluminum’s energy absorption capacity will make it attractive as a protection plate under the battery cells, as seen in Tesla’s Model 3. (Audi’s new e-tron vehicle uses a similar approach.)

- Further advances in high-strength aluminum (e.g., 400-600 MPa) will make the shift to using more aluminum in closures and other applications a more effective range enhancer for electric vehicles than simply adding additional battery cells.

Conclusion

As the electric vehicle battery tray benchmarking illustrates, important insights that can be derived from the dismantling and analysis of automotive vehicles. Such data can be essential for automotive OEMs and Tier suppliers in assessing their competitive position and stimulating innovative and successful designs.

Editor’s Note: This article first appeared in the February 2019 issue of Light Metal Age. To receive the current issue, please subscribe.