By Mark Butterfield, Metal Exchange Corporation.

Editor’s Note: This is the third in a series of six articles (available in the print magazine) in which the author will explore opportunities for the aluminum extrusion industry in the automotive market. The series will specifically address the supply chain, raw material supply, extrusion, fabrication, and assembly.

With more than 50 lbs of extruded content per vehicle and an overwhelming commitment by automotive OEMs to transition to electric vehicle platforms, it is expected that overall extrusion demand could grow 70% by 2027. This growth in extruded automotive applications combined with other traditional markets leads to the increased demand in specific extrusion capabilities and capacity. Looking at the period between 2015 and 2021, the industry brought online over 40 automotive and non-automotive presses across U.S. and Canada combined. This was primarily focused on the 8–10 inch press size range.

Looking ahead at the period between 2022 and 2024, it is already expected that approximately 8–10 new presses (or around 250 million lbs) will be slated specifically for automotive, primarily in the 10 inch or larger size range. At the same time, non-automotive growth is expected to reach 28 presses or around 770 million lbs.

As evidenced by these investments, the aluminum extrusion industry recognizes the increase of overall demand across both automotive and non-automotive. The industry is responding with nearly 1 billion lbs of capacity—impressive when considering the fact that a press line alone can cost $12–25 million depending on its size, automation, and end use. This article looks at the overall extrusion process and considers how the design of a press line can impact extruders’ ability to meet these growing demand and capacity increase targets.

Press Design Factors

To better understand the expected capacity increases aimed at responding to the demands of automotive OEMs, one must first look at the specific type of press lines being added and their associated capabilities. These lines are being constructed to produce tight tolerance lineals (profiles) and need to operate under rigidly controlled parameters with minimal process variation. All of this is necessary to achieve the consistent material and metallurgical properties that push the limits of the extrusion process and 6000 series alloy chemistries at the scaled volumes required by OEMs.

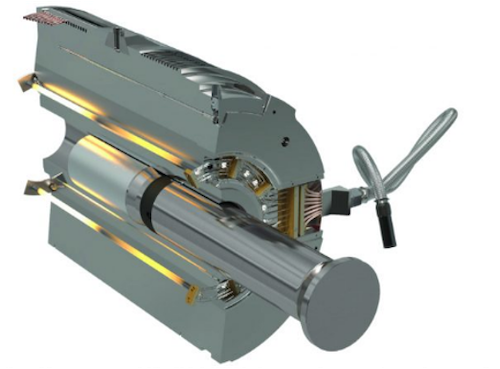

The extrusion process—from the input of raw material to the exit of a completed lineal ready for additional secondary operations—begins with the handling and thermal management of the log or billet prior to the entry of the press, including washing, thermal heating, thermal tapering, and lubrication. In addition to the quality and microstructure, the thermal control of the billet within ±8–10°F along with the ability to achieve high temperature bands is necessary for consistent material flow and, ultimately, the metallurgical performance and tolerances of the product (Figure 1). This is why, in the extrusion industry, it is often said that the three most important parameters in the process are temperature, temperature, and finally temperature.

In addition to the need to deliver a properly heated billet to the press, the demand for temperature control continues with the thermal intelligence, monitoring, and control within the container to ensure front to back and top to bottom temperature control of the profiles during the press cycle (Figure 2). These temperature gradients and thermal relationships between the container and billet impact material flow, making it critical for metallurgical and productivity performance.

Analyzing the press further, the critical drivers to focus on are its size (tonnage and billet diameter), structure, hydraulics, system controls, cycle time and performance, billet length, and thermal management. Press sizes and capabilities are evolving along with OEM development of new applications and extrusion needs. As more extruders invest in lines to produce larger consolidated profiles (8–14 inch circle sizes) utilizing high strength alloys for structural and crush applications, the need for larger presses with 10–12 inch billet diameters and an associated high tonnage (4,000–7,000 tons) also continues to increase.

The structural characteristics of the press and its associated deflection rates become the foundation for achieving the required tolerance capabilities. As is well known, press deflection translates into tool deflection and the pressure variance of a press cycle directly affects product variation (front to back), which is exaggerated by today’s aggressive ramps, alloys, temperature parameters, and extended billet lengths of 60 inches or greater. OEMs purchase completed components that are often assembled into complex structures with other extrusions and materials, where control of product variation is critical and determines a design’s ultimate manufacturing capability.

Once the size, structure, tonnage, and thermal controls are understood, the next major factors are the press hydraulics and cycle controls. These aspects ensure the efficient performance of extrusion cycles with repetitive and consistent (12–18 second) dead cycle times.

Handling and Other Factors

With today’s demand for extruded solutions in structural and crush applications, metallurgical capabilities become a key metric in which a press line’s capability can be determined. As previously mentioned, the metallurgical quality begins with the thermal control of the billet and continues throughout the extrusion process, but it is ultimately determined at the critical process of quenching.

For an extruder producing quench sensitive alloys constrained by tight profile tolerances, the quenching process is one of the most difficult. The strength of 6xxx alloys comes from magnesium and silicon, which combine to make Mg2Si. These alloys must be quenched fast enough to avoid undesirable concentrations of alloying elements and achieve the desired hardness, yet they must also be quenched slow enough to minimize residual stresses and distortion that impact tolerance requirements in longer length components. Therefore, the quench system design and flexibility is critical relative to product specifications. Today’s quench systems have the capacity and capability to provide advanced quench rates (Figure 3), as well as the controls and management system necessary to provide material properties and microstructure without excessive distortion.

Once a profile is extruded and quenched under tight process controls, the material handling system (marking, puller, stretching, cut down, scrap management, and artificial aging) takes over. The stretching process was once utilized primarily for straightening, but it now often serves as a method for achieving additional control of the profile’s mechanical properties (deformation/cold working), thus requiring systems and controls for consistent and repeatable stretch recipes specific to profile design, alloy, and tolerance specifications. Stretcher capacity will continue to evolve as large profiles are extruded with higher strength alloys that require greater tonnage and precision.

The proper aging of solution treated product is required to grow and disperse the precipitates, ultimately setting the mechanical properties and performance of the end product. Aging ovens require temperature and time controls for dynamic control and age cycles. OEM specifications are driving the lot sizes—with the mass and duration of the aging cycles ultimately determining the oven capacity and manufacturing space necessary for press lines to serve the automotive market.

One final key element of an extrusion press line is capturing data from every stage of the process for traceability and future optimization. Traceability begins with the raw material inputs and billet casting and is maintained throughout the manufacturing process, with the expectation that automated in-line laser or ink jet systems will be able to provide precision marking of both front and back engineered scrap at the time of extrusion and for the proper segregation and control of material. OEMs generally expect suppliers to trace all material data, process, and product information at a component level. Without automated marking and management systems incorporated within the press line, traceability at scale becomes unmanageable.

Conclusion

Automotive demand continues to increase, creating challenges and opportunities within the aluminum extrusion industry. This includes the need for increased capacity and the further development of advanced processing capabilities. When analyzing existing and future press capacity, one must ask whether it has the capabilities (tonnage, size, structure, quench capabilities, thermal controls, and management systems, etc.) to support the processing of the complex, metallurgically driven profiles within the rigid tolerance specifications required to meet post extrusion fabrication, assembly, and product performance needs.

The most important part of the extrusion manufacturing process is the technical resources necessary to support all functions of the operation, including the maintenance of these advanced press lines expected to operate within very tight specifications. It could be said that purchasing the equipment is the easy part, but it is what you do with it that is most important—and that takes people. Therefore, another parameter in the evaluation of capacity beyond the physical equipment is the technical strength, training, and well-defined succession planning of the personnel running the operation.

The extrusion industry is innovative and responsive to customer demand. This is represented by the investments in capacity today and in the future. These investments are supported by dedicated people, ensuring that the industry’s capabilities exceed the expectations of OEMs, assuring aluminum remains the material of choice and extrusion the process of choice.

With more than 30 years of experience in the aluminum extrusion industry, Mark Butterfield is currently president of Manufacturing at Metal Exchange Corporation, which includes the Pennex brand. An established industry leader, he also serves the Aluminum Extruders Council (AEC) in multiple positions, including that of vice chairman of the board of directors, chairman of the Automotive Committee, and vice chairman of Extrusion Technology 2024.

With more than 30 years of experience in the aluminum extrusion industry, Mark Butterfield is currently president of Manufacturing at Metal Exchange Corporation, which includes the Pennex brand. An established industry leader, he also serves the Aluminum Extruders Council (AEC) in multiple positions, including that of vice chairman of the board of directors, chairman of the Automotive Committee, and vice chairman of Extrusion Technology 2024.

Editor’s Note: This article first appeared in the June 2023 issue of Light Metal Age. To receive the current issue, please subscribe.