By Goran Djukanovic, Aluminum Market Analyst.

After replacing some quantities of steel in the automotive industry in recent years, aluminum has another potential area of increasing use, which is gaining importance, namely the beverage industry. Although aluminum has been present in the packaging and beverage industry for a long time, it is now challenging plastics and glass. Aluminum is not only being used in soda or beer cans (where it has been commonplace), but is also implemented where plastics and glass have been dominant thus far—the packaging of water. This may result in a strong increase in demand for aluminum in the future—from the beverage industry as well as in numerous other products where plastics have been dominant in the past.

In the last several years, there has been strong and growing pressure on both producers and consumers of plastic products to switch to alternative materials. The focus has especially been on plastic bottles used in the beverage industry, due to rising public concern about the environmental impact caused by plastic pollution.

This pressure has intensified since 2017, when the BBC nature documentary Blue Planet II showed how staggering amounts of plastics were ending up in seas and oceans. At the time, according to Ocean Conservancy, a U.S. environmental group, some eight million tons of plastic a year (now even more) end up in seas and oceans, bringing danger to sea plant life and creatures, including birds.

On the mainland, recent studies have shown that particles originating from degradation of plastic waste, known as microplastics, are being absorbed through plant roots, ending up in the wheat and vegetables humans and animals eat. These particles have previously been found throughout the ocean and other aquatic ecosystems, and even in our seafood and salt, according to researchers.

Polyethylene terephthalate (PET) bottles are commonly used for soft drinks and mineral water, but can also be used in other household or personal care products. Data from Euromonitor International shows that more than 480 billion of these bottles were sold in 2018 alone. In 2020, it is estimated that more than half a trillion plastic bottles will be sold globally. Of these, fewer than half are recycled—the rest will take more than 400 years to decompose in landfills.

Every day, over 8 million pieces of plastic waste find their way into seas and oceans around the world. There may now be around 5.3 trillion plastic pieces floating in the open ocean, collectively weighing around 272,000 tons. This is disastrous for sea life. A recent study by The Center for Biological Diversity in the U.S. predicts that, if the industry continues to grow at current rates, plastic production will increase by 40% by the end of this decade. An alternative material to replace plastics and ease environmental concern is aluminum, since it is recyclable, sustainable, and produces low carbon emissions when recycled.

The Aluminum Alternative

Aluminum packaging (in the form of a can, cup, or bottle) is praised not only for its durability, but also its recyclability. It may be the best material replacement for plastics when it comes to beverage packaging, according to experts from various producers. Moreover, some of the world’s biggest beverage brands have recently announced they will address the plastic waste challenge by introducing new aluminum packaging for water.

Coca-Cola Company has started filling its Dasani bottled water in aluminum cans, followed by rival PepsiCo’s announcement that it would do the same with its own water brand, Aquafina, at restaurants and stadiums. The largest bottled water company, Nestle, announced it would make its S.Pellegrino flavored water and Perrier juice available in aluminum cans.

Italy’s San Benedetto also launched small aluminum cans in December 2018. “We’re planning a significant growth in the next few years … first market acceptance figures seem to be quite positive,” a San Benedetto official told Reuters.

French group Danone has become the latest company to make a move in 2019. The company is starting with replacing some plastic bottles with aluminum cans for its Flyte water brand in the U.K., Poland, and Denmark.

In the U.S., where the average consumer drinks some 40 gallons of bottled water a year, sales have actually overtaken those of sodas. Reacting to this growing trend, the San Francisco airport, which plans to be zero-waste by 2021, put a ban on plastic water bottles in 2019. Now travelers must bring their own reusable bottles and refill them at a hydration station, or else buy water in an airport-approved glass bottle or aluminum can.

Increased Aluminum Demand

Measures to reduce plastic packaging by replacing it with aluminum in order to protect the environment would lead to increased demand for aluminum packaging, as the latest reports and figures from large producers of rolled aluminum products and aluminum cans suggest.

According to Ball Corp., the world’s largest can producer, about 100 billion cans are consumed each year in North America. The company is buying an increasing amount of aluminum can stock from outside the U.S. Ball told investors it planned to add 4-5 billion additional cans to its existing 105 billion annual capacity by mid-2021 (Figure 1). This does not even include a planned expansion in the water sector. The company recently launched a new impact-extruded aluminum bottle line as a cyclic solution to plastic pollution.

Alcoa is also bullish about the future of can stock. “We’ve started to see that North American can shipments are showing signs of growth,” said Tim Reyes, executive vice president and chief commercial officer, Alcoa, in an interview with Earth Protect. “There’s a lot of advantages toward using aluminum for sure, and I think that’s the trend that we’re seeing now versus the disadvantage of a single-use plastic beverage container.”

A shift of only 1% of global soft drinks, beer, and bottled water from plastic and glass to aluminum cans would mean a surge of 24 billion more cans. That 1% change would increase aluminum demand by around 310,000 tons, according to Uday Patel, an analyst at Wood Mackenzie. In parallel with the rising demand for aluminum beverage cans, bottles, and tubes, demand for aluminum slugs (out of which these products are produced) will grow, too. Global leading slug producers are already preparing for higher demand.

U.S. demand for aluminum can stock will grow by about 3-5% annually by 2025, as metal cans capture further market share against plastic, according to Harbor Intelligence. However, it should be noted that this forecast originated before the coronavirus pandemic started. The latest data show that demand for can stock may turn out even higher as a result of lockdowns. A chart of demand growth for can stock is shown in Figure 2.

The last two years have seen a significant fall in aluminum prices. With companies typically hedging the cost of metal packaging about a year in advance, 2020 and 2021 should see a 5-10% decline in can costs, compared to the previous two years. This is favorable for the penetration of aluminum into the plastics world.

Impact of Covid-19

From March through May, after the coronavirus outbreak, beer brewers worldwide shifted their priorities from kegs to cans after bars and restaurants were forced to close in order to stem the spread of the pandemic. This shift has caused a further increase in demand for aluminum cans in recent months. As a result, packaging companies are struggling to meet the rising demand and some markets are experiencing aluminum can shortages.

For U.S. rolling mills making can sheet from recycled aluminum, raw material availability was an issue up until recently, as closures of scrap yards, material recovery facilities, and state deposit programs tightened the supply of used beverage cans (UBCs). However, as states reopened, deposit programs and scrap yards resumed buying as usual and supply has returned to a more normal balance.

“The aluminum beverage can manufacturing industry has seen unprecedented demand for this environmentally friendly container prior to and especially during the Covid-19 pandemic,” said Matt Meenan, senior director of Public Affairs at the Aluminum Association. “Can sheet producers have increased shipments to market, which were up significantly in May.”

Ball Corp. has profited from this market development. Its earnings for the first quarter of 2020 were US$146 million on sales of US$1.2 billion, compared to earnings of US$118 million on sales of US$1.1 billion during the same period last year. “This is a level of growth that we haven’t seen in a long time,” said Kathleen Pitre, chief commercial and sustainability officer for Ball’s global beverage packaging business. “We’re looking at a number of speed-up projects, new can lines.”

The sharp increase in take-home beverage demand also necessitated higher U.S. imports of can sheet. The U.S. relies on a mixture of domestic and imported aluminum beverage can sheet, which is formed into cans by companies such as Ball and Crown. U.S. imports of can sheet from January through May rose by 34% from a year earlier to 88,089 tons. During March and April, imports rose by 6% and 23% y-o-y, respectively.

Potential Hurdles

The main obstacle to increased use of aluminum in the beverage industry is the much higher price of aluminum compared to plastics. According to the Aluminum Association, aluminum can scrap in 2019 was sold for US$1,317/ton on average, compared to against US$299/ton for plastic (PET) and US$20/ton for glass. However, Harbor Intelligence estimates beverage can scrap prices at nearly US$900/ton below the London Metal Exchange’s benchmark primary aluminum CMAL3 at around US$1,760/ton. According to Wood Mackenzie, aluminum for cans costs about 25-30% more compared with a PET bottle of similar volume.

Another problem is the potential supply gap in the U.S. aluminum industry. According to Wood Mackenzie, the U.S. generated 5.9 million tons of aluminum scrap in 2018, up about 20% on 2016. Of that, about 5 million tons were recycled domestically, while the rest was exported. Total aluminum consumption (primary and recycled) in the U.S. last year is estimated at around 11 million tons.

About 15% of U.S. consumption of aluminum can stock in 2019 was based on imports (the U.S. imposes a 10% levy on imports of primary aluminum, but not on scrap), compared to 10% in 2018 and 7% in 2017. The U.S. market recorded a deficit of 200,000 tons in 2019, up from a shortfall of 115,000 tons in 2018 and 80,000 tons in 2017, reported Wood Mackenzie.

It is reasonable to believe (and many industry experts would agree) that cans could well carve out a niche within the US$19 billion-a-year bottled water industry, but are unlikely to sweep the board anytime soon, if ever. A wide shift to aluminum cans would raise costs for beverage companies. This includes the need to implement new manufacturing infrastructure. “The consideration for aluminum is much higher on the list than it has been for the last few years but the hardest thing to change is infrastructure,” said Simon Lowden, chief sustainability officer at PepsiCo. At least some of these increased costs are likely to be passed on to consumers, thus hitting products’ competitiveness against plastic rivals.

Another key factor is consumer convenience. While advances are being made in can technology, most cans after being opened remain open, while bottles can be recapped. Another advantage of plastic and glass bottles compared to aluminum cans and bottles is the transparency of the material—the water/liquid inside the container can be seen by the user. Moreover, plastic water bottles are sold in a range of sizes and shapes, while cans have been more limited in both so far.

Sustainability: A Growing Priority

Importance of Recycling

While bottles are among the most readily collected plastic items and can be recycled relatively easily the first time, their reprocessing actually brings few long-term environmental benefits, according to Zero Waste Europe, a European Union-supported industry consultant group. In contrast to aluminum, which can be recycled time and again without losing its properties, the recycling of plastic is more complex, leads to degradation and has lower reuse rates than aluminum. Globally, only 14% of plastic packaging produced is collected for recycling and only 5% of the material value is retained for later use, according to a report by the Ellen MacArthur Foundation.

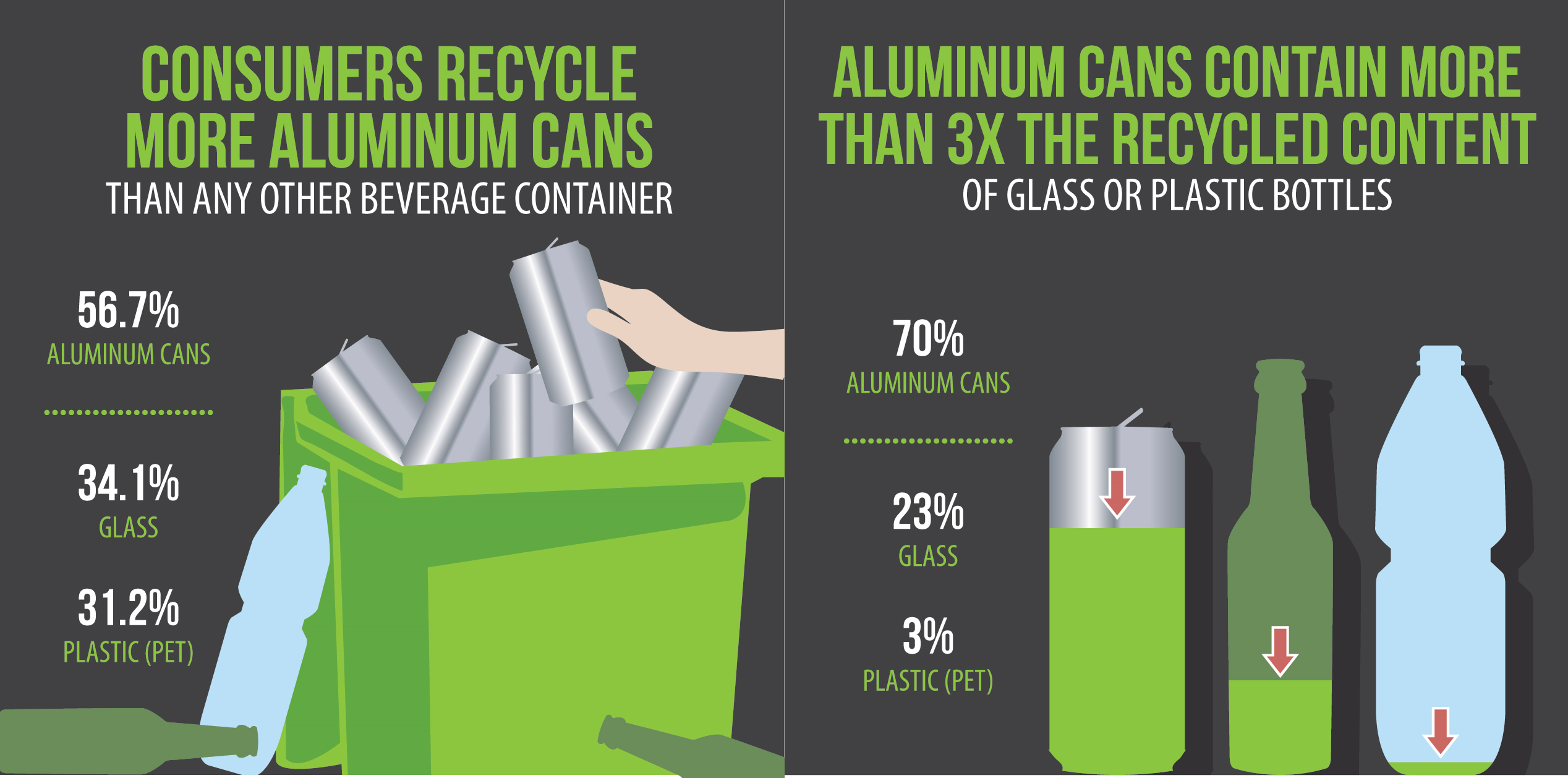

The global recycling rate of aluminum cans is much higher at 69%, according to Resource Recycling Systems. Furthermore, aluminum cans in the U.S. contain 68% recycled content compared to 3% for plastic bottles, according to the U.S. Environmental Protection Agency (EPA). The Aluminum Association also estimates that over 50% of the cans made of the light metal in the U.S. are recycled, compared with about 29% for plastic bottles (Figure 3). In the European Union the aluminum can recycling rate hit a 74.5% record in 2017 (based on the latest figures).

In accordance with the growing recycling trend, Novelis plans to invest US$36 million to boost and upgrade recycling capacity at its Greensboro facility in Georgia. The expansion will enable automotive closed-loop recycling, as well as enabling the continued recycling of UBCs for the beverage packaging industry. The project is to be completed during the second half of 2021.

JW Aluminum recently completed the expansion of its facility in Goose Creek, SC, at a cost of US$255 million. The move will support its primary markets, including packaging, building and construction, HVAC fin stock, and transportation.

Canada-based Matalco is planning a new US$80 million aluminum recycling facility in Wisconsin, which will produce aluminum billet and rolling slab for a variety of markets. The new facility is expected to be completed and commissioned in 2020.

Closed-loop recycling is gaining efficiency and popularity, both in the automotive and aluminum packaging industries. With closed-loop recycling, aluminum sheet off cuts that are produced in the stamping or forming facility are sent straight back to the supplier. The supplier recycles these into aluminum sheet of equal quality, which are then again used in production. This results in a significant cost reduction for production, as well as a reduction of CO2 emissions.

Carbon Footprint

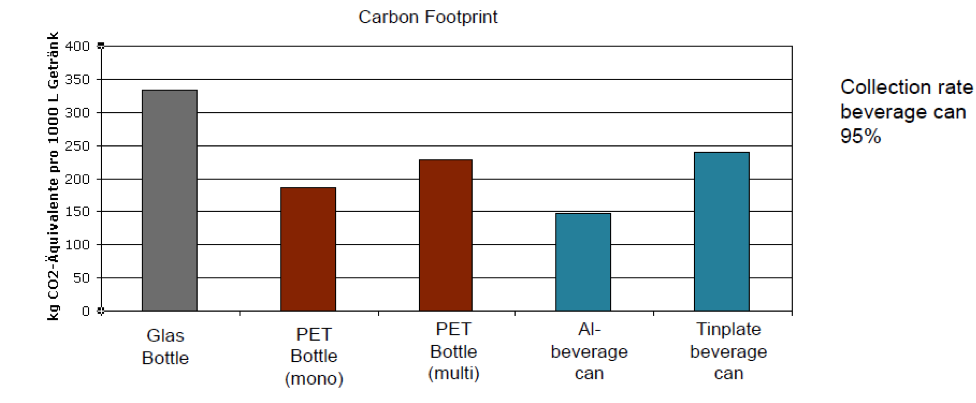

Metal Packaging Europe, a European association of packaging manufacturers, reported that data from 2016 covering the life cycle of aluminum beverage cans showed a significant reduction in CO2-equivalent emissions, compared to 2006 data. The CO2 footprint was reduced on average by 31%. The German Aluminium Association (GDA) provided data that the aluminum can had the lowest carbon footprint compared to other beer packaging materials (Figure 4).

However, calculating carbon emissions is complex and two different life cycle assessment (LCA) models could produce two very different results. “It is not an exact science and LCAs do not take into account all issues like littering and when plastics end up in the oceans. For instance, most aluminum cans are recycled in Europe, whereas most plastics are recycled in the Far East,” said Rick Hindley, executive director of Alupro. “Generalizations are not helpful. There are many different factors that need to be taken into account when looking at sustainability.”

Though aluminum has been reported as having a lower carbon footprint compared to plastics, there may be added emissions from transportation that come from sourcing recycled aluminum. Increased recycling of aluminum means more scrap, which also means more collecting and more transportation (excluding closed-loop recycling).

The share of plastics in packaging increased from 17% in 2000 to 25% in 2015, according to the Ellen MacArthur Foundation. Today, roughly 6% of global fossil fuel consumption goes into making plastics, and that is expected to increase to 20% by 2050, according to the International Energy Agency.

New Regulations Against Plastics

Governments worldwide are introducing new regulations in an attempt to reduce the use of plastics and plastic pollution. So far, 127 countries have placed limits on plastic bags, while the European Union has voted to ban ten single-use plastic items by 2021, including straws, forks, and knives. It has also set stringent recycling quotas for plastic packaging by 2030.

The U.K. government has made tackling plastic pollution a key part of its 25 year environment plan, which aims to eradicate “avoidable” plastic waste by 2042. The Resources and Waste Strategy aims to make packaging producers bear the full cost of recycling their products. It also plans to implement a deposit return scheme for disposable drink containers and to introduce a tax on plastic packaging that uses less than 30% recycled content. Several U.K. supermarkets, including Morrison’s, Tesco, and Sainsbury’s, have switched from single-use plastic bags to single-use paper bags for loose produce and bakery items.

Also, the U.K. alcoholic beverage company Diageo Plc said it has created a plastic-free, paper-based spirits bottle, made entirely from sustainably sourced wood. The company will debut the new bottle with Johnnie Walker Scotch whisky in early 2021. The move is part of the company’s efforts to reduce plastic waste and minimize the environmental footprint of packaging.

Although this may seem like a step forward in reducing plastic waste, paper can have a much higher carbon footprint. A Danish study found that a paper bag has to be reused 43 times to have a lower environmental impact than the average plastic bag. Another report from Green Alliance also warned of the dangers of single-use alternatives to plastic, pointing out that all materials have environmental impacts—glass, for example, produces considerably higher carbon emissions than plastic or aluminum.

Conclusion

The process of substituting plastics with aluminum in cans, bottles, and other packaging will be a slow and long term process. But aluminum demand in this segment will grow, most probably at higher rates in the future than in the past. It will happen above all, because in the huge beverage and packaging market, even small changes (switches) will result in significantly higher demand—in this case for aluminum. The growing pressure to ban plastics and to switch to an alternative, as well as relatively cheap aluminum scrap prices and efficient closed-loop recycling schemes, are all in favor of securing higher use of aluminum in this sector.

On the other hand, despite the increasing scientific understanding of the irreversible damage plastics can cause to the environment and communities, the fossil fuel industry intends to increase production of plastics by an additional 40% over the next decade. Plastics could account for 20% of the total global oil consumption, according to a 2019 report from Greenpeace. This additionally emphasizes the important role aluminum must take in replacing plastic products in the future. Aluminum could open up a new era for the beverage and packaging industry.

Editor’s Note: This article first appeared in the October 2020 issue of Light Metal Age. To receive the current issue, please subscribe.

Goran Djukanovic is an aluminum market analyst and industry consultant based in Podgorica, Montenegro. He has published articles in a number of publications and presents at industry events around the world. Email: gordju@t-com.me

Goran Djukanovic is an aluminum market analyst and industry consultant based in Podgorica, Montenegro. He has published articles in a number of publications and presents at industry events around the world. Email: gordju@t-com.me