By Alton Tabereaux, Contributing Editor.

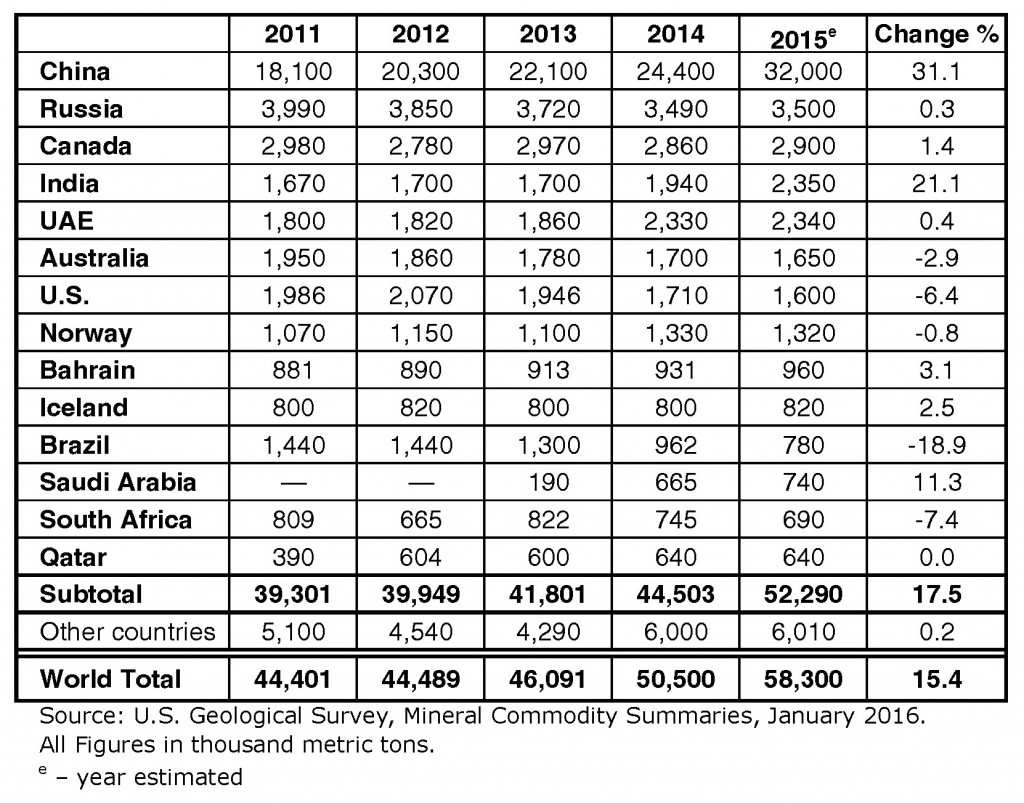

The largest gain in primary aluminum production during 2015 was in China at 31.1%, followed by India (21.1%) and Saudi Arabia (11.3%). This was due to startup of new low cost smelters and/or the restart of potlines. China accounted for a staggering 54.9% of the total world aluminum production in 2015 largely in Xinjiang Province. India started up an additional 325,000 tpy of production at the BALCO Korba smelter (325,000 tpy) and construction of a 1.1 mtpa aluminum smelter expansion at the Vedanta Jharsaguda aluminum smelters.

The largest decrease in aluminum production occurred in Brazil (-18.9%), South Africa (-7.4%), U.S. (-6.4%), and Australia (-2.9%) due to permanent closure of smelters and/or curtailments in aluminum production.

High Cost Smelters

The regions with the highest cost smelters along with the most permanent shutdown capacity are Australia, Brazil, China, and South Eastern Europe and the U.S. The majority of the world’s highest-cost smelters are located in China with the average production costs in 2015 being 14% above the average cost for the rest of the world. However, in China, employment rather than profit is frequently the main decision factor for companies and local governments that elect to continue operating smelters despite losses.

Low Cost Smelters

Ma’aden Aluminium, the joint venture between Saudi Arabian Mining Company (Ma’aden) and Alcoa, located in Ras Al-Khair on the Gulf coast of Saudi Arabia, is the lowest cost and largest greenfield aluminum smelter in the world. This is according to Alcoa, which holds a 25% stake, and is based on the smelter’s own low cost alumina, electricity, and anode production. The smelter has two potlines with a total of 720 smelting pots, featuring AP37 technology with a combined capacity of 740,000 tonnes of aluminum per year. The Ma’aden Aluminum smelter started commercial production of aluminum in 2014 and reached full production capacity in 2015.

In British Columbia, Canada the US$4.8-billion modernized Rio Tinto Kitimat smelter reopened in 2015 and reached full production of 420,000 tpy in 2016, increasing its aluminum production by 40%. Kitimat’s new potlines consist of 384 electrolysis pots with the latest AP40 technology operating at 405 kA and 13,150 kWh/t Al. Kitimat is reported to be one of the most efficient and lowest cost aluminum smelters in the world with operating costs in the first decile of the industry costs curve reportedly due to having the lowest power tariff in the world (below US$ 6/MWh).

New “Mega” Chinese smelters (>1 million tpy of aluminum) located in the Northwestern Xinjiang Province have joined the elite group of lower cost smelters due to their low electricity costs from low coal prices and new low cost smelting technology (consuming less than 13,000 KWh/t Al). Smelters in Xinjiang Province are able to expand their primary aluminum capacity because they are low-cost producers compared with other regions in China, benefiting from low power costs and solitary power grid (a grid that operates independently to the state grid). For example, the Qiya, East Hope, and Shenhuo aluminum smelters are significantly more self-sufficient in power supply and have the geological advantage of being very close to coal resources in Zhundong. Estimates indicate that up to 2 trillion tonnes of coal reserves, around 40% of all of China’s coal reserves, are in four large coal basins located in Xinjiang Province with an annual production of 50 million tons.

Interestingly, Xinjiang Joinworld is able to profitably produce very high purity aluminum (99.99% Al), utilizing “Hoopes” three-layer electrical refining cells (first developed by Alcoa). The process is expensive, as the company must first produce regular grade aluminum (99.5%) and then pour this into the refining cells, which necessitates additional electricity. This high purity aluminum metal is required in electronic components (capacitors, etc). The company currently has 25,000 tpy high-purity aluminum capacity and plans to add 10,000 tpy capacity in the near future. China is now the world largest producer of high purity aluminum due to plentiful cheap electricity in Xinjiang providence, where the JoinWorld plant is located. Russia and Norway also produce high purity aluminum.

Edited on June 13: China’s percentage of world primary aluminum production was updated to 54.9%, from the previously reported 55.5%.

Editor’s Note: Part II of this review can be viewed here.

Dr. Alton Tabereaux is a technical consultant in resolving issues and improving productivity at aluminum smelters since 2007. He worked for 33 years as a manager of research and process technology for both Reynolds and Alcoa Primary Metals. He was recipient of JOM Best Technical Paper Award in 1994 and 2000, editor of Light Metals in 2004, and received the TMS Light Metals Distinguished Service Award in 2007. He has been a lecturer at the annual International Course on Process Metallurgy of Aluminium held in Trondheim, Norway, and an instructor at the annual TMS Industrial Aluminum Electrolysis Courses. He has published over 65 technical papers and obtained 17 U.S. patents in advances in the aluminium electrolysis process. He participated as a consultant in an EPA sponsored “Asian-Pacific Partnership” program to minimize perfluorocarbon (PFC) emissions generated during anode effects in the electrolytic cells at aluminum smelters in China.

Dr. Alton Tabereaux is a technical consultant in resolving issues and improving productivity at aluminum smelters since 2007. He worked for 33 years as a manager of research and process technology for both Reynolds and Alcoa Primary Metals. He was recipient of JOM Best Technical Paper Award in 1994 and 2000, editor of Light Metals in 2004, and received the TMS Light Metals Distinguished Service Award in 2007. He has been a lecturer at the annual International Course on Process Metallurgy of Aluminium held in Trondheim, Norway, and an instructor at the annual TMS Industrial Aluminum Electrolysis Courses. He has published over 65 technical papers and obtained 17 U.S. patents in advances in the aluminium electrolysis process. He participated as a consultant in an EPA sponsored “Asian-Pacific Partnership” program to minimize perfluorocarbon (PFC) emissions generated during anode effects in the electrolytic cells at aluminum smelters in China.