Aluminum cans are among the most sustainable forms of beverage packaging, thanks to their high recycling rate, as highlighted by the new study announced by the International Aluminium Institute (IAI) at COP30. Commissioned by the Global Beverage Can Circularity Alliance (GBCCA) and conducted by Eunomia Research & Consulting, the study notes that aluminum beverage cans achieved a global recycling rate of 75% in 2023, compared to 47% for PET (plastic) and 42% for glass.

Even with these excellent global recycling numbers, there is room to improve aluminum can recycling rates, particularly in regions like the U.S., where the aluminum can recycling rate is only 43%. The Can Manufacturers Institute (CMI) is working to address this issue through a combination of grant and revenue share programs, funded by beverage can manufacturers Ardagh Metal Packaging and Crown Holdings. These programs provide financial support to material recovery facilities (MRFs) across the country, enabling them to invest in additional can capture equipment that will prevent valuable used beverage cans (UBCs) from ending up in landfill. The CMI’s grant program alone is now enabling more than 150 million aluminum beverage cans per year to be collected and recycled.

In this interview, Scott Breen (pictured), president of the CMI, discusses the state of the aluminum can recycling industry and the organization’s grant and revenue share programs. Breen joined the CMI in 2019 as senior vice president of Sustainability, where he elevated the association’s vision of the metal can to be recognized as the superior, sustainable package. Prior to joining CMI, he was the associate manager of the Sustainability and Circular Economy Program at the U.S. Chamber of Commerce Foundation and an attorney-adviser at the National Oceanic and Atmospheric Administration.

What is the current status of the aluminum beverage can recycling industry?

Aluminum beverage cans are the most recycled beverage container in the U.S. with an average recycling rate of 43%. This translates into recycling nearly 90,000 aluminum beverage cans every minute in the U.S. In addition to high recycling rates, there is a high amount of can-to-can recycling in the U.S. An astounding 97% of recycled beverage cans become new cans, with the cycle from recycling bin to newly formed can taking an average of less than 60 days.

Most used cans become new cans because it is easiest from a chemistry standpoint, as well as because there is a significant amount of aluminum can sheet manufacturing in the U.S. This capacity will soon be increased with two new rolling mills coming online in the next couple of years, one in Alabama and another in Mississippi.

Aluminum beverage can manufacturers and their suppliers are committed to reaching new heights in the U.S. aluminum beverage can recycling rate. CMI members have set ambitious U.S. aluminum beverage can recycling rate targets, including reaching a 70% rate by 2030 and a 90% rate by 2050.

Why is can recycling so vital to the U.S. aluminum industry? Why is capturing cans so crucial?

As aluminum beverage cans are recycled, they facilitate domestic manufacturing and jobs. According to The Aluminum Association, 98% of jobs in the U.S. aluminum industry are in mid-and-downstream processing and recycling. In addition to jobs at secondary aluminum production facilities, beverage can manufacturers are a significant portion of the 28,000 can manufacturing jobs across 33 states, Puerto Rico, and American Samoa.

Recycled cans provide a domestic supply of a critical material—aluminum. Resilient, domestic supply chains mean increased national security and less dependency on foreign imports. This is particularly important in a time like today of high tariffs on imported metals.

Can recycling also helps the U.S. aluminum industry reduce its environmental footprint. Aluminum recycling saves 95% of the energy needed for primary aluminum production.

Recycling aluminum enables these many benefits each time it is recycled. Not capturing and recycling a can means foregoing these benefits not just once but many times, since the metal recycles forever.

How is the can recycling industry expected to evolve in the coming years?

The aluminum beverage can industry has set ambitious recycling rate targets with four pillars of action to achieve them. These targets are a 70% rate by 2030, 80% by 2040, and at least 90% by 2050. The four pillars of action are: (1) well-designed recycling refund systems, (2) increased household and away-from-home recycling, (3) proper sortation at recycling centers, and (4) increased consumer awareness of the can’s sustainability advantage.

Reaching these targets will have significant environmental and economic impacts. Consider that in 2023, if the recycling rate had been 70% instead of 43%, there would have been around 28.9 billion more cans recycled. The recycling of additional cans would have generated more than $450 million in revenue for the U.S. recycling system and resulted in energy savings that could power more than 1.3 million U.S. homes for an entire year.

Tell us about the CMI’s grant and revenue sharing programs for MRFs. How did the idea for such a program come about? What are the CMI’s primary goals in developing this program?

CMI modeling in the Primer and Roadmap found that if every missorted aluminum beverage can at every material recovery facility (MRF), which sort single-stream recyclables, was captured, 3.5 billion additional UBCs would be recycled, increasing the national recycling rate 3%. It is an incremental increase relative to other major pillars of action, but is still a significant opportunity, and it provides a means by which to capture millions of UBCs in the immediate term.

CMI’s comprehensive effort to capture missorted cans at MRFs started with research in 2020, which found that while most MRFs wouldn’t be able to operate without the revenue from UBCs, up to one in four UBCs are missorted at a typical MRF.

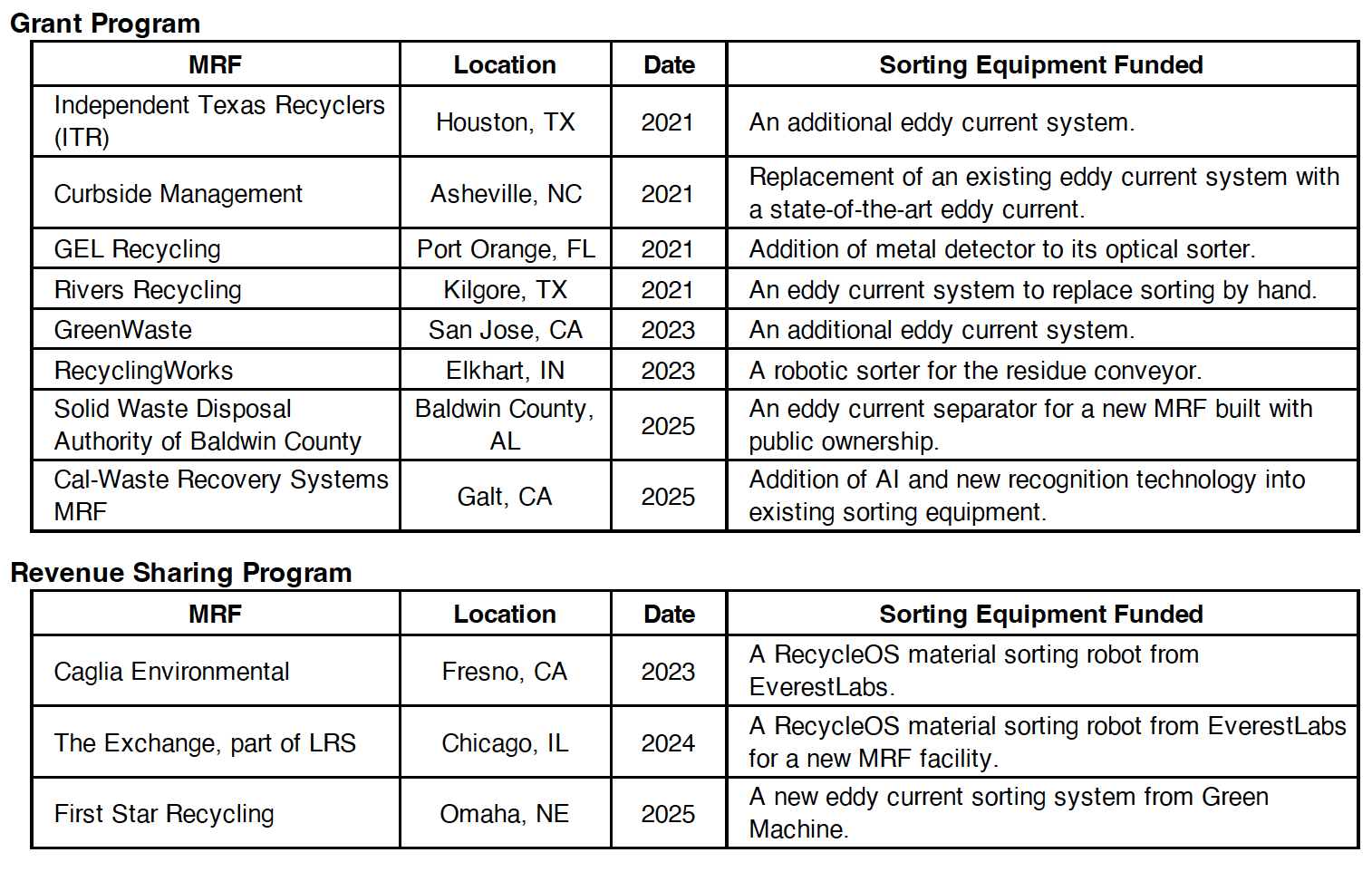

In 2021, CMI started a grant program in collaboration with The Recycling Partnership with funding from CMI members Ardagh Metal Packaging and Crown Holdings that would give money to MRFs for can capture equipment. Eight grants have been given with this program, and the funded equipment captures nearly 150 million UBCs per year that otherwise would have been missorted at the MRF level.

Testing was conducted in 2022 at several MRFs proving the number of UBCs that are being missorted and the return on investment (ROI) to capture them, as well as a free online ROI calculator for MRFs to use. This testing at five loss points across three diverse MRFs found an average loss of seven to 36 UBCs per minute, which represents an annual average revenue loss of $71,900 with a payback period of three years, according to the ROI calculator.

CMI’s current focus is on funding can capture equipment with revenue share agreements rather than traditional grants. The revenue share is made possible by the aluminum beverage can’s relatively high economic value. This model enables investments from Ardagh and Crown to be used to fund multiple equipment. To date, three MRFs have agreed to revenue share agreements for equipment financing. The most recent is First Star Recycling’s MRF in Omaha, NE. Under this deal, First Star got a fully financed eddy current with funding from Ardagh and Crown, as well as the revenue received from the first two revenue share agreements. In exchange, it is providing CMI a 50% revenue share on all UBCs captured with the eddy current, as well as a guarantee to pay back the principal after year three, if the revenue share has not already fully covered it.

What are the key kinds of scrap sorting and can recovery technologies that this program is targeting? Why are these technologies a key focus?

The program utilizes technologies that capture missorted UBCs inside a MRF. This includes eddy currents, like the one from Green Machine used in the latest revenue share agreement with First Star Recycling. An eddy current uses magnetic forces to separate non-magnetic metal like aluminum beverage cans from other recycled materials. While eddy currents are more than 95% effective at sorting out UBCs present on the MRF’s container processing line, cans may be missorted prior to reaching the eddy current. One example is flattened cans that are sorted with two-dimensional materials like mixed paper. The second eddy current at First Star’s MRF is being placed on the fiber line and is expected to capture more than 3 million UBCs per year.

The program has also deployed AI-powered, optical sorting robots, like the one found in Chicago’s LRS “The Exchange,” a high-tech MRF facility. These sorting robots help identify UBCs from the “last chance” recovery line. At The Exchange, an EverestLabs’ RecycleOS robot is capturing about two million UBCs per year.

How can MRFs get engaged in the program? Are there any ways in which the CMI plans to further improve upon or grow the program?

Money received from the revenue share agreements will support future installations. This is a model that is designed to be a “pay-it-forward” approach to recycling, so CMI can help even more communities capture more UBCs. And when MRFs recover more cans, recycling economics improve across the board.

Aluminum’s high market value can offset processing costs for lower-value materials, helping local recycling programs stay viable. In fact, aluminum beverage cans make up only 3% of the volume by weight, but represents nearly one third of the total revenue of all recyclables at single-family households. The environmental upside is equally compelling. As the recycling industry looks toward modernization and circularity, aluminum cans offer a powerful proof point. Investing in robust can capture equipment isn’t just good for the environment, it’s good for businesses and their bottom lines.

CMI and its members will continue to support projects and partnerships that maximize UBC recovery. Because when we capture every can, we’re not just recycling better—we’re strengthening the entire recycling system.

Editor’s Note: Learn more about the CMI’s can recycling studies and programs on the CMI website. MRFs interested in partnering with the CMI, can email info@cancentral.com.

This article first appeared in the December 2025 issue of Light Metal Age. To receive the current issue, please subscribe.