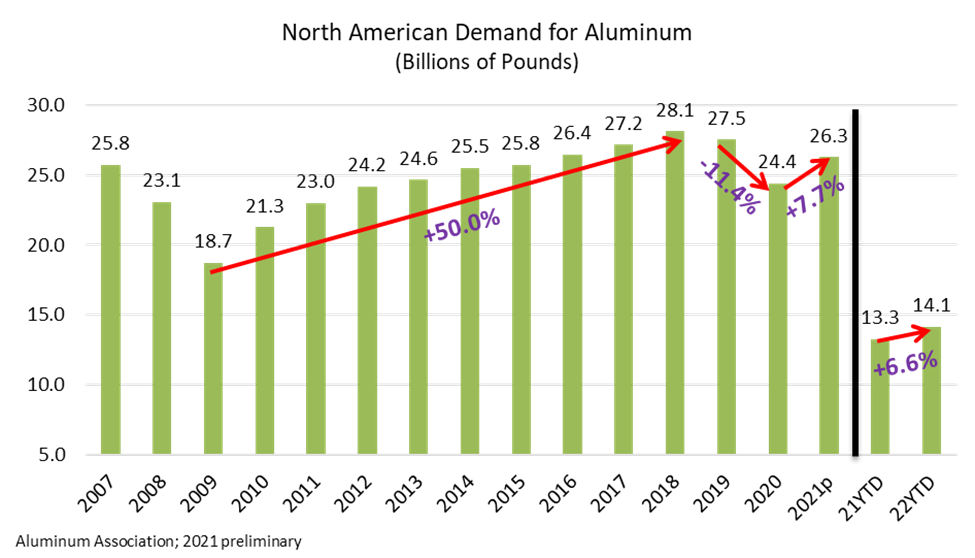

As part of its monthly Aluminum Situation report, the Aluminum Association released preliminary estimates showing 6.6% year-to-date demand growth for the aluminum industry in North America (U.S. and Canada) through the first half of 2022. This is a nearly 8% year-over-year increase over 2021 estimates.

Since 2021, Aluminum Association member companies have announced more than $3.7 billion in domestic manufacturing operations — including new, U.S.-based greenfield facilities for the first time in decades. Other firms have announced additional aluminum investments in the U.S. in recent months totaling more than $4 billion.

“We are seeing strong demand and truly unprecedented levels of investment in the U.S. aluminum industry today,” said Charles Johnson, president and CEO of the Aluminum Association. “America is one of the best places in the world to make aluminum and our industry is putting its money where its mouth is to ensure a strong, vibrant domestic industry for years to come.”

Increased Demand

According to the Aluminum Situation report, aluminum demand in the U.S. and Canada (shipments by domestic producers plus imports) totaled an estimated 14.1 billion lbs through June, advancing 6.6% over the same period in 2021. Nearly all major semi-fabricated product categories (including sheet, extrusion, and other forms) saw increased year-over-year demand growth in the first half of the year, led by sheet and plate products (12.5%) and electrical wire and cable (9.2%). In total, semi-fabricated product demand in the U.S. and Canada grew 9.1% year-over-year through June 2022.

Focusing on the demand for sheet and plate products (based on the association’s quarterly “Sheet & Plate End Use Report”), it can be seen that growth in the containers and packaging segment has helped drive some of the increase in overall aluminum demand. Domestic producer shipments in this segment were up 13.1% year-to-date through June 2022 as companies and consumers increasingly look to aluminum for sustainable packaging solutions. Aluminum cans are the most sustainable beverage package on virtually every measure. They have a higher recycling rate and contain dramatically more recycled content than competing packaging types.

Exports and Imports

The report also noted that aluminum exports (excluding scrap) to foreign countries declined 18% from the year-ago level. Meanwhile, imported aluminum and aluminum products into North America have grown 35.7% year-to-date through the second quarter, reaching 4.7 billion lbs. While growing, the year-to-date import levels remain below the level of imports seen over the same period as recently as 2019.

Association Reports

The Aluminum Situation report is one of more than two-dozen ongoing industry statistical reports, covering every segment of the aluminum market, from orders to shipments to capacity. These reports are developed exclusively by the Aluminum Association through surveys of aluminum producers, fabricators, and recyclers. The reports are presented in an online portal (open to subscribers) with data users can manipulate directly to produce interactive, presentation-ready charts and graphs.