By Alton Tabereaux, Contributing Editor.

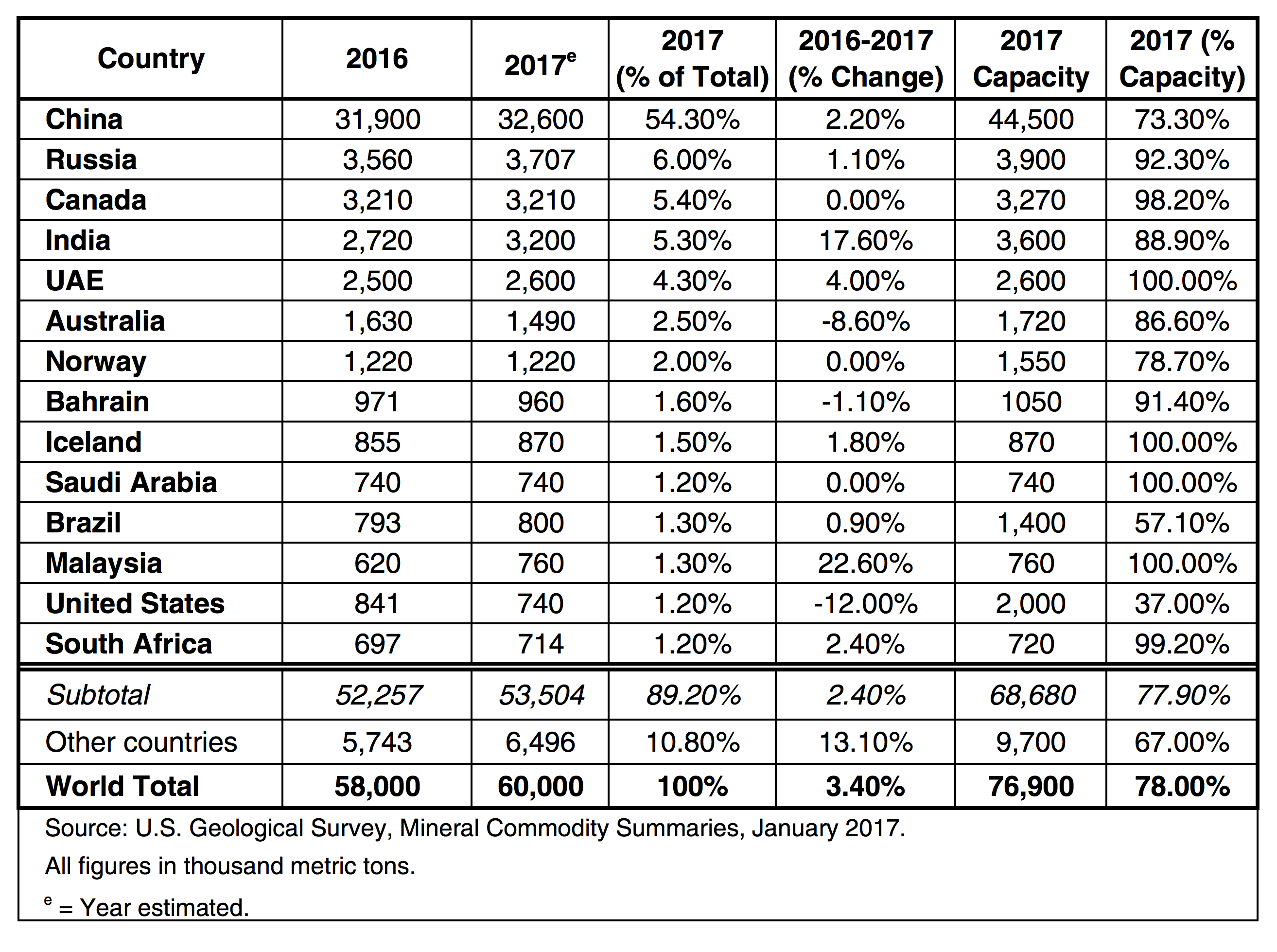

Production by Country

As prices generally increased throughout 2017, world primary aluminum production increased 3.4% compared with the previous year (Table I). China is the world’s largest producer of electrolytic aluminum, making up over half of the global output. The terminal consumption of electrolytic aluminum in China is mainly concentrated in three areas: building and construction, electronic power, and transportation. Other important sectors in the downstream include machinery manufacturing and packaging materials.

In 2017, Global primary aluminum production increased to 60.0 million tonnes and China represented 54.3% of the worldwide aluminum production. The increase in aluminum production in China was only 2.2% in 2017 following the directions given by the Chinese government for cutbacks due to illegal capacity and removing old, idled, and uncompetitive capacity. During the same period, the output of electrolytic aluminum declined in some other regions of the world.

Outside China, the strongest production growth has been among the aluminum companies active in India, particularly Vedanta Aluminum. India was the 4th largest aluminum producer in the word during 2017 with a production of 3.2 million tonnes of primary aluminum. This represented a 17.6% increase over the previous year due to the startup of Vedanta’s 1.25 million tpy greenfield Jharsuguda-II smelter in the state of Odisha and the restart of pots taken out of production due to a power failure in 2016, as well as pots taken out of production due to a failure incident at Balco’s Kora smelter in the state of Chhattisgarh.

With the completion of the 320 million tpy Phase 3 aluminum smelter at Samalaju Industrial Park in Malaysia, Press Metal’s Samalaju aluminum smelters reached their full production capacity of 760 million tpa in 2017, which denotes a 22.6% increase over the previous year. Press Metal restarted the pots taken out of production due to fire incident at its smelters located at Samalaju, Bintulu, and Sarawak.

Australia experienced an 8.6% decrease in aluminum production in 2017 due largely to the shutdown of cells in potlines because of a lengthy electrical power outage at the Alcoa Portland Aluminum smelter located in Victoria. Prior to the electrical fault, the smelter had been operating at nearly 85% of its nameplate capacity of 358,000 tpy. In addition, record high power prices resulted in a 14% curtailment of production at Pacific Aluminum’s Boyne Island smelter and temporary diversion of electricity at its Tomago smelter. Other Australian aluminum smelters that have closed in recent years due to high electrical rates include the 180,000 tpy Kurri Kurri smelter in 2012 and 185,000 tpy Alcoa Point Henry smelter in 2014.

U.S. Developments

On April 27, 2017, President Trump signed a memorandum instructing the U.S. Secretary of Commerce, Wilbur Ross, to conduct an investigation on the impact of aluminum imports on U.S. national security under the authority of Section 232 of the Trade Expansion Act of 1962. If the investigation found that aluminum is being imported in quantities or under circumstances which threaten to impair the national security, the Secretary of Commerce was to submit a report to the President recommending actions and steps that could to be taken to adjust aluminum imports so that they will not threaten to impair national security. On March 8, 2018, President Trump signed two proclamations, one covering steel and one covering aluminum, imposing tariffs of 25% on imported steel articles and 10% on imported aluminum articles, which became effective March 23, 2018.

In 2017, the import value of aluminum and its products to the U.S. from China was about US$3.7 billion, accounting for nearly 30% of the total imports. Accordingly, the move in the U.S. to implement tariffs is expected to have a detrimental effect on China’s export of aluminum products to the U.S. in 2018.

U.S. production of primary aluminum has decreased for the fifth consecutive year, declining by about 12% from that in 2016 and 64% from that in 2012. This was the lowest level since 1951 when production was 759,000 tons. In 2017, U.S. domestic smelters operated at about 37% of capacity of 2 million tonnes per year.

In July 2017, the Alcoa announced that the company would revise the situation at Warwick 269,000 tpy aluminum smelter in Evansville, Indiana (Figure 1), which had been permanently shut down in 2016. The company stated that three potlines with a total of 160,000 tons of capacity per year would be restarted in 2nd quarter of 2018 to supply the adjacent Warrick rolling mill.

Following the implementation of tariffs in March, Century aluminum announced that it would be able to add 300 jobs and invest over $100 million to restart production and upgrade technology at the Hawesville, Kentucky smelter. In addition, Magnitude 7 Metals announced plans to reopen the former Noranda aluminum smelter in Marston, MO, with the aim of bringing two of the three production lines back into service over two years, beginning in 2018. The Magnitude 7 Metals smelter can support a production capacity of up to 263,000 tonnes of aluminum per year.

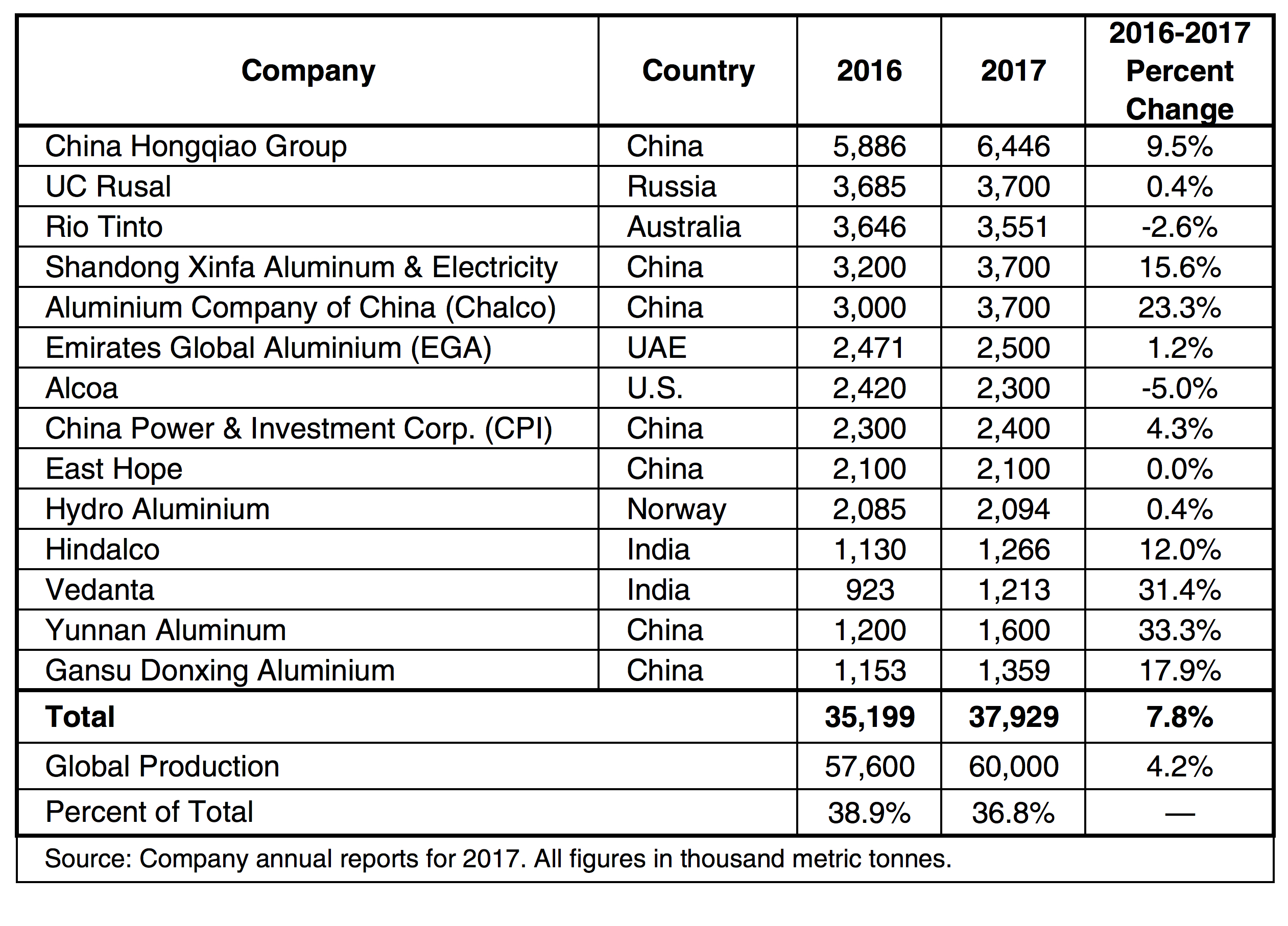

Production by Company

The China Hongqiao Group is the largest primary aluminum company in the world with an annual production of 6.5 million tons in 2017 (Table II), representing a 9.5% increase from the previous year. During 2017, the company shut down several aluminum projects with a total annual production capacity of 2.68 million tons to comply with relevant government policies and strategies for the national supply-side reform of aluminum industry.

The other large aluminum companies in China also reported increases in aluminum production in 2017, even with the shutting down of a limited amount of production as ordered by the government. They include: Shandong Xinfa (15.6%), Chinalco (23.3%), CPI (4.3%), East Hope (0%), Yunnan (33.3%), and Gansu Dongxiang (17.9%).

Decreases in aluminum production were reported by Alcoa (-5.0%) and Rio Tinto (-2.6%).

Dr. Alton Tabereaux is a technical consultant in resolving issues and improving productivity at aluminum smelters since 2007. He worked for 33 years as a manager of research and process technology for both Reynolds and Alcoa Primary Metals. He was recipient of JOM Best Technical Paper Award in 1994 and 2000, editor of Light Metals in 2004, and received the TMS Light Metals Distinguished Service Award in 2007. He has been a lecturer at the annual International Course on Process Metallurgy of Aluminium held in Trondheim, Norway, and an instructor at the annual TMS Industrial Aluminum Electrolysis Courses. He has published over 65 technical papers and obtained 17 U.S. patents in advances in the aluminium electrolysis process. He participated as a consultant in an EPA sponsored “Asian-Pacific Partnership” program to minimize perfluorocarbon (PFC) emissions generated during anode effects in the electrolytic cells at aluminum smelters in China.

Editor’s Note: This article was reprinted in the August 2018 issue of Light Metal Age. To receive the current issue, please subscribe.