By Alton Tabereaux, Contributing Editor.

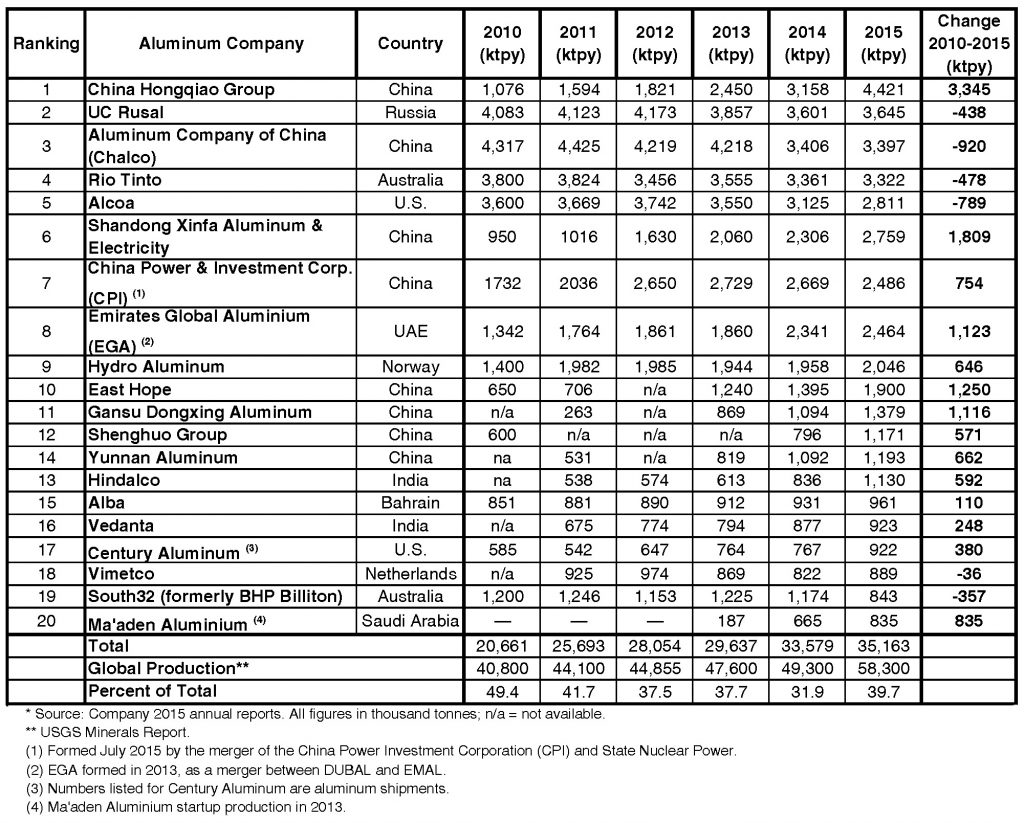

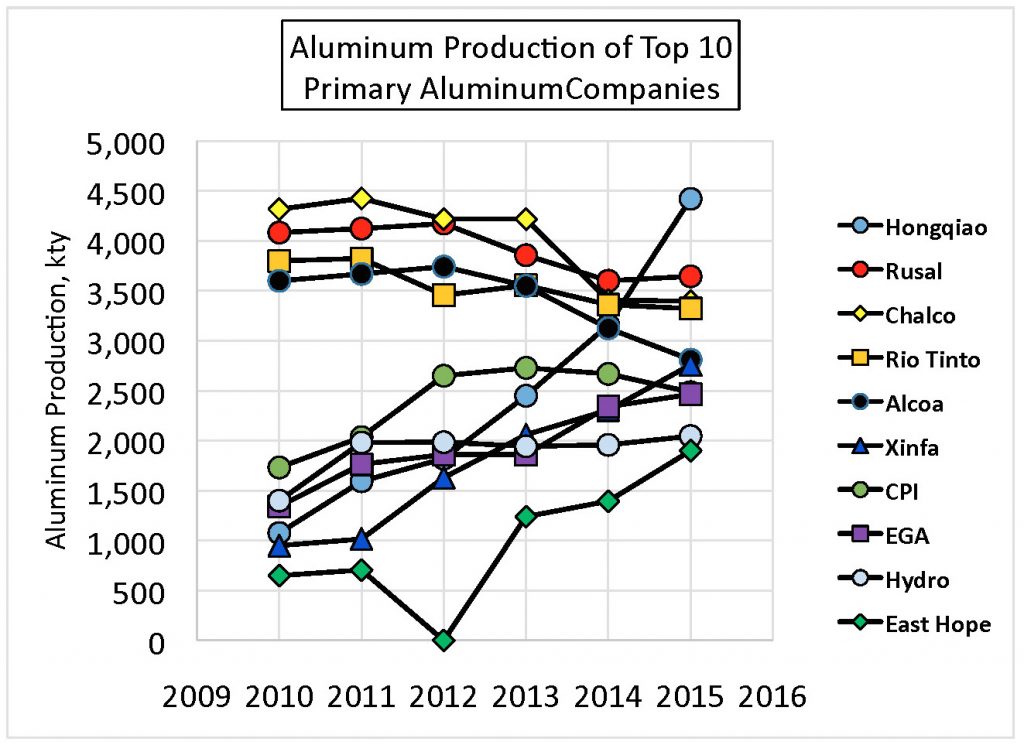

A conspicuous transformation occurred in the world’s primary aluminum industry during the past five years with the construction of “Mega” aluminum smelters (>1 million tpy) in China, which have boosted aluminum production to levels not previously experienced by companies. Nine aluminum companies had an annual production greater than 2 million tpy in 2015, compared with only four companies in 2010. Eight of the top aluminum companies are located in China and they represent 32.1% of total world production of primary aluminum.

Production by Company

The top five primary aluminum companies in the world during the years 2010-2015 were China Hongqiao, UC Rusal, Aluminium Company of China (Chalco), Rio Tinto, and Alcoa. Hongqiao had an astonishing 3 million tpy increase in primary aluminum production, up from 1 million tpy in 2010 to 4.4 million tpy in 2015. Meanwhile, aluminum production decreased about 400,000-600,000 tpy at Rusal, Chalco, Rio Tinto, and Alcoa over the same period.

With Honqiao’s dramatic increase in production, the company surpassed Rusal in 2015 as the world’s largest primary aluminum company. The company had a 40% increase in production of primary aluminum from 2014 to 2015. Hongqiao, also known in the industry as Shandong Weiqiao Aluminum & Electricity, is based in Binzhou, Shandong Province. The first complete 600 kA potline in the world was put into operation at the Shandong Weiqiao smelter in 2014. The 600 kA potline has 186 NEUI designed prebake cells with a design capacity of 300,000 tpy. The successful completion of this smelter represents an important international breakthrough in aluminum smelting technology.

Hongqiao announced plans in March 2016 to increase its annual capacity by 15% in 2016, if the market recovery continues in spite of a global surplus of aluminum inventory. Expansion is possible at Hongqiao due to its unique position as one of the world’s lowest-cost aluminum producers. The private aluminum company benefits from much lower costs than its rivals because it has its own power plants and in-house upstream bauxite, alumina, and carbon production facilities. The company proposes an increase to about 6 million tpy of annual aluminum capacity by the 2016 year-end from 5.2 million tpy in 2015.

A significant increase in aluminum production (2.5 million tpy) occurred in the Middle East Gulf states with the merger of Dubal (1.2 million tpy) and Emal (1.3 million tpy) into a single company, Emirates Global Aluminum (EGA) in the UAE and with the increase in production due to the startup of Ma’aden Aluminium smelter (740,000 tpy) in Saudi Arabia. Aluminum production increased twofold over the past five years at Hindalco (1.13 million tpy) and Vedanta (0.9 million tpy) in India.

Decreases in annual aluminum production continued for Alcoa (-10%) and BHP Billiton (-28%), due primarily to the closure of older smelters that have higher operating costs. On May 25, 2016, BHP demerged all its aluminum assets (Mozel and Hillside smelters, and Worsley Alumina) into a new company, South32.

Aluminum production increased twofold at the CPI (2.8 million mty), Xinfa (>2.5 million tpy), EGA (2.5 million tpy), and East Hope (1.9 million tpy) aluminum companies over the five year period; aluminum production increased over 1 million tpy at the Gansu Dongxing, Shenghou, Hindalco, and Yunnan aluminum companies.

Editor’s Note: Part I of this review can be viewed here.

Dr. Alton Tabereaux is a technical consultant in resolving issues and improving productivity at aluminum smelters since 2007. He worked for 33 years as a manager of research and process technology for both Reynolds and Alcoa Primary Metals. He was recipient of JOM Best Technical Paper Award in 1994 and 2000, editor of Light Metals in 2004, and received the TMS Light Metals Distinguished Service Award in 2007. He has been a lecturer at the annual International Course on Process Metallurgy of Aluminium held in Trondheim, Norway, and an instructor at the annual TMS Industrial Aluminum Electrolysis Courses. He has published over 65 technical papers and obtained 17 U.S. patents in advances in the aluminium electrolysis process. He participated as a consultant in an EPA sponsored “Asian-Pacific Partnership” program to minimize perfluorocarbon (PFC) emissions generated during anode effects in the electrolytic cells at aluminum smelters in China.

Dr. Alton Tabereaux is a technical consultant in resolving issues and improving productivity at aluminum smelters since 2007. He worked for 33 years as a manager of research and process technology for both Reynolds and Alcoa Primary Metals. He was recipient of JOM Best Technical Paper Award in 1994 and 2000, editor of Light Metals in 2004, and received the TMS Light Metals Distinguished Service Award in 2007. He has been a lecturer at the annual International Course on Process Metallurgy of Aluminium held in Trondheim, Norway, and an instructor at the annual TMS Industrial Aluminum Electrolysis Courses. He has published over 65 technical papers and obtained 17 U.S. patents in advances in the aluminium electrolysis process. He participated as a consultant in an EPA sponsored “Asian-Pacific Partnership” program to minimize perfluorocarbon (PFC) emissions generated during anode effects in the electrolytic cells at aluminum smelters in China.