By Geoff Scamans, Innoval Technology and Brunel University.

The majority of the U.K.’s greenhouse gas emissions now come from transport, a sector whose emissions rose by 2% according to the recently released 2016 figures from the U.K. Department for Business, Energy and Industrial Strategy (BEIS). Transport accounts for 26% of the U.K.’s greenhouse gas emissions, compared to 25% coming from energy supply. The main sources were petrol and diesel cars and a similar pattern is being experienced worldwide.

Faced with these issues the U.K. and several other countries (among them Norway, the Netherlands, Austria, and France) have proposed making new internal combustion engine vehicles illegal within one or two decades. As an alternative to the internal combustion engine, electrification is the most mature and cost-efficient solution for decarbonizing car traffic and simultaneously putting an end to air pollution emissions, although this has to depend on the simultaneous decarbonization of electricity supply. The European Union (EU) 2050 CO2 emission reduction target will require most of their car fleet to become fossil-fuel free. This means that at least 80% of the European fleet in 2050 must be partially or fully electrified. To achieve this, electric vehicles would have to make up around 50% of new sales by 2030.

EVs to Propel Aluminum Growth

Moving to electric vehicles is no longer just an option, it’s a must. China, most of Europe, and the U.S. have already taken the positive decision for electro-mobility with state supported R&D programs, charging infrastructure, and buyer incentives. The U.K. has made a major investment in battery development, but not as much in the supply chain for lightweight battery enclosures or the essential materials for lightweight electric vehicle production.

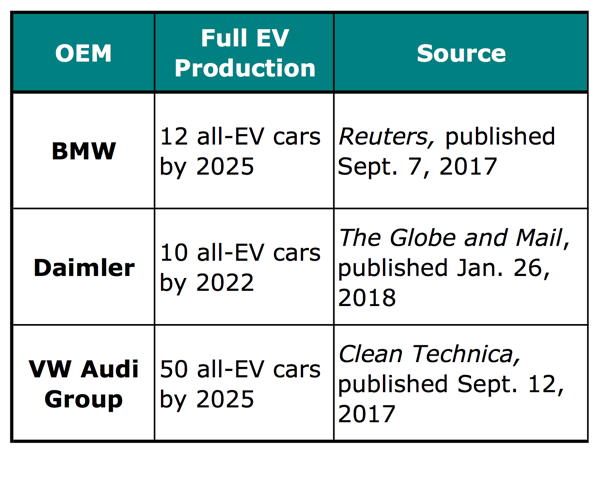

There is a direct relationship between vehicle curb weight and the energy requirement in Wh/kg for electric vehicle driving range. This provides a compelling case for vehicle weight reduction to make electric vehicles both more affordable and compatible with range requirements as less energy means a lower investment in the expensive battery pack. The larger electric vehicles, as exemplified by the Tesla S and Model 3, both have batteries with a capacity of 100 kWh to provide maximum range. Significantly, the electrification programs of major vehicle manufacturers (Table I) have an increased dependence on automotive aluminum extrusions, particularly for lightweight battery enclosure manufacture. The key technical challenge is to be able to supply components for these enclosure structures in a short timeframe from the shortest possible supply chain, which ideally should be sited close to the electric vehicle and battery pack manufacturers and be formulated from the highest possible fraction of end-of-life recycled aluminum.

Earlier this year Bloomberg revised their estimate for the annual sale of electric vehicles to suggest that by 2040 the sales volume could be as high as 65 million electric cars per year. Figure 1 shows the increased tonnage requirement for aluminum extrusions based on the Bloomberg estimates compared to information from the most recent EAA supported Ducker report for conventional vehicles for applications of aluminum extrusions in crash management systems, chassis, and body structures in North America and the EU. The Bloomberg estimate for the aluminum extrusion tonnage was obtained by multiplying the number of projected electric vehicles by 80 kg of extrusions per vehicle. Determined in this way, the projection shows a much higher requirement compared to the Ducker projection figures, which did not include the additional tonnages required for battery enclosures.

By 2040, the aluminum extrusion tonnage required for electric vehicles could exceed 3 million tonnes, if the requirement for the Chinese market is included. For the U.K. alone, based on a forecast of 2.2 million vehicles by 2035 of which 50% are battery electric vehicles (BEVs) and 50% plug-in hybrid electric vehicles (PHEVs), this will require 88,000 tonnes of extrusions with an associated battery enclosure market estimated to be on the order of £870 million. Since there is no capacity in the U.K. that can supply this level of tonnage, the extruded profiles will have to be imported either from the EU or China.

The combined requirement for aluminum automotive body sheet and extrusions for electric vehicles has also recently been estimated by CRU. They are predicting that the total world demand will be almost 10 million tonnes by 2030. The ratio of this demand between sheet and extrusions is likely to be 80/20, which is an extrusion demand of 2 million tonnes. Predictions of this scale of demand are relatively new and have not been realized from assessments based on the analysis of the present vehicle populations. The future requirements for aluminum due to the increasing production of electric vehicles are now much higher than before and also there is a much higher relative demand for aluminum extrusions, which conventionally sits at 10-11% of the automotive body sheet volume. It is clear that a large number of new extrusion presses will have to be installed worldwide to meet this rising demand, particularly if it is largely based on the supply of the strongest AA6xxx alloys to optimize lightweighting. An added challenge is that, in addition to further extrusion capacity, the required heat treatment and finishing capabilities will need to be installed in order to provide automotive aluminum extrusions with an equivalent quality and performance to that of automotive aluminum sheet.

Battery Enclosure Design

For battery enclosures, material selection is decided when the vehicle is at the initial design stage, as it impacts the vehicle chassis and allows for the number of cells to be calculated, therefore determining the vehicle range. Presently, aluminum alloys are more commonly being selected for battery enclosures rather than steel or carbon fiber reinforced plastic (CFRP). The composite industry is not currently mature enough to support high volume vehicles, still comes at a very high premium, and has an extremely high carbon intensity with no real recycling capability especially at end-of-life.

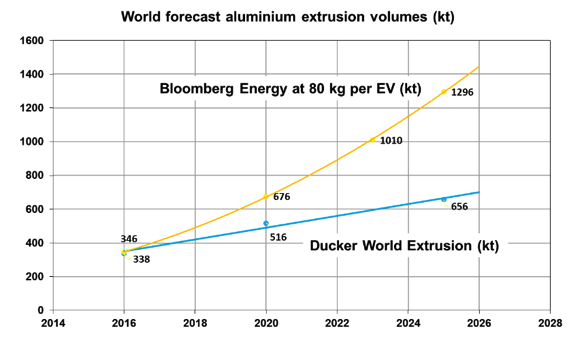

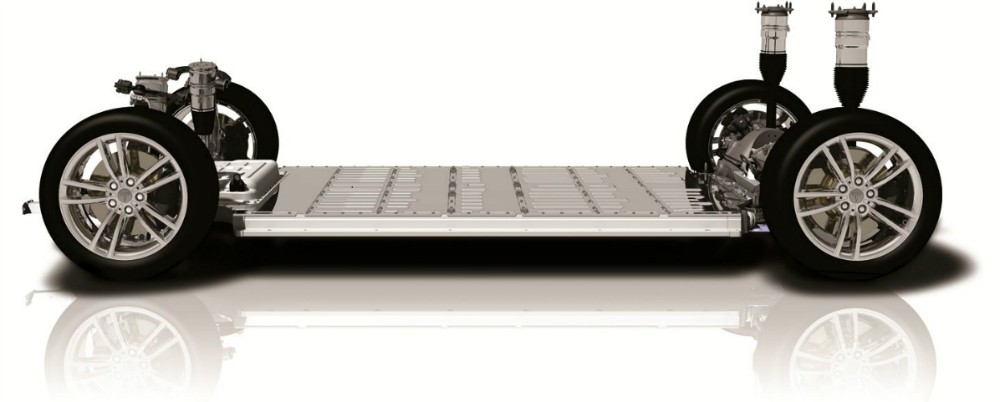

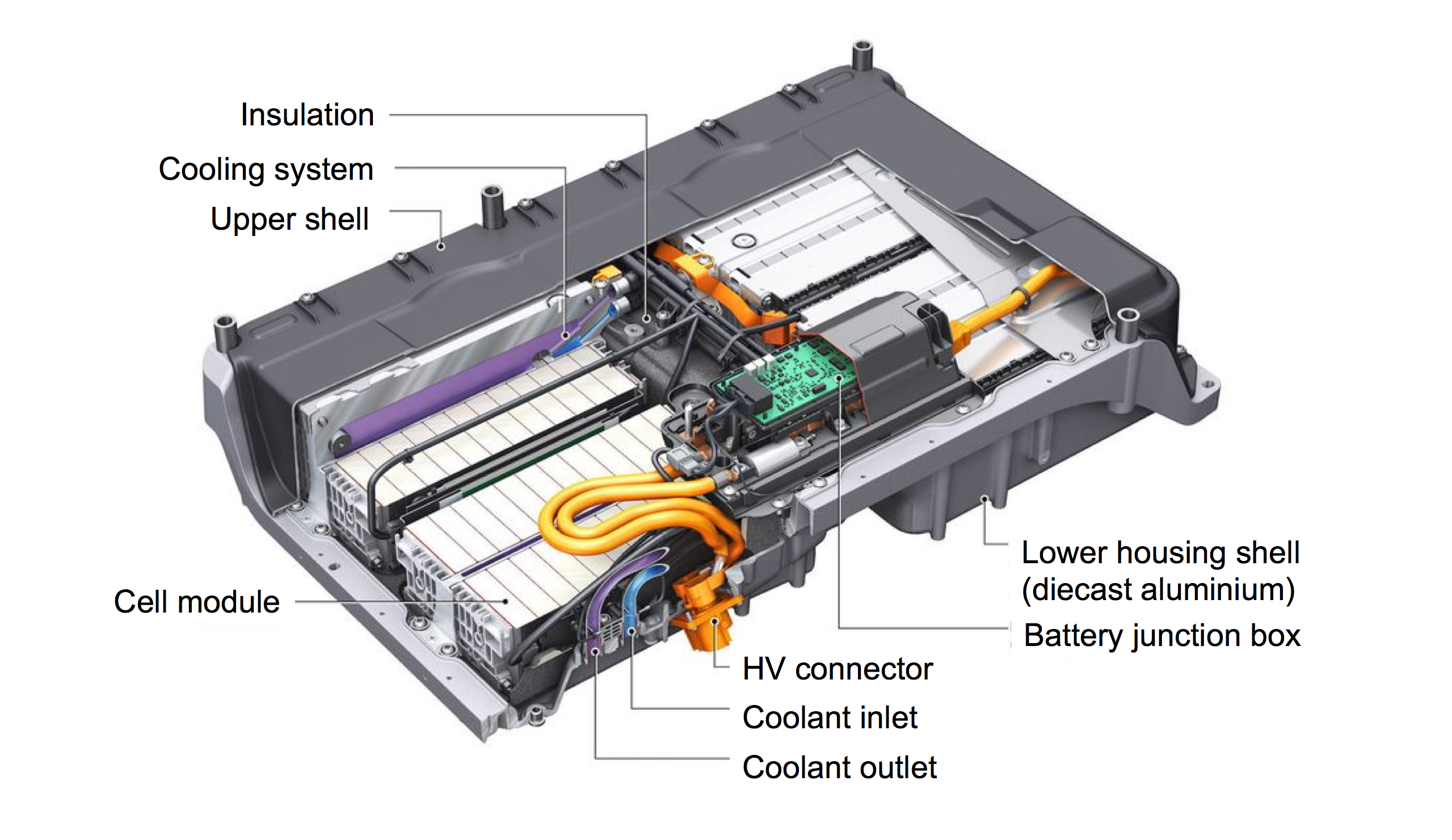

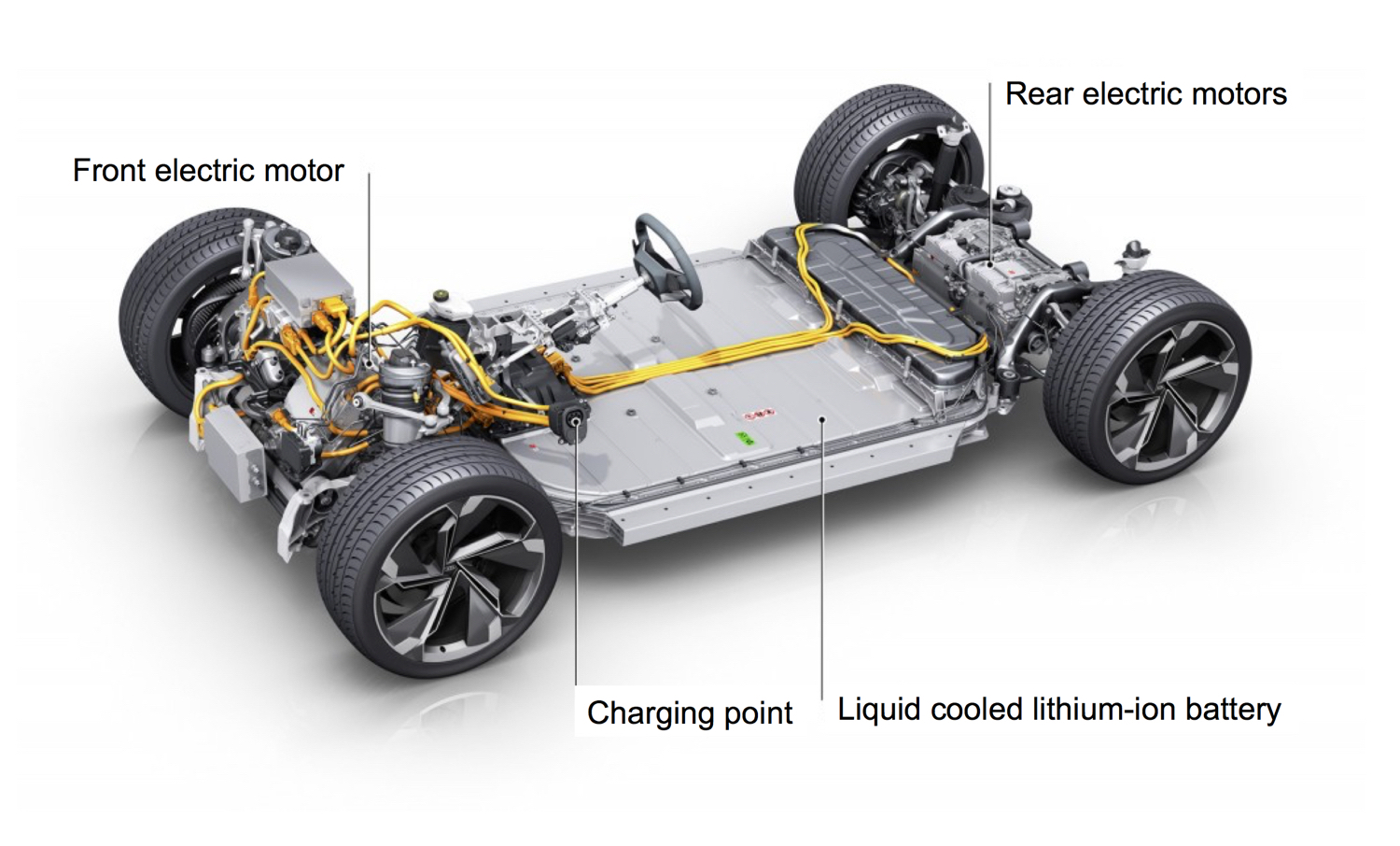

Almost all demand from the large volume OEMs is for aluminum battery enclosures. Most established OEMs—BMW, Audi, Porsche, Daimler, Volvo—and the new group of electric vehicle start-ups are approaching the design of battery enclosures based on Tesla’s aluminum extrusion intensive skateboard approach (Figure 2). The main demand for aluminum extrusion supply is coming from the German OEMs, like BMW for their i20 EVs, Audi for their e-tron electric vehicles, and Daimler for their EQ range of electric vehicles. Audi is developing a modular approach by changing their battery enclosure from an aluminum die-cast intensive design (Figure 3) to aluminum extrusion intensive (Figure 4). Daimler uses the same enclosure construction techniques for both its BEVs and PHEVs.

It is notable that several car manufacturers are moving from steel to aluminum designs. Nissan, which has used a steel battery enclosure for the Leaf EV (Figure 5), will be moving to an aluminum structure for their next BEV in 2020. Groupe PSA, after having a first generation model using steel, has announced that their 2022 electric vehicle will have an aluminum battery enclosure. VW, which has long been steel friendly due to their history, location, and industrial assets, will have an aluminum design for all of its future BEV enclosures. Even though ArcelorMittal has convinced Tesla to use high strength steel grades for the body structure of its Tesla Model 3, the company found that steel could not meet performance targets for the battery enclosure and so the model will maintain an aluminum enclosure design.

The use of CFRP and glass fiber reinforced polymer (GFRP) in battery enclosures has been developed by Kia and GM for their electric models, including the Spark, Volt, and Bolt. Most of the information available on the use of compression molded composites by GM is from the development of the battery enclosure for the Bolt, which was based on the earlier composite molded enclosure for the Spark. However, the Bolt is the first GM electric vehicle to move to a skateboard design, with the battery enclosure made from a thermoset vinyl hybrid resin with a woven glass reinforcement.

New Design Development: Constellium has developed a novel cold plate technology for the efficient cooling of battery modules. This is called a “CALD” (cold aluminum) cooling plate. The design eliminates the need for friction stir welding in producing a highly efficient aluminum cooling plate that has been tested to high pressure without any leaks and has proven to be a highly cost effective solution. The best results to date have been obtained with a hybrid system that uses both active and passive cooling, providing an effective temperature control to within ±2°C (±35.6°F), which has a direct benefit in increasing both battery module life and battery cell safety. It also obviates the need for individual cell cooling. A novel bent extrusion corner design has been developed with no chips from drilling, no space wastage, and only a small degree of deformation. There is no heat-affected zone and the design provides excellent sealing capability. The bent extrusion corner design has resulted in an improved performance in pole intrusion tests with a 15% weight reduction compared to a welded corner.

Aluminum Alloy Development

The future vehicle electrification programs of the major vehicle manufacturers will depend on the supply of high strength AA6xxx series alloys in both sheet and extruded form to optimize the weight savings that can be made in vehicle structures. The production of high strength aluminum automotive sheet alloys like AA6111 is well understood through all stages of production, including casting, homogenization, hot and cold rolling, and then solution heat treatment, quenching, pre-aging, and finishing to provide sheet that is suitable for aluminum intensive mass electric vehicle manufacture. In order to promote the rapid bake hardening of AA6xxx alloys during paint baking, a short pre-aging heat treatment is applied after solution heat treating and quenching that both stabilizes the alloys mechanical properties and accelerates the aging response. This is the basis of the standard temper (T4P) for the supply of all aluminum automotive body sheet worldwide in AlMgSiCu alloys used in vehicle applications like external body panels. The advantage of the pre-aged T4P temper is that the mechanical properties of the sheet remain relatively stable and retain their high formability even after extended storage prior to part forming. In the future a specific technical challenge could be to supply automotive aluminum extrusions with a similar pre-aged T4P temper, although this is not presently done.

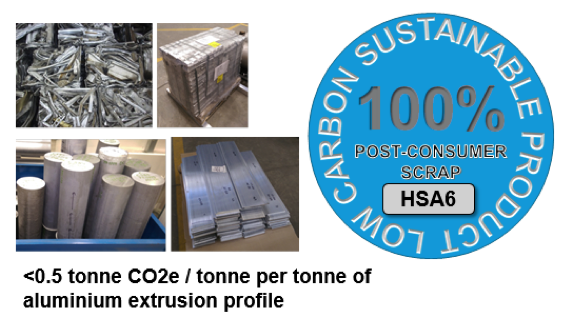

Current extruded aluminum battery enclosure designs are based predominantly on relatively low strength AA6063 extruded aluminum alloys (220 to 240 MPa proof strength), due to the required section complexity and performance characteristics. The higher strength alloys to enable weight reduction must match, as far as possible, the extrudability and section complexity of AA6063. The present generation of these HSA6 alloys is able to provide a weight saving of about 20%.

The next generation of HSA6 alloys is currently under development by Constellium, the Brunel Center for Advanced Solidification Technology (BCAST), and Innoval. The HSA6 alloy family has the ability to transform lightweight battery enclosure manufacture to meet the urgent short timescales of vehicle manufacturer’s electrification programs with lightweighting solutions.

One of the ongoing R&D programs started in 2011 by the Constellium, BCAST, and Innoval team is looking to develop high strength AA6xxx extrusion alloys with properties in excess of the AA6111 sheet alloy produced in the bake hardened or post-formed heat treated condition, which is used today in automotive structures. The project estimates that AA6xxx automotive aluminum alloys could be made stronger through a novel processing technology that enables yield strengths above 450 MPa and potentially above 500 MPa.

The result of the project has been the development of Constellium’s range of high strength HSA6 extrusion alloys. These alloys have the same advantages as the aluminum automotive body sheet alloys—provided they are cast, homogenized, solution heat treated, and quenched to avoid grain boundary precipitation during the quench process. For the first time, this has enabled the potential supply of automotive extrusion alloys with all the inherent advantages that are built into automotive body sheet supplied in the T4P temper.

The research team has worked to develop a novel and efficient means of producing these HSA6 alloys for automotive applications, initially for application in crash management systems and now for battery enclosures and associated electric vehicle structures. The present HSA6 alloy in the fully aged condition (T6) has a minimum yield stress of 370 MPa and an ultimate tensile strength minimum of 400 MPa. When compared to a standard AA6082 extrusion alloy with a yield stress of 320 MPa, the intrusion distance reduction of a rear bumper beam can be reduced by 14%, while the bumper mass is reduced by 15%. Generally, the use of stronger aluminum extrusion alloys such as these results in a weight savings of up to 30% compared to conventional extrusion alloys.

The HSA6 alloys can be produced using conventional extrusion technology, but this necessitates an expensive formal solution heat treatment step after press quenching to provide acceptable mechanical properties. However, the extrusion process for the HSA6 alloys has been developed so that all the available magnesium, copper, and silicon is taken into solid solution during the extrusion process and is then directly available for age hardening without the need for a formal solution heat treatment step after quenching. This means that the HSA6 alloys are fully cost competitive with press-quenched alloys. The technical challenge has been to industrialize this novel extrusion process at a pilot plant scale and then to transfer the technology to industrial practice worldwide. This industrialization process was achieved by trials on the full sized extrusion press at the Advanced Metal Casting Centre (AMCC) at BCAST (Figure 6). Using this process, the approach will be to replace all conventional extrusion alloys with high strength HSA6 alloys at the same manufacturability or to deliver higher productivity and/or higher performance variants of more conventional extrusion alloys.

The Constellium, BCAST, and Innoval team is also developing thermomechanical processing techniques for aluminum alloys based on technologies that were originally proposed in the 1960s that were not commercialized at that time. Dubbed STrain Enhanced Precipitation (STEP) by Constellium, the process can be applied to all aluminum age hardening alloys. This means that aluminum alloys should no longer be seen as either work hardening or age hardening, as for all aluminum alloy systems combining the two can lead to improved mechanical properties. This type of development is critical for aluminum alloys to compete with higher strength grades of steel. Use of STEP processing for HSA6 alloys has already achieved yield stresses in excess of 550 MPa with an elongation of more than 8%.

The preliminary work to optimize the STEP process will be undertaken as part of the Aluminium for Ultra-Low Emission Vehicles (AL-ULEV) project. This project successfully bid for funding from the Innovate UK IDP14 competition aimed at accelerating the transition to zero emission vehicles. The main problems to be overcome are the development of the optimal thermo-mechanical aging cycles needed to enable maximum extrudability at minimum required thicknesses and to provide the target levels of strength, dimensional tolerances, and damage tolerance along with compatibility with the multiple joining techniques under evaluation, including laser welding, adhesive bonding, electromagnetic pulse technology (EMPT) welding, and cold metal transfer (CMT) MIG welding.

The AL-ULEV project will demonstrate how aluminum extrusions can form both the protective structures and provide novel thermal management systems, which can control battery operating temperatures to precise levels to reduce the risk of thermal runaway and optimize battery pack operating temperatures during operation to reduce energy losses. The project will design and develop extruded components for prototype vehicle integration systems and for battery enclosures for Gordon Murray Design for an electric vehicle based on the aluminum intensive version of their iStream technology. The second development in the project will be for vehicle integration and battery box enclosures using the skateboard design for electric vehicles.

Sustainable Supply Chain

Extruded aluminum alloys can be seen as both an affordable and sustainable choice for selection in battery enclosures and associated vehicle structures. The competition in sustainable materials is very much between aluminum and steel and the price competition between these materials becomes much smaller when they are both made from recycled end-of-life scrap sources. It can be argued that aluminum has a clear affordability advantage over steel in its recycled form, as a lower weight of aluminum needs to be purchased.

End-of-life recycling is the main challenge for all automotive materials. Carbon fiber is still at the beginning stage of recovering and promptly manufacturing scrap, so this material has not properly entered the post-consumer scrap recycling arena. Meanwhile, the main challenge for both steel and aluminum is to manufacture high performance wrought products (sheet for steel and sheet and extrusions for aluminum) from a secondary source while achieving all the expected properties of a primary based product. In the long term, it is intended that high strength aluminum extrusion alloys of the HSA6 family will be formulated from up to 100% end-of-life scrap (Figure 7) from sources such as shredded vehicles (Zorba), construction scrap (old rolled and old extruded aluminum), and incinerator bottom ash (IBA). Such alloy formulations are already under evaluation by Innoval and BCAST as part of the Innovate UK supported project, REcycled ALuminium through Innovative Technology (REALITY). As part of the project, HSA6 alloys have already been cast and extruded at BCAST from 100% end-of-life old rolled scrap. The future supply of HSA6 alloys will directly benefit from the scrap sorting and melt treatment technology under evaluation in the REALITY project.

Aluminum extrusions used for electric vehicles should have as low an embodied carbon as possible, particularly as the electricity supplies for battery charging are progressively de-carbonized. However, most of the aluminum sheet, extruded sections, and structural castings used for automotive manufacture are presently made from primary aluminum. This aluminum has a high carbon intensity—mainly from the smelting process to make the primary product. The present world average carbon intensity for primary aluminum production is 15.8 tonnes CO2e/tonne. The EU average for primary aluminum production is 9.1 tonnes CO2e/tonne, which is considerably lower than the average for primary aluminum produced in China from coal-fired electricity generation, which is 22.4 tonnes CO2e/tonne. Importing carbon intensive primary aluminum formulated alloys from China for the manufacture of vehicles in the EU is not a sustainable option although it may be attractive from a piece cost point of view. The primary aluminum for electric vehicles should be sourced from suppliers using sustainable electricity derived from either hydropower or nuclear power.

However, the much better option is not to use primary aluminum at all, but rather to use aluminum recycled from end-of-life scrap sources. This aluminum can have an embodied carbon content of less than 0.5 tonnes CO2e/tonne, which could be further reduced to zero by using clean electricity for the scrap remelting operation. On an individual part basis, the embodied energy in recycled aluminum is lower than that of recycled steel and much lower that of CFRP. Recycled aluminum is the ideal material for the manufacture of the next generations of electric vehicles. This aluminum should be sourced, sorted, cast, and fabricated into wrought product forms as far as possible as part of a local supply chain to avoid any additional transport costs and emissions.

Summary

The aluminum industry is now faced with the major challenge of supplying aluminum wrought products for the manufacture of millions of electric vehicles in a very short time frame. This challenge is particularly intense for aluminum extrusion supply that will require significant investment in new infrastructure, particularly to supply the higher strength aluminum extrusion alloys as exemplified by the Constellium HSA6 alloy. Such alloys are essential to optimize the lightweighting potential of electric vehicles and the extra challenge is to provide these alloys from a recycled end-of-life scrap source to minimize the level of embedded carbon. It is also vital to minimize the length of the supply chain so that the chain from the recycling center to alloy casting, extrusion, and processing to components and battery enclosures occurs as close as possible to the centers for electric vehicle manufacture. This is of particular importance in the U.K.

Editor’s Note: This article first appeared in the October 2018 issue of Light Metal Age. To receive the current issue, please subscribe.

Geoff Scamans is the chief scientific officer at Innoval Technology and is a professor of Metallurgy at Brunel University. His expertise is in light metals and their applications in the automotive and aerospace industries, and in knowledge transfer from the research base to industry. Over the last 30 years, he has initiated and managed a number of R&D programs on both materials development and technology innovation, making substantial contributions to the light metals sector, described in over 150 publications. He is a fellow of the IOM3 and vice president of their Light Metals Division. At Brunel his main interest is in research and technology development to promote recycling of aluminum and magnesium alloys as an alternative to primary production. Email: geoff.scamans@innovaltec.com.