By Andrea Svendsen, Managing Editor.

Demand for aluminum in the automotive industry is continuing its growth trajectory, according to a new report from DuckerFrontier, 2020 North American Light Vehicle Aluminum Content and Outlook. The report notes that aluminum content is expected to grow to 514 lbs per vehicle by 2026, up by 12% from 2020 levels. Aluminum sheet used in closures (hoods, doors, etc.), body-in-white, and chassis applications represents one of the key growth areas, as well as an increase in electric vehicles.

“Aluminum is the fastest growing automotive material,” said Abey Abraham (Figure 1), managing director of DuckerFrontier. “The caveat is that there is no one universal material that achieves everything the OEMs require. Automakers have to evaluate a number of factors to determine the best material for their vehicles. Therefore, we see a multi-material approach emerging more and more as different vehicle models have come out. As this approach evolves, we believe it is one of the factors driving aluminum’s increased market penetration.”

Factors Impacting the North American Market

The methodology used by DuckerFrontier to compile the report included gathering information and opinions from OEMs and their suppliers. In addition, they accessed data available from the U.S. National Highway Traffic Safety Administration (NHTSA), the U.S. Environmental Protection Agency (EPA), and other published sources in order to establish an independent view of vehicle and technology paths likely to be taken by OEMs through 2026. Two major issues and their impact on the automotive market are also discussed in the report, including the COVID-19 pandemic and the contentious situation surrounding fuel economy standards in the U.S.

Effect of the Pandemic

Calculations for 2020-2022 had to be adjusted due to the impact of the COVID-19 pandemic, including the production stalls in March to May of this year. The report notes that production volumes are expected to be down in 2020, with the baseline scenario showing a 15-20% drop, resulting in around 12.8 million vehicles forecast for April 2020 (compared to the 16.6 million previously expected). Information suggests that production volumes will continue to be significantly impacted through 2022, with some level of normalcy to return in 2023.

U.S. Fuel Economy Standards

Over the past few years, the fuel economy and greenhouse gas standards for cars and trucks have been undergoing changes. In 2012, the Obama administration adjusted the Corporate Average Fuel Economy (CAFE) standards regulated by the NHTSA. The adjusted standards proposed that automakers improve the fuel economy of their cars and trucks, bringing it to 54.5 miles per gallon by model year 2025. These standards have driven many of the lightweighting measures undertaken by U.S. vehicle manufacturers.

However, under the Trump administration, the EPA issued the Safer Affordable Fuel-Efficient (SAFE) Vehicle Rule in 2018, which would roll back the 2012 CAFE standards. The proposal under consideration provides several alternative measures, but essentially would outline a 1.52% CO2 reduction each model year through 2026. It would also eliminate the legal waiver issued to California that allows it to implement more stringent standards.

Under the Clean Air Act, California has been the only state permitted to set vehicle emission standards. The waiver was first issued by the EPA in 2013, allowing the state to maintain its own greenhouse gas (GHG) and zero emission vehicle (ZEV) standards regulated by the California Air Resources Board (CARB). The GHG regulations target an 80% reduction of vehicle emissions by 2050 (compared to 1990). The ZEV standards require auto manufacturers to have a percentage of their fleet be comprised of vehicles with no emissions, with a target of 8% by 2025. A total of 13 states, along with the District of Columbia, have adopted these regulations. Four OEMs have also come out in support of the CARB standards, including BMW, Ford, Honda, and Volkswagen.

Following the introduction of the SAFE rules, California and 22 other states filed a lawsuit to prevent the revocation of the EPA waiver, with the aim of keeping the CARB standards in place. The outcome of this lawsuit is not clear and may ultimately be decided in the U.S. Supreme Court. As noted in the DuckerFrontier report, the uncertainty surrounding these regulations until a decision is determined will have an impact on the automotive industry, which plans changes to its vehicle models years in advance. “Ultimately, it’s not in the best interest of OEMs to have two different sets of rules that they have to follow,” said Abraham.

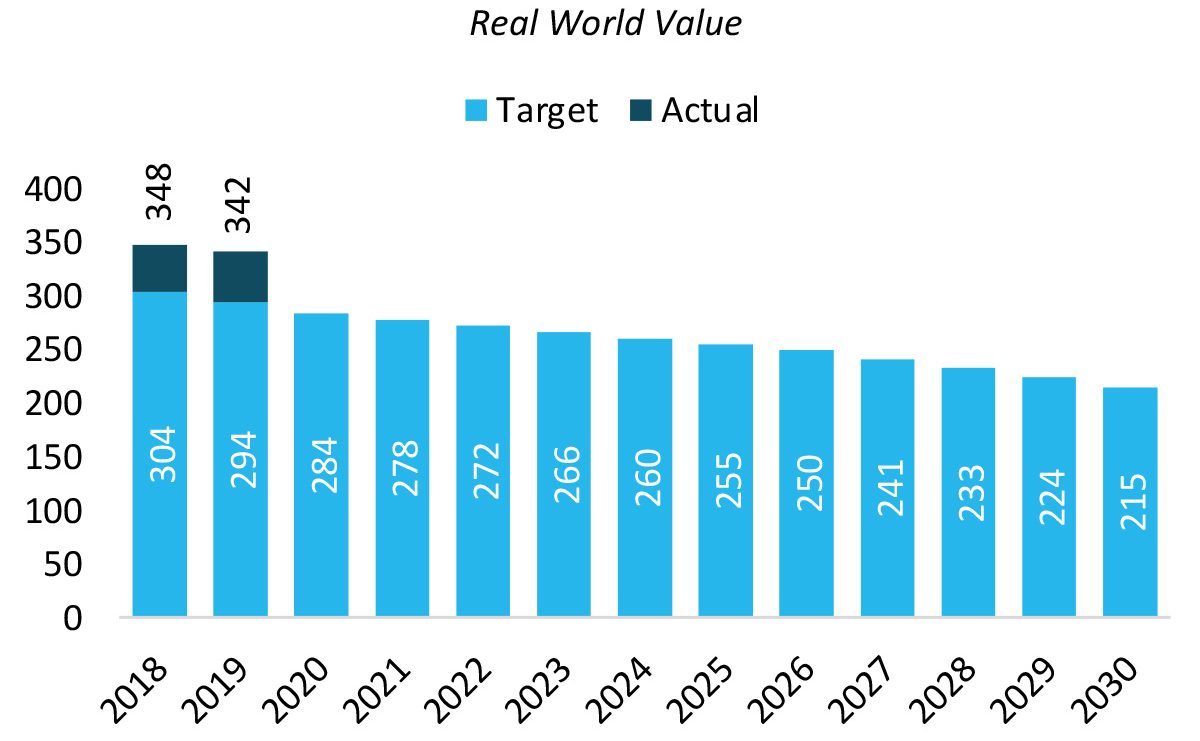

DuckerFrontier took a blended approach to their North American automotive aluminum forecast, considering both the SAFE and CARB regulations. The report notes that the CO2 emissions measured in 2018 were 342 grams of CO2 per mile, with the goal expected to be a 28% reduction by 2026 to 250 grams of CO2 per mile (Figure 2). “OEMs will have to pursue a measured approach that relies on the careful contribution of a mix of powertrain improvements, electrification, and mass savings to achieve that goal of 250 grams of CO2 per mile,” explained Abraham. “Around 50-75% of the CO2 gap will be closed by powertrain improvements, with 20-30% being addressed by a mix of different electrifications, either BEV or plug-in hybrid vehicles. The remaining amount will really have to come from mass savings, and this is where aluminum will play a major role.”

Trends Driving Aluminum Use

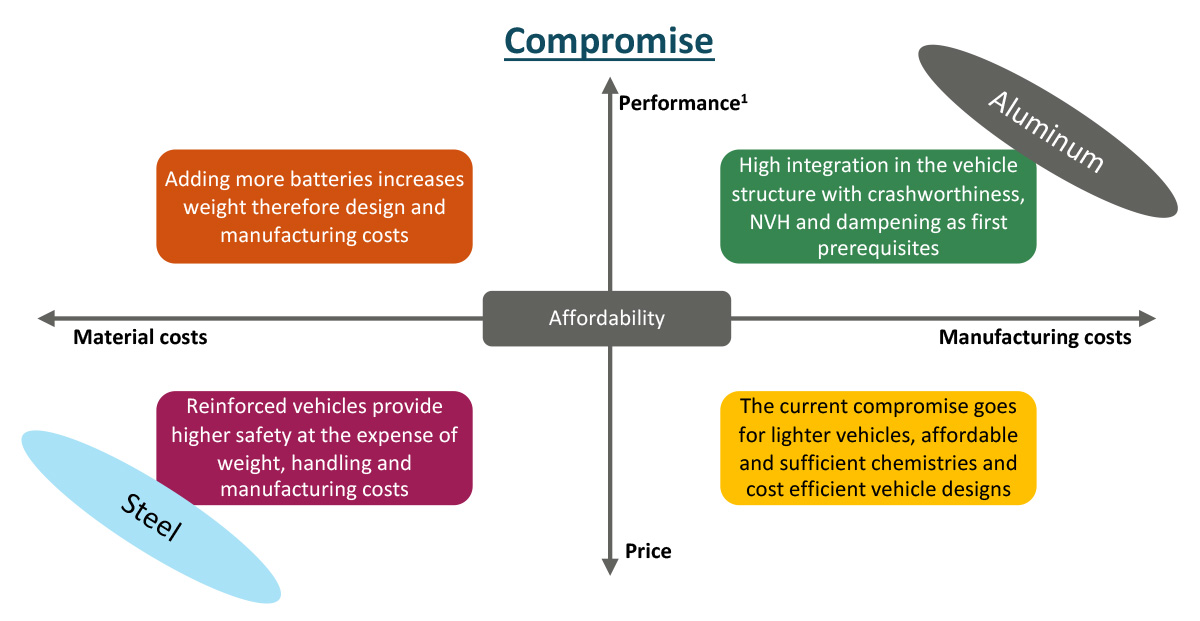

As automotive manufacturers focus on fuel economy and lightweighting, there has been an evolution in the engineering and design of new vehicles. Automakers have shifted their perspective, garnering a technical knowledge of the value and drawbacks of a variety of materials—high-strength steel, aluminum, plastics, composites, and magnesium. Thanks to improved joining and processing technologies, car companies do not have to focus on a singular material for the entire car. Rather, their aim is to utilize the best material for the weight, strength, and performance required of a particular component.

“We’re not seeing as many new launches of very aluminum intensive vehicles,” said Andreas Afseth (Figure 3), technical director at Constellium and the Aluminum Association’s Transportation Group Technical Committee chair. “Instead we’re seeing the focus be on multi-material vehicles, in which aluminum is often used in parts where it can provide the biggest weight savings for the lowest cost.”

North American vehicles are also getting bigger. Due to low gas and oil prices, consumers are showing a greater interest in large trucks and SUVs over smaller lighter passenger cars. Since 2016, the industry has shown an average mass increase of 32 lbs per vehicle. As cars and trucks get bigger, the need for lightweighting likewise increases in order to meet fuel economy requirements. Therefore, aluminum content increased by 62 lbs per vehicle over the same period.

Electric Vehicles

Another major design trend is electrification. Nearly every major vehicle manufacturer has announced plans to include battery electric vehicles (BEVs) or plug-in hybrids in their lineup. Companies such as Jaguar Land Rover and Volvo plan to make every vehicle in their fleet available in an electric engine option. General Motors, Ford, Volkswagen, and others have also set their own targets for increasing the number of BEVs or hybrids in their vehicle fleets. “BEVs are expected to grow to reach 10% of the total number of cars produced by the end of the decade,” noted Afseth. “These cars use a lot more aluminum than the traditional internal combustion engine vehicles.”

Each vehicle manufacturer has an individual approach to implementing electrification. For many car manufacturers, the battery is being added to existing designs as a separate component. However, in dedicated BEVs from companies such as Tesla, Audi, and others, a skateboard platform is used that integrates the battery into the overall design in order to save weight and improve stiffness and rigidity. Each approach comes with various battery integration costs, including the cost and heavy weight of the battery itself.

“As electrification grows, automakers are hitting the market with aggressive range targets to achieve what consumers want,” said Abraham. “We’re going to see more automakers relying on aluminum to help balance the various costs that are associated with batteries. In fact, given the current battery chemistries and manufacturing processes, aluminum is considered a favored material for electric vehicles, as it offers OEMs value in terms of the manufacturing costs, weight savings, and performance” (Figure 4).

There is a content trade-off in switching from a traditional internal combustion engine to an electric motor, since various powertrain (engine block, oil pan, etc.), transmission, and driveline components are removed—representing about 200 lbs of aluminum. However, this is counterbalanced by the implementation of electric powertrain and platform components, including motor housings, battery cases, and electrical units, as well as closure and body platform components. As a result about 400 lbs of aluminum for specific electric vehicle components is added back in.

Aluminum extrusions, sheet, and structural castings are all expected to see major growth in the electric vehicle market. “It’s important to stress that the average BEV made in North America today has almost twice as much aluminum sheet and almost three times as much extrusions than the average conventional powertrain vehicle,” said Afseth. “Though there’s a reduction in the usage of secondary castings, there is a big increase in engineered products.”

Aluminum Growth

The current North American Light Vehicle Aluminum Content and Outlook report reveals that aluminum usage has already experienced significant increases in just the last ten years. In 2010, the average aluminum content per vehicle was at 340 lbs. “At that time, the applications for aluminum were rather limited, with only small amounts of body sheet used,” said Abraham. “Even so, it was a significant amount of aluminum to begin with.”

Since 2010, aluminum usage in automotive has grown by more than 100 lbs per vehicle, with 459 lbs of average aluminum content per vehicle expected in 2020. According to DuckerFrontier, more than 30 platforms in 2020 will have more than 500 lbs of aluminum content in their vehicles. In the next six years, aluminum is expected to see another burst of growth, with average aluminum content to exceed 514 lbs per vehicle, a 12% increase from the current numbers (Figure 5).

Automotive aluminum sheet is expected to be a main driving factor of this growth. Currently, about 23% of automotive aluminum content is sheet. The amount of sheet usage is expected to grow from 107 lbs per vehicle to around 133 lbs, representing 26% of the aluminum content per vehicle. Much of this increase is expected to be influenced by the use of aluminum auto body sheet (ABS) and closures. “It’s evident that aluminum auto body sheet is demonstrating very high rates of growth,” noted Abraham. “New vehicle launches that have been confirmed in 2020 include the Nissan Rogue, Ford Bronco, and recently launched General Motors SUVs (including the Tahoe, Suburban, and Escalade), all of which are great examples of ABS growth.”

Aluminum extrusions and forgings have also recorded growth since 2016. During this time, there was a 10% increase in vehicles utilizing extrusions for crash management systems, as well as a 7% increase in vehicles implementing forged control arms. Extrusions currently account for 10% of aluminum content in 2020, representing around 45 lbs per vehicle. Meanwhile, forgings are at around 2%, with about 8 lbs per vehicle.

Both extrusions and forgings are expected to stay stable through 2026. Extrusions will see a slight growth to 55 lbs per vehicle (or around 11% of aluminum content), while forgings will grow to 10 lbs (maintaining 2% of content).

Castings still account for the largest amount of aluminum content at 65%, with about 299 lbs per vehicle in 2020. Through 2026, aluminum castings per vehicle are expected to grow to 316 lbs. However, this will take up a smaller amount of the overall aluminum content at 61%. In general, the amount of aluminum powertrain castings has been decreasing, in part due to the downsizing of engine blocks and the number of cylinders. Instead, there is a new trend towards structural castings, especially for BEVs and plug-in hybrids. For example, Tesla is adopting a large structural casting for the rear of its electric SUV. The massive casting is said to replace over 70 extrusions and stamped sheet components, combining them into a single piece.

Automotive Body Closures

Aluminum sheet closures, including body sheet, hoods, doors, trunk lids, roofs, and fenders, represent an area of significant growth. Closure penetration has grown from 41 lbs per vehicle in 2016 to 59 lbs per vehicle in 2020. It is expected to continue this growth trajectory to 73 lbs per vehicle by 2026 (Figure 6).

The adoption of aluminum hoods into vehicles is expected to see a steady increase (Figure 7). DuckerFrontier expects aluminum hoods to penetrate 60% of the automotive market by the end of 2020. This will grow to approximately 80% of all hoods produced by 2026. “Hoods are kind of a gateway material for different aluminum closure applications,” said Abraham. “If an OEM is comfortable utilizing aluminum for their hoods, it is usually an indicator that they have studied and accepted the strengths and weaknesses that aluminum provides.”

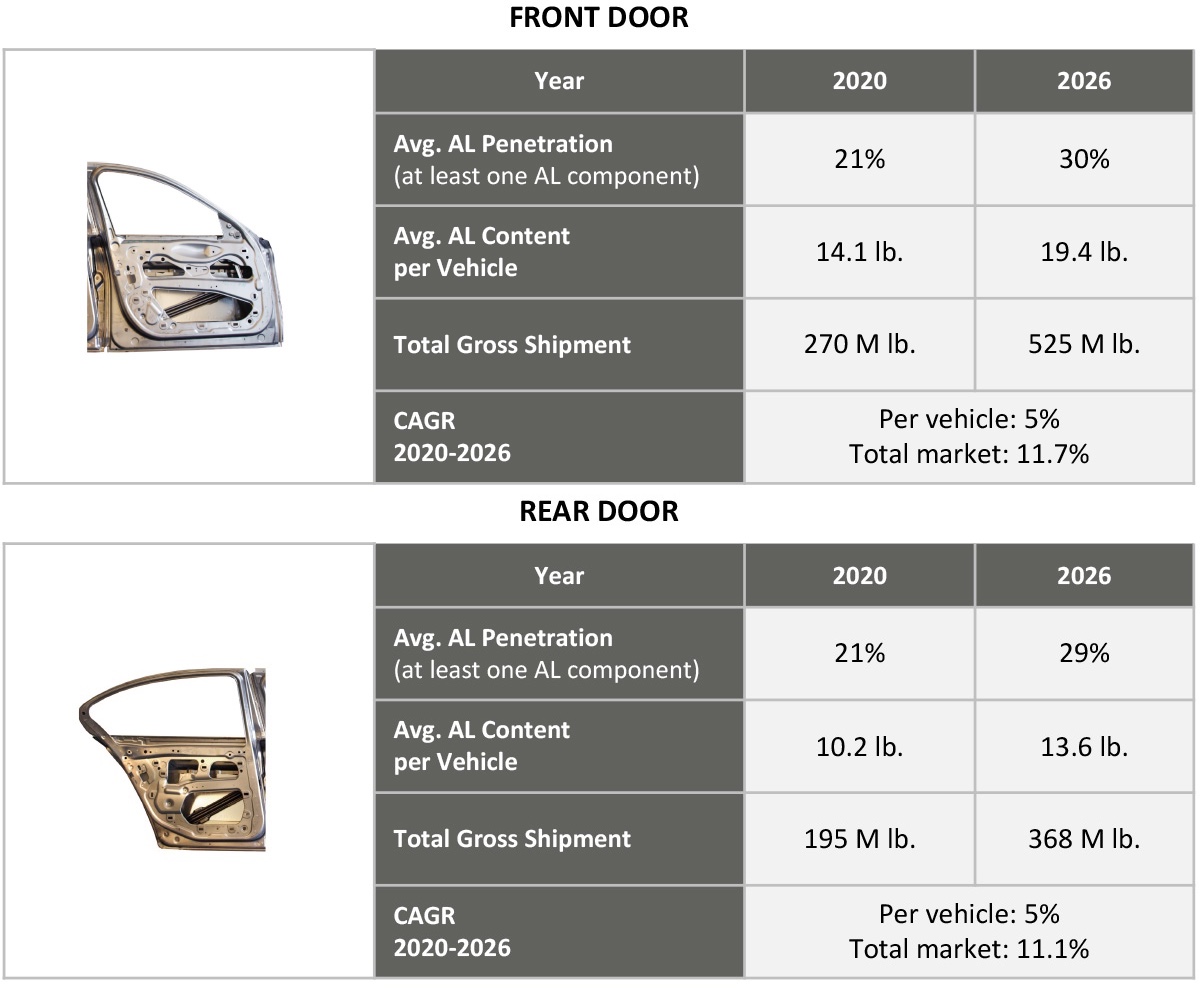

Doors, on the other hand, represent more recent growth—mostly in European brands (Figure 8). Currently, BMW has the highest penetration, with aluminum front doors being used in most of their models and both front and rear aluminum doors being used in their large SUVs. In general, aluminum doors represent about 20% of the 2020 market, which is expected to grow to 30% by 2026. Abraham noted, “If you consider that less than 8% of available doors were made of aluminum in 2016, you can see this is really highlighting an interesting shift toward aluminum.”

According to Afseth, there are two underlying reasons as to why aluminum is seeing such growth in closures. The first reason is that the thickness of closure panels is mainly stiffness dominated compared to body structural parts, which are often dimensioned based on strength. Due to aluminum’s lower density and high specific stiffness, OEMs can always save more than 40% of a component’s weight just by switching from any steel grade to aluminum.

The second significant factor is that closures are hang-on components, which means that they require simple joining processes to connect to the main body of the vehicle and they are finished on sub-assembly lines, rather than the main automotive body assembly line. As a result, the CAPEX investment needed by OEMs to transition to aluminum is much lower.

Additive Manufacturing

Although aluminum additive manufacturing is not directly addressed in the new DuckerFrontier report, Light Metal Age asked Abraham and Afseth about its potential use in the automotive industry. Both agreed that it’s a technology that’s in the very early stages of its development. “There’s a lot of growing interest regarding additive manufacturing,” said Abraham. “There are a lot of research programs being conducted by academia, Tier suppliers, and OEMs. It’s an area that we need to keep a close eye on.”

Prototyping of high volume components is one of the main areas that automotive manufacturers are pursuing in additive manufacturing. This is because it has the potential to significantly shorten development time for new components. “It’s beneficial to be able to rapidly produce a sample part and have an advanced look at what it might look like and how it might fit in a high volume application,” noted Abraham.

Afseth added that another area for additive manufacturing is small, high-value components on low-volume vehicles. “Niche applications for motorsports and other specialized vehicles will increase, with new aluminum alloys designed specifically for additive,” he explained. “But there is no short-term expectation for additive aluminum to be used in large volume vehicle production.”

Conclusion

Automakers continue to favor aluminum in an ever-changing industry climate, with evolving trends such as electrification and shifts toward multi-material construction. As the automotive aluminum sector thrives, it remains vital to the North American manufacturing base and a healthy U.S. economy. As the new DuckerFrontier report shows, over the next decade, there will be significant decreases in the use of mild steel, traditional steel sheet, and cast iron. Subsequently there will be large growth in the use of aluminum and advanced high strength steels, as well as some growth in magnesium, plastics, and carbon fiber composites.

“We believe multi-material vehicles are the way of the future,” said Abraham. “Broadly speaking, every material has its place in the automotive supply chain. We didn’t find any single material that’s going to threaten aluminum content in the industry. In fact, aluminum pounds per vehicle is growing at a pretty fast clip.”

Faced with this increased demand, the aluminum industry has invested or committed more than $3 billion to ensure increased automotive capacity in the U.S. since 2013. In addition, the industry is continuing to work to develop new innovations in terms of alloys (with different strengths, formability, joining capabilities, etc.) and manufacturing processes to ensure that it will be able to meet the automotive industry’s requirements throughout the vehicle.

Editor’s Note: To view the 2020 North American Light Vehicle Aluminum Content and Outlook report summary, visit: www.drivealuminum.org/research-resources.

This article first appeared in the October 2020 issue of Light Metal Age. To receive the current issue, please subscribe.